MutualFunds

Key FAQs for Mutual Funds:

A Mutual fund is a type of a financial product which pools together a group of individuals and invests their money in stocks, bonds and other securities. Each investor owns “units” the price of which is commonly known as “NAV” or “Net Asset Value”. The NAV changes on a daily basis based on the price movements of the securities in a mutual fund’s portfolio.

A unit-holder can make money from a mutual fund in three ways:

- Income is earned from dividends on stocks and interest on bonds. A fund pays out nearly all of the income it receives over the year to fund owners in the form of a distribution

- If the fund sells securities that have increased in price, the fund has a capital gain. Most funds also pass on these gains to investors in a distribution

- If fund holdings increase in price but are not sold by the fund manager, the fund's NAV increases in price. The change in the NAV is also the unit-holder’s return

An equity mutual fund is a one which invests primarily in publicly traded equity. The objective of such a fund is to find good opportunities and invest in business that will grow, thrive and generate considerable returns for stakeholders.

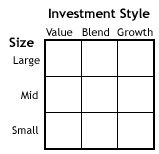

There are, however, many different types of equity funds because there are many different types of equities. A great way to understand the universe of equity funds is to use a style box, an example of which is below.

The idea is to classify funds based on both the size of the companies invested in and the investment style of the manager. The term value refers to a style of investing that looks for high quality companies that are out of favor with the market. These companies are characterized by low P/E and price-to-book ratios and high dividend yields. The opposite of value is growth, which refers to companies that have had (and are expected to continue to have) strong growth in earnings, sales and cash flow. A compromise between value and growth is blend, which simply refers to companies that are neither value nor growth stocks and are classified as being somewhere in the middle.

For example, a mutual fund that invests in large-cap companies that are in strong financial shape but have recently seen their share prices fall would be placed in the upper left quadrant of the style box (large and value). The opposite of this would be a fund that invests in technology companies with excellent growth prospects. Such a mutual fund would reside in the bottom right quadrant (small and growth).

Benefits of equity mutual funds:

- Offer widespread diversification for a very small initial investment - Most equity funds keep less than 1% to 5% of assets in any individual stock. For the average small investor to achieve the same portfolio diversification, he or she would need hundreds of thousands of dollars

- Offers professional management of your money for a low fixed fee – The funds are managed and monitored by professional fund managers who charge a small fixed fee for the same. For someone who doesn't want to think about reading annual reports, that can be an appealing arrangement

- Can be used to invest In specific sectors, industry, or even countries – The variety of equity funds provides an investor with the opportunity to invest in a particular sector, industry or country. This is particularly helpful for people who have a view on the performance of a particular sector, industry or country but do not have the time or expertise to select individual securities within the sector, industry or country

Debt funds are also known as Bond funds or Income funds. These terms denote funds that invest primarily in government and corporate debt. While fund holdings may appreciate in value, the primary objective of these funds is to provide a steady cashflow to investors. As such, the audience for these funds consists of conservative investors and retirees.

Bond funds are likely to pay higher returns than certificates of deposit and money market investments, but bond funds aren't without risk. Because there are many different types of bonds, bond funds can vary dramatically depending on where they invest. For example, a fund specializing in high-yield junk bonds is much more risky than a fund that invests in government securities. Furthermore, nearly all bond funds are subject to interest rate risk, which means that if rates go up the value of the fund goes down.

The objective of these funds is to provide a balanced mixture of safety, income and capital appreciation. The strategy of balanced funds is to invest in a combination of fixed income and equities. A typical balanced fund might have a weighting of 60% equity and 40% fixed income. The weighting might also be restricted to a specified maximum or minimum for each asset class.

A similar type of fund is known as an asset allocation fund. Objectives are similar to those of a balanced fund, but these kinds of funds typically do not have to hold a specified percentage of any asset class. The portfolio manager is therefore given freedom to switch the ratio of asset classes as the economy moves through the business cycle.

Liquid fund is a category of mutual fund which invests primarily in money market instruments like certificate of deposits, treasury bills, commercial papers and term deposits. Lower maturity period of these underlying assets helps a fund manager in meeting the redemption demand from investors.

Benefits of liquid funds:

- These mutual funds have no lock-in period

- Withdrawals from liquid funds are processed within 24 hours on business days. The cut-off time on withdrawal is generally 2 p.m. on business days. It means if you place a redemption request by 2 p.m. on a business day, then the funds will be credited to your bank account on the next business day by 10 a.m.

- Liquid funds have the lowest interest rate risk among debt funds as they primarily invest in fixed income securities with short maturity

- Liquid funds have no entry load and exit loads

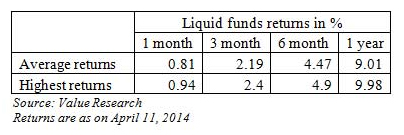

Liquid funds are among the best investment options for the short term during a high inflation environment. During high inflationary period, the Reserve Bank typically keeps interest rates high and tightens liquidity, helping liquid funds to earn good returns.

Even though it is more than two years since the Reserve Bank of India deregulated interest rates on savings deposits, most banks still offer around 4 per cent. Some banks offer higher interest rates on savings accounts but ask for a higher minimum deposit. Still, we park a significant proportion of our spare cash in these low-yielding savings accounts, earning much lower rates than the inflation rate.

Liquid funds can help us earn much higher rates than what the savings deposits offer without compromising too much on how quickly we can get our hands on the cash.

During the past year, some liquid funds have even offered higher returns than bank fixed deposits, which levy a penalty on premature withdrawal.

Arbitrage fund is a type of mutual fund that leverages the price differential in the cash and derivatives market to generate returns. The returns are dependent on the volatility of the asset. These funds are hybrid in nature as they have the provision of investing a sizeable portion of the portfolio in debt markets.

Arbitrage funds are the panacea for low risk taking investors. In a situation of high and persistent volatility, arbitrage funds provide investors a safe avenue to park their hard earned money. These funds capitalize on the market inefficiencies and generate profits for the investors. As these funds invest predominantly in equities, their tax treatment is at par with equity funds.

A comparison of post tax returns: Kotak Equity Arbitrage Fund Regular Plan v/s Fixed Deposit

| Instrument | 1-Year | Compounded returns in 3 years |

|---|---|---|

| Kotak Equity Arbitrage Fund Regular Plan* | 8.23% | (1.0823*1.0823*1.0823) – 1 = 26.8% |

| Fixed Deposit (9% interest) | 6.3% | (1.063*1.063*1.063) – 1 = 20.1% |

*Source: Value Research. It has been assumed that the Kotak Equity Arbitrage Fund Regular Plan is earning approximately same return year on year. This assumption has been made to ensure like to like comparison.

This classification of mutual funds is more of an all-encompassing category that consists of funds that have proved to be popular but don't necessarily belong to the categories we've described so far. This type of mutual fund forgoes broad diversification to concentrate on a certain segment of the economy.

Sector funds are targeted at specific sectors of the economy such as financial, technology, health, etc. Sector funds are extremely volatile. There is a greater possibility of big gains, but you have to accept that your sector may tank.

Regional funds make it easier to focus on a specific area of the world. This may mean focusing on a region (say Latin America) or an individual country (for example, only Brazil). An advantage of these funds is that they make it easier to buy stock in foreign countries, which is otherwise difficult and expensive. Just like for sector funds, you have to accept the high risk of loss, which occurs if the region goes into a bad recession.

Socially-responsible funds (or ethical funds) invest only in companies that meet the criteria of certain guidelines or beliefs. Most socially responsible funds don't invest in industries such as tobacco, alcoholic beverages, weapons or nuclear power. The idea is to get a competitive performance while still maintaining a healthy conscience.

These funds buy and sell units on a continuous basis and, hence, allow investors to enter and exit as per their convenience. The units of open ended funds can be purchased or sold even after the initial offering period is over. The units are bought and sold at the net asset value (NAV) declared by the fund.

The number of outstanding units goes up or down every time the fund house sells or repurchases the existing units. This is the reason that the unit capital of an open-ended mutual fund keeps varying. The fund expands in size when the fund house sells more units than it repurchases as more money is flowing in. On the other hand, the fund's size reduces when the fund house repurchases more units than it sells. An open-ended fund is not obliged to keep selling new units all the time. For instance, if the management thinks that it cannot manage a large-sized fund optimally, it can stop accepting new subscription requests from investors. However, it has to repurchase the units at all times.

The unit capital of closed-ended funds is fixed and they sell a specific number of units. Unlike in open-ended funds, investors cannot buy the units of a closed-ended fund after its initial offering period is over. This means that new investors cannot enter, nor can existing investors exit till the term of the scheme ends. However, to provide a platform for investors to exit before the term, the fund houses list their closed-ended schemes on a stock exchange.

Trading on a stock exchange enables investors to buy and sell units through a broker in the same manner as transacting the shares of a company. The units may trade at a premium or discount to the NAV depending on the investors' expectations of the fund's future performance and prospects. The demand and supply of fund units and other market factors also affect their price.

The number of outstanding units of a closed-ended fund does not change as a result of trading on the stock exchange. Apart from listing on an exchange, these funds sometimes offer to buy back the units, thus offering another avenue for liquidity. Sebi regulations ensure that closed-ended funds provide at least one of the two avenues to investors for entering or exiting.

The closed-ended funds are free from the worry of regular and sudden redemption and their fund managers are not worried about the fund size.

Mutual funds allow investors to pool in their money for a diversified selection of securities, managed by a professional fund manager. They are ideal for people who do not have the time or expertise to make investments into individual securities and thus is an effective tool to optimize their returns.

Following are some of the benefits of investing in mutual funds: (Each of the boxes can be clicked to see the description)

Several parameters are important while choosing a fund:

- Size of the fund - Typically, the size of a fund does not hinder its ability to meet its investment objectives. However, there are times when a fund can get too big. Although there is no benchmark for how big is too big, a very large fund size might make it difficult for the fund manager to perform efficiently. It might be difficult for a fund manager of a very large fund size to acquire a position in a stock or dispose it off without dramatically running up the stock on the way up and depressing it on the way down. It might also get difficult to maintain anonymity

- Historical performance vis-à-vis benchmark – Fund performance cannot be evaluated on an isolated basis. It should always be compared with the benchmark returns. Each fund may have a separate benchmark and a fund which outperforms the benchmark returns is reflective of a more robust portfolio. Consistency in fund returns is also an important consideration. A fund with a more consistent performance (low return volatility in past years) demonstrates more professional management and a sound logic behind security selection.

- Desired tenure – The investment horizon is a key consideration in deciding which fund to choose. >3 years: Equity or balanced mutual funds 1 – 3 years: Debt funds < 1 year: Liquid funds

- Ability and willingness to take risk - Ability to take risk is the measure of financial independence from possible losses. The less the investor relies on the invested assets for covering his actual and future financial obligations, the greater his financial independence and therefore his ability to take risks. Personal willingness to take risks determines to what extent an investor is prepared to accept price fluctuations and losses. It has to be differentiated from the investor`s objective ability to take risks. An investor who has a high ability and willingness to take risk is likely to choose long term equity funds over other alternatives.

- Portfolio diversification - By its very nature, mutual funds are supposed to provide diversification across different asset classes, stocks, sectors and even geographies. A diversified portfolio has lower risk than a portfolio biased towards a particular stock, an asset class or a sector

- Expense ratio - The ratio is the annual expenses incurred by the funds expressed in percentage of their average net asset. To make the choice between two similar funds, you should consider the expenses charged by them. Lower expenses benefit you in the longer term. Usually, schemes with higher assets have lower expense ratio than that of a small sized fund

- Fund manager profile – The profile of the fund manager is also a critical consideration for making the fund choice. An experienced and knowledgeable fund manager is likely to take more informed decisions and manage the fund more professionally. It is also important that the fund manager is candid and gives the investor some sense of the prospects for the fund and/or its holdings in the year(s) ahead as well as discuss general industry trends that may be helpful

- Fund house record - Fund houses that have a strong presence in the financial world and provide funds that have a reasonably long and consistent track record are relatively more reliable. A strong parentage ensures greater operational efficiency and professionalism in fund management

One of the principles of investing is the risk-return tradeoff, defined as the correlation between the level of risk and the level of potential return of an investment. For the majority of stocks, bonds and mutual funds, investors know that accepting a higher degree of risk or volatility results in a greater potential for higher returns. In order to determine the risk-return tradeoff of a specific mutual fund, investors analyze the investment's alpha, beta, standard deviation and Sharpe ratio.

- Alpha - Alpha is used as a measurement of a mutual fund's return in comparison to a particular benchmark, adjusted for risk. A positive alpha of 1 means that the fund has outperformed the benchmark by 1%, while a negative alpha means the fund has underperformed. The higher the alpha, the greater the potential return with that specific mutual fund

- Beta - Another measure of risk-reward tradeoff is a mutual fund's beta. This metric calculates volatility through price movement compared to another market index, such as the SENSEX. A mutual fund with a beta of 1 means that its underlying investments move in line with the comparison benchmark. Beta that is above 1 results in an investment that has more volatility than the benchmark, while a negative beta means the mutual fund may have fewer fluctuations over time. Conservative investors prefer lower betas and are often willing to accept lower returns as a result of less volatility

- Standard Deviation - In addition to alpha and beta, a mutual fund company provides investors with a fund's standard deviation calculation to show its volatility and risk-reward tradeoff. Standard deviation measures an investment's individual return over time and compares it to the fund's average return over the same period. This calculation is most often completed using the closing price of the fund each day over a set period of time, such as one month or a single quarter. When daily individual returns regularly deviate from the fund's average return over that time frame, the standard deviation is considered high. Often, this measurement is compared among funds with similar investment objectives to determine which has the potential for greater fluctuations over time

- Sharpe Ratio - A mutual fund's risk-reward tradeoff can also be measured through its Sharpe ratio. This calculation compares a fund's return to the performance of a risk-free investment, most commonly the G- secs. A greater level of risk should result in higher returns over time, so a ratio of greater than 1 depicts a return that is greater than expected for the level of risk assumed. Similarly, a ratio of 1 means that a mutual fund's performance is relative to its risk, while a ratio of less than 1 indicates the return was not justified by the amount of risk taken

What is a SIP?

A Systematic Investment Plan or SIP is a smart and hassle free mode for investing money in mutual funds. SIP allows one to invest a certain pre-determined amount at a regular interval (weekly, monthly, quarterly, etc.). A SIP is a planned approach towards investments and helps inculcate the habit of saving and building wealth for the future.

How does it work?

A SIP is a flexible and easy investment plan. The investor’s money is auto-debited from his or her bank account and invested into a specific mutual fund scheme. The investor is allocated certain number of units based on the ongoing market rate (called NAV or net asset value) for the day. Every time money is invested, additional units of the scheme are purchased at the market rate and added to the investment account. Hence, units are bought at different rates and investors benefit from Rupee-Cost Averaging and the Power of Compounding.

Rupee – Cost Averaging

With volatile markets, most investors remain skeptical about the best time to invest and try to 'time' their entry into the market. Rupee-cost averaging allows the investor to opt out of the guessing game. Since SIP ensures regular investment, the investor’s money fetches more units when the price is low and lesser when the price is high. During volatile period, it may allow the investor to achieve a lower average cost per unit.

Power of compounding

The rule for compounding is simple - the sooner you start investing, the more time your money has to grow.

Example

If you started investing Rs. 10000 a month on your 40th birthday, in 20 years time you would have put aside Rs. 24 lakhs. If that investment grew by an average of 7% a year, it would be worth Rs. 52.4 lakhs when you reach 60. However, if you started investing 10 years earlier, your Rs. 10000 each month would add up to Rs. 36 lakh over 30 years. Assuming the same average annual growth of 7%, you would have Rs. 1.22 Cr on your 60th birthday - more than double the amount you would have received if you had started ten years later!

Other benefits of SIPs:

- Inculcates the habit of saving - Discipline is the key to successful investments. When one invests through SIPs, one commits himself or herself to save regularly. Every investment is a step towards fulfillment of future goals

- Flexibility - While it is advisable to continue SIP investments with a long-term perspective, there is no compulsion. Investors can discontinue the plan at any time. One can also increase/ decrease the amount being invested

- Long-Term Gains - Due to rupee-cost averaging and the power of compounding SIPs have the potential to deliver attractive returns over a long investment horizon

- Convenience - SIP is a hassle-free mode of investment. Once the bank account is linked to the investment account, designated amount of funds get automatically invested periodically