CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

Gyaan Ki Baat

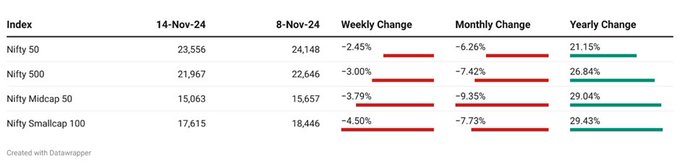

Recently, the Indian stock market has experienced a significant correction, with major indices seeing declines of over 10% from their peaks. This shift has raised concerns among investors, especially after a strong bull run in the past few years. While it may seem alarming, market corrections are a natural part of the investing cycle and offer important lessons for investors.

Why Market Corrections Happen:

Overvaluation: Stocks or entire sectors sometimes become overvalued due to excessive optimism, and when the market corrects, it brings the valuations back to more sustainable levels.

Economic Factors: Changes in the global or domestic economic environment—such as inflation concerns, rising interest rates, or geopolitical tensions—can trigger corrections.

Investor Sentiment: A shift in investor sentiment, driven by fear or uncertainty, often leads to increased selling pressure, resulting in market declines.

The ongoing market correction in India, fueled by external economic factors and shifting investor sentiment, is a natural part of market cycles. While it might be unsettling, it is important to view it as an opportunity to reflect on your financial goals, review your investments, and stay focused on the long-term horizon. In the face of volatility, maintaining discipline and patience can help investors navigate corrections successfully and capitalize on opportunities that may arise.

Personal Finance

- My $507.34 Ridiculous Mistake! A five-year mistake, silent price hikes, and hundreds lost on a service never used—could you be missing the same hidden cost? Read here

- What NRIs need to know about investing via mutual funds in India: The NPCI now allows NRIs with NRE or NRO accounts to make UPI transactions linked to international mobile numbers. Available in countries like the US, UK, UAE, and Australia, the service enables NRIs to send money to family in India or make payments without traditional wire transfers, fee-free.Read here

- How to make NPS contributions via the BHIM app: NPCI BHIM Services has just made retirement planning a whole lot easier. Now, you can directly contribute to your National Pension System (NPS) account right from the comfort of your smartphone. To know how to load the money through BHIM appRead here

Investing

- Indian stock market: 8 key things that changed for market overnight – Gift Nifty, US inflation, to surging dollar: Sensex and Nifty 50 are set for a cautious start amid global market fluctuations and a strong US dollar. With US inflation spurring Fed rate cut, and relentless FII selling weighing on Indian stocks, the markets brace for continued volatility as key economic factors plays out. Read here

- A New Dawn: Navigating Market Uncertainty and Seizing Opportunities: With inflation fears looming large and market volatility persisting, are investors taking the right steps to protect their portfolios? As interest rates rise, how will the bond market fare? Can the stock market weather the storm, especially in the tech sector? What strategies can investors employ to navigate these turbulent times? Watch here

- Index Funds are the go-to choice for India’s young investors, shows survey: A recent survey reveals that index funds are highly favoured among Millennials and Gen Z, with nearly half of investors under 43 choosing them, compared to just 35% of Gen X and Boomers. Passive investing, particularly in sectoral indices, has seen rapid growth, pushing Assets Under Management to over Rs 11 trillion. Read here

- RBI announces rules to reclassify FPI investment as FDI once it crosses 10% holding in Indian firms: RBI has streamlined the process for FPIs to reclassify their holdings as FDI if their stake in an Indian company exceeds 10 percent. Previously, FPIs exceeding this cap were required to either divest the surplus shares or reclassify them as FDI. To know more about the framework. Read here

Economy & Sectors

- Indian banks to have steady growth in earning over next 3-4 years, fees from unsecured lending may dip, notes Jefferies report: Indian banks anticipate steady growth in loans and earnings, though risks in unsecured lending and uncertain rate cuts could affect margins. Will they thrive or falter? The next few months will reveal whether they can outpace the broader market’s momentum. Read here

- Global Macro and Investment Implications of President Trump Win: Rees Chan outlines U.S. reindustrialization under Trump, emphasizing domestic growth, defense spending, and a lower dollar. He anticipates significant opportunities for India, particularly in manufacturing and defense, while U.S. tech giants may face heightened regulatory pressure and challenges.Watch here

- India’s middle class tightens its belt, squeezed by food inflation: India’s urban spending is slowing, with middle-class budgets squeezed by persistent inflation. While top earners continue to spend, the middle segment shrinks, affecting major consumer goods firms. This shift raises questions about the long-term stability of India’s economic growth. Read here

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.