CAGR Insights is a weekly newsletter full of insights from around the world of the web.

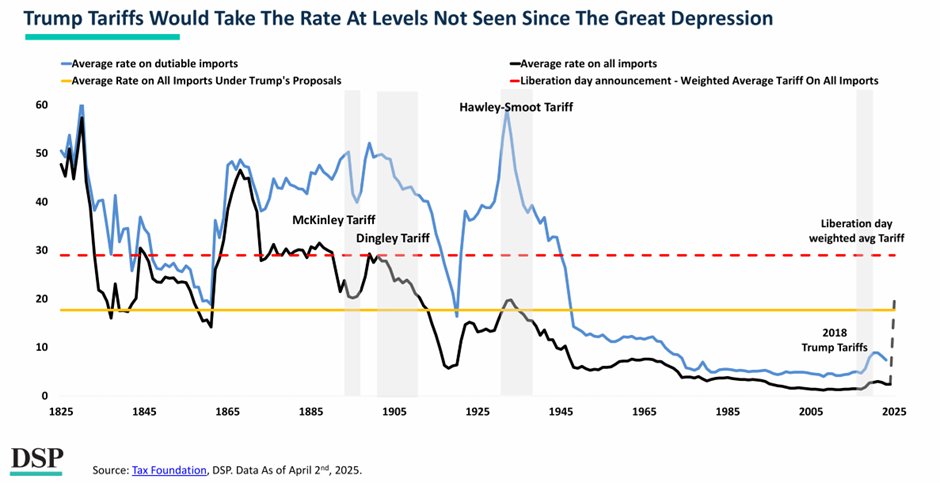

Chart Ki Baat

Gyaan Ki Baat

Why Moving from Wealth Accumulation to Wealth Preservation Matters

In the early stages of our financial journey, the focus is clear—grow, invest, and multiply wealth. This is the phase of wealth accumulation, where risk-taking and aggressive strategies are rewarded by time and compounding. But as we move closer to our financial goals—retirement, children’s education, or legacy planning—the game changes. The priority shifts from “How much more can I make?” to “How can I protect what I’ve built?” This is the essence of wealth preservation.

Why does this shift matter? Simply put, time is no longer on your side. Market downturns that were once mere blips can now threaten your lifestyle and long-term security. Preserving wealth is about safeguarding your hard-earned assets from risks like market volatility, inflation, unexpected expenses, and even taxation. It’s a proactive approach—diversifying investments, rebalancing portfolios, planning for taxes, and ensuring adequate insurance coverage.

Wealth preservation isn’t about abandoning growth; it’s about finding the right balance. Your portfolio should still have some growth potential, but the emphasis is on stability, steady income, and risk management. Think of it as shifting from sprinting to marathon running—pace, endurance, and protection become the new priorities.

Remember, the journey from accumulation to preservation is not a sign of slowing down, but a mark of financial wisdom. Protecting your wealth ensures that your dreams, lifestyle, and legacy remain secure for you and your loved ones, no matter what life throws your way

Personal Finance

- How to settle credit card payments without extra charges? 6 smart tips that work: Want to ditch credit card debt without wrecking your credit score? Discover smart, fee-free strategies like budgeting, balance transfers, and auto-pay. Build financial strength and avoid costly mistakes—click to take control of your money the smart way! Read here

- Old tax regime vs new tax regime: Which one to pick as the new financial year kicks in. Check details: As FY26 begins, choose wisely between the old and new tax regimes—lower rates vs. higher deductions. The new regime is now default! Wondering which one saves you more? Read here

- Why buying multi-year policies in health insurance makes financial sense: Rising medical costs? Lock in your health insurance premium now! Multi-year policies (3–5 years) offer discounts, stability, and peace of mind—especially for young buyers. Avoid future hikes and enjoy tax perks too. Click to see why this strategy is a game-changer! Read here

Investing

- The Price of Peace: Why Diversification is Difficult, but Necessary: Diversification won’t make you rich fast—but it will keep you from going broke. While a concentrated bet might outperform, a well-diversified portfolio cushions the blow when markets crash. Curious how the “optimal portfolio” stacked up against the S&P 500? Click to learn the true cost—and reward—of peace of mind. Read here

- Patience pays: How long‑term investing works its magic: Investing in fundamentally strong companies at reasonable prices—and then simply holding on long enough – can work wonders for your wealth. The Long‑Term Growth Portfolio is built on this very philosophy: buy quality stocks, be patient, and let compounding do the heavy lifting. To understand why this approach leads to prosperity. Read here

Economy & Sector

- Tariffs are just one weapon in a trade war: Global trade is set to contract by 0.2% in 2025 amid rising U.S.-China tensions, new chip export bans, and cancelled freight shipments. Markets are reeling—but trading desks are booming. Click to understand the full impact of Trump-era trade shocks. Read here

- India eyes ending import tax on US ethane and LPG in trade talks, sources say: India is considering removing import taxes on Ethane and LPG from the United States. This move is part of broader trade negotiations with Washington. The goal is to reduce India’s trade surplus and ease tariff burdens. India may also eliminate import tax on U.S. liquefied natural gas. Increased U.S. energy imports could help India avoid heavier tariffs. Read here

- Missing the target: On the economy, the Centre’s growth target: India’s industrial growth hit a 6-month low of 2.9% in February, dragged down by weak manufacturing and mining, and a sharp dip in consumer demand—despite easing inflation. Investment picked up, but global jitters and market volatility hurt confidence. Will India miss its 6.5% GDP growth target? Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.