CAGR Insights is a weekly newsletter full of insights from around the world of the web.

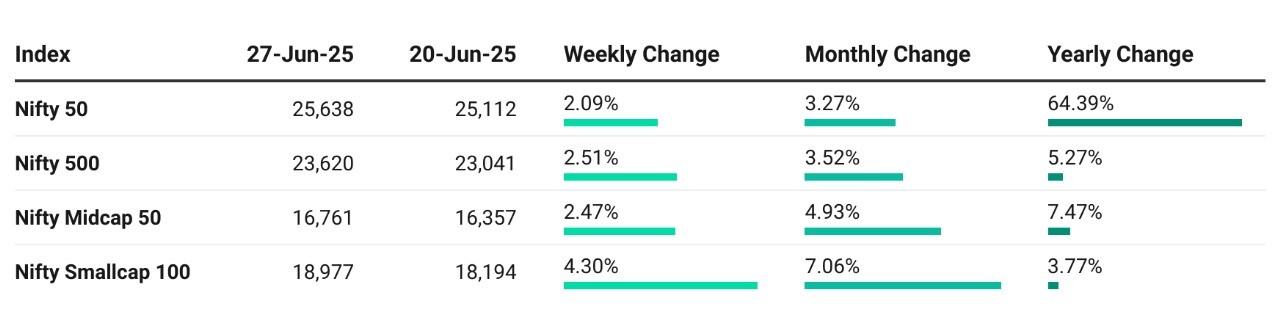

Chart Ki Baat

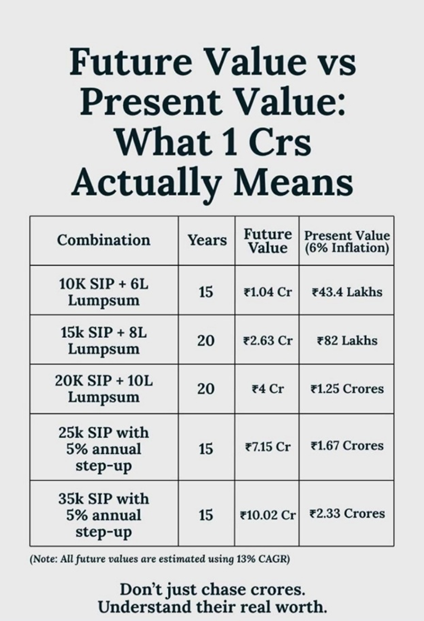

Gyaan Ki Baat

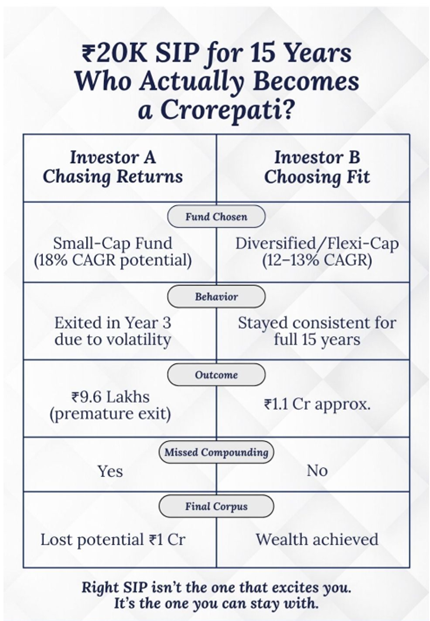

Want High Returns Fast? Here’s the Reality Check

We all dream of quick riches — like Sameer, hoping for 20% returns in just three years, with zero risk. Sounds amazing, right? But here’s the truth: chasing high returns without respecting risk is like expecting a Ferrari to run on just water.

Small- and mid-cap funds can deliver big gains, but they’re also rollercoasters — sometimes dropping your money by 30-40% in just a few years. If your cash is needed soon, riding that wave is a gamble you might lose.

So, what’s the smart move? When the clock’s ticking, think boring but steady: short-duration debt funds. They won’t make you rich overnight, but they protect your money and grow it reliably.

Remember, investing is a marathon, not a sprint. Patience is your best friend — and respecting risk is the secret sauce. Fast money sounds sweet, but steady wins the race every time!

Personal Finance

- EPF, NPS can build Rs 12 crore retirement fund. Tax expert breaks it down: A ₹12 crore retirement corpus is possible for salaried individuals earning up to ₹14.65 lakh by smartly using EPF and NPS. This strategy offers tax-free salary today and long-term wealth, combining stability, growth, and tax efficiency over 30 years. Read here

- Non-Resident Indians can pay zero tax on capital gains; here’s how: NRIs can pay zero tax on long-term capital gains from foreign exchange assets by reinvesting proceeds in specified Indian assets under Section 115F. With smart planning, they can legally reduce tax, preserve wealth, and reinvest efficiently across borders. Read here

- Why hitting pause on your loan might cost you more: Loan moratoriums offer temporary EMI relief but can lead to long-term costs due to accrued interest and potential compounding, making it a costly option for borrowers in financial stress. Read here

Investing

- Why Financial Independence is Overrated: Financial independence is often overhyped. True financial well-being lies in financial freedom—having choices and security, not just quitting work. Instead of rushing toward early retirement, aim for Coast FIRE: a balanced life where meaningful work and financial peace coexist.Read here

- How do changing interest rates affect the stock market? Despite high but stable interest rates, equity markets have rebounded in 2025, with the S&P 500 reaching record highs. Range-bound Treasury yields and steady Fed policy support investor confidence, while sector performance shifts reflect evolving economic and inflation dynamics. Read here

- The Power of Longevity Investing: When Retirement Goes Off-Card: Retirement is evolving as longer lifespans, rising costs, and shifting goals reshape expectations. Many now work past 65, emphasizing purpose over just savings. Longevity trends are also opening new investment opportunities in healthcare, tech, real estate, and lifestyle sectors. Read here

Economy & Sector

- Govt approves ₹1-trillion RDI scheme to boost private-sector innovation: The Union Cabinet approved a ₹1-trillion RDI Scheme to boost private investment in high-growth sectors like AI and green tech. Managed by ANRF, it offers long-term, low-interest funding to bridge research funding gaps and strengthen strategic innovation. Read here

- Power Sector: How Financial Sustainability Can Make Discom Landscape Resilient: India’s discoms face mounting financial challenges amid rising energy demand. Ensuring sustainability requires smart metering, tariff reforms, debt restructuring, and infrastructure upgrades. Government schemes like RDSS, along with private investment and policy support, are key to long-term viability.Read here

- India needs a nationwide strategy, not patchwork SEZs: India must move beyond Special Economic Zones (SEZs) to achieve true industrial competitiveness. Instead of relying on isolated enclaves, systemic reforms in governance, infrastructure, and regulatory consistency nationwide are needed to position India as a credible global manufacturing power. Read here

****

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.