CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

Gyaan Ki Baat

A policy stance serves as the guiding principle for decision-making by central banks, reflecting their priorities in balancing economic growth, inflation control, and financial stability. The Reserve Bank of India (RBI) regularly adjusts its monetary policy stance to address evolving economic challenges.

Types of Monetary Policy Stances:

- Accommodative Stance: Focuses on boosting economic growth by lowering interest rates and increasing money supply.

- Neutral Stance: Balances inflation control and growth, allowing flexibility to either hike or cut rates.

- Hawkish Stance: Prioritizes controlling inflation through higher interest rates and tighter monetary policy.

RBI’s Current Policy Stance (April 2025)

The RBI recently shifted its monetary policy stance from neutral to accommodative during its April 2025 Monetary Policy Committee (MPC) meeting. This shift was accompanied by a 25 basis points (bps) cut in the repo rate, bringing it down to 6%.

Why the Shift?

- Easing Inflation: Retail inflation has moderated to around 4%, providing room for rate cuts without stoking price pressures.

- Slowing Growth: GDP growth projections for FY 2025-26 were revised downward to 6.5% from 6.7%, prompting the need for policy support to stimulate demand.

- Global Uncertainty: Trade tensions, US tariff threats, and global economic slowdown risks have increased uncertainty, necessitating measures to shield domestic growth.

Implications of an Accommodative Stance

- Lower Borrowing Costs: Reduced repo rates will lead to lower interest rates on loans, encouraging borrowing and investment.

- Boost to Consumption and Investment: Cheaper credit can revitalize demand in sectors like housing and automobiles.

- Economic Resilience: By prioritizing growth, the RBI aims to counteract external shocks and maintain economic momentum.

Takeaway

The RBI’s accommodative stance reflects its proactive approach to addressing slowing growth while leveraging low inflation levels. This shift underscores the central bank’s commitment to fostering economic stability amidst global headwinds.

Personal Finance

- What is a part payment in a personal loan? Benefits and drawbacks explained: Part payment helps cut loan interest and shorten tenure by reducing the principal early boosting credit too. But beware of prepayment charges! Want to save big on your personal loan? Read here

- RBI circular: Banks should pay 8% interest to retired govt employees for pension payment delay: Retired govt employees to get 8% interest on delayed pensions—automatically credited! RBI’s new rule strengthens pensioners’ rights. Missed or late payments since 2008? You could be owed money. To find out if your bank owes you. Read here

- UIDAI launches new Aadhaar app for simplified Aadhaar verification: Say goodbye to photocopies! UIDAI’s new Aadhaar app (beta) lets you share only what’s needed—instantly, securely, and with full control. From hotel check-ins to online verifications, it’s Aadhaar made smarter. To know how it protects your privacy Read here

Investing

- How Long Does it Take for the Market to Recover? Markets fall fast but recover slowly—historically taking 4–9 years after major drops. While downturns are tough, they do end. Staying invested with realistic expectations is key. Remember: nothing lasts forever, not the lows… and not the highs either. Read here

- Bear Market? Don’t Panic. Here’s How to Invest During One: Bear markets are short-lived downturns that often spark fear—but staying calm is key. With smart strategies like dollar-cost averaging, diversification, and a long-term mindset, investors can turn panic into opportunity and come out stronger when the market inevitably rebounds.Read here

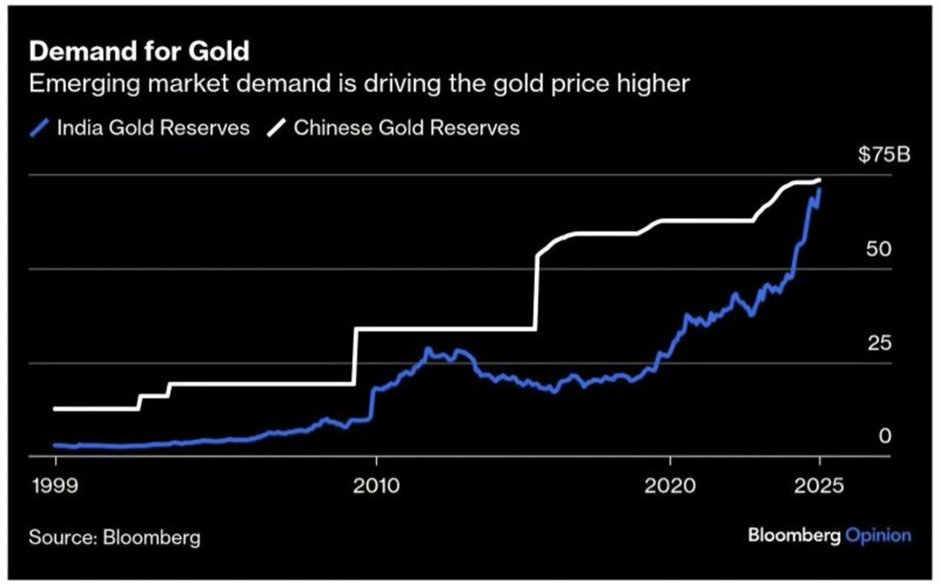

- Should you start investing in gold as global financial order shifts? Central banks are boosting gold reserves to hedge against inflation, geopolitical risks, and economic uncertainty. While gold offers security, it’s less predictable than equities. Experts recommend a balanced portfolio, with gold making up just 5-10% for long-term stability. Read here

Economy & Sector

- RBI monetary policy: 6 key takeaways from MPC meeting: The Reserve Bank of India (RBI) on Wednesday announced a reduction in the repo rate. The move comes at a time when global uncertainties, like ongoing trade tensions and a weakening US dollar, are creating pressure on economies around the world. Here are 6 takeaways. Read here

- Microfinance: Its rising importance and relevance in the Indian economy: Microfinance in India, serving 80 million borrowers, has thrived despite crises like COVID-19 and demonetisation. With strong recovery rates and digital innovation, it’s bridging vast credit gaps. Discover how this resilient sector is bouncing back—again. Click to read more! Read here

- Indian job market stays strong amid global uncertainty, Michael Page India: India’s job market thrives despite global uncertainty, fuelled by digital growth, STEM talent, and AI-focused upskilling. Booming sectors like cybersecurity and semiconductor design drive demand. Discover why global giants are betting big on India’s workforce.Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.