CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 23-Jun-23 | 16-Jun-23 | Change |

| Nifty 50 | 18,666 | 18,826 | -0.85% |

| Nifty 500 | 16,012 | 16,181 | -1.05% |

| Nifty Midcap 50 | 9,807 | 9,884 | -0.78% |

| Nifty Smallcap 100 | 10,624 | 10,741 | -1.09% |

Chart Ki Baat

Improved balance sheets support a capex cycle: HSBC Global Asset Management

Gyaan Ki Baat

Tax Deferral represents an obligation to pay tax in the future. Mutual funds schemes are not liable to pay tax on the income they earn. If the same income were to be earned by the investor directly, then tax may have to be paid in the same financial year.

Under the growth plan of mutual funds an investor can let the money grow in the scheme for several years. This helps investors to legally build their wealth faster than would have been the case if they were to pay tax on their income each year. The final tax liability arises only in the year of redemption.

Source : NISM

Here’s the list of curated readings for you this week:

Personal Finance

- Women and their relationship with Money – Episode 1 – Shruti speak to Stuti Bhageria about her journey with money and wealth creation. Stuti says that her upbringing plays a huge role in the way she started thinking and feeling about money very early on. As per her, investing is simple but requires the awareness of how massively it can impact your future. Watch here.

- Great read: The Anatomy of a Fund Universe– There are eleven types of mutual fund: knowing them will help you find the good and avoid the bad. Read here.

- Why MNC employees with ESOPs are on taxman’s radar – MNC employees in India often get ESOPs or stocks in their companies. What they do not realize it that it makes them ‘foreign asset holders’. Read here.

- India is expected to lose 6500-dollar millionaires in 2023 – 122,000 of dollar millionaires globally are expected to move to a new country in 2023. Read here.

- Next decade for India and how to play it by Manish Chokhani- So, while the last few years they have all gone after the retail guys, I think this whole corporate banking, the PSU banking pack, if you take the top three or four banks after SBI, they are all in Rs 30,000 crore type PPOPs, which are large numbers. Watch here

- How to (almost) get away with fraud? – The story of Zee’s promotor and SEBI alleged charge. Read here.

- Quantitative and factor investing: a practitioner’s perspective –The session covers what exactly is quantitative and factor investing and the different styles and use cases. We will also see how portfolios are constructed using these methods and what are the biases that come with it. Watch here

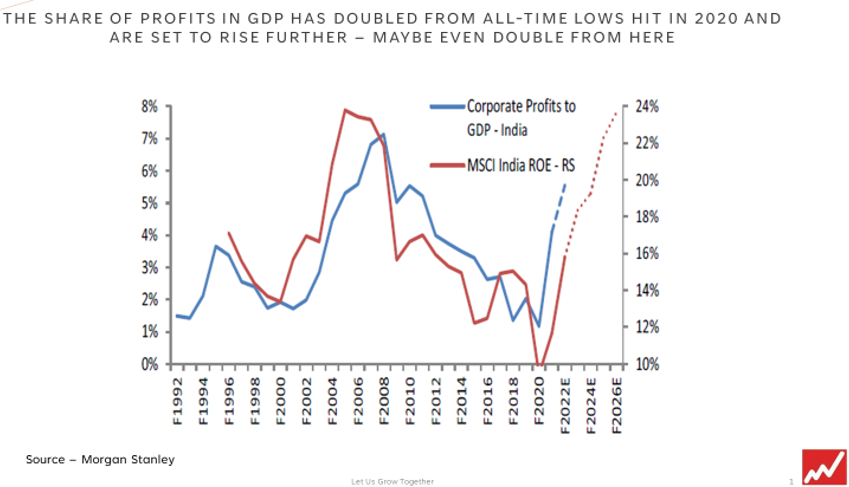

- Net quarterly profits of Indian listed companies in Q4FY23 was 3.5X the average quarterly profit before pandemic in 2020 – What is leading to this stupendous increase? Read here

- Don’t get burned in China again – Never in our experience has the disconnect between Wall Street bullishness and China’s bearish reality been more glaring. Analysts keep calling for 2023 GDP growth to come in well above 5 percent—higher than the official growth target—and for retail sales to grow at 9 percent. But company reports suggest growth that fast is not possible. Read here.

Economy

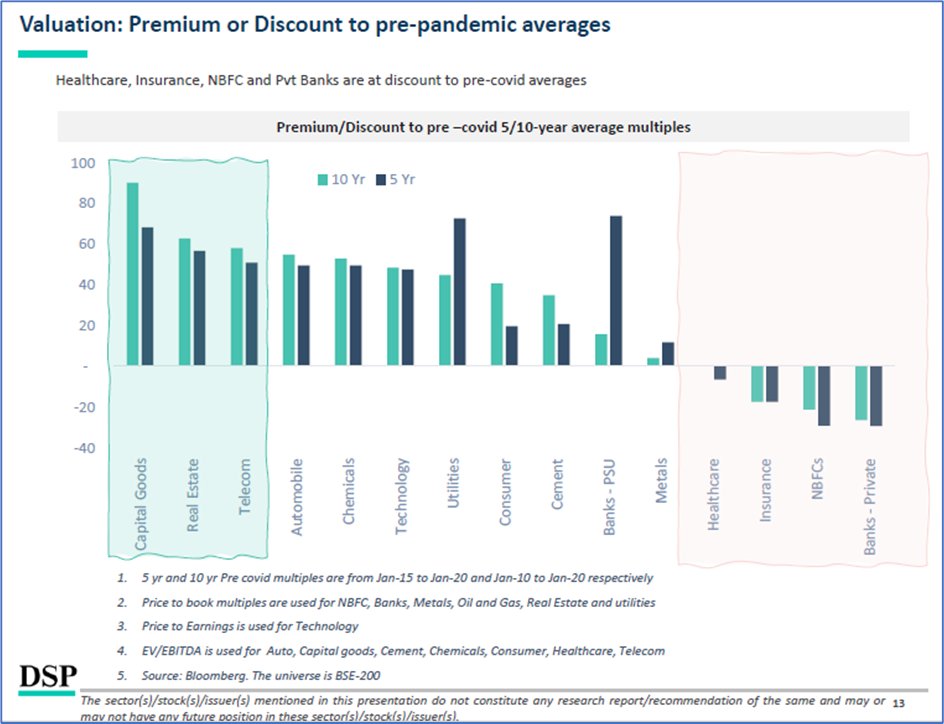

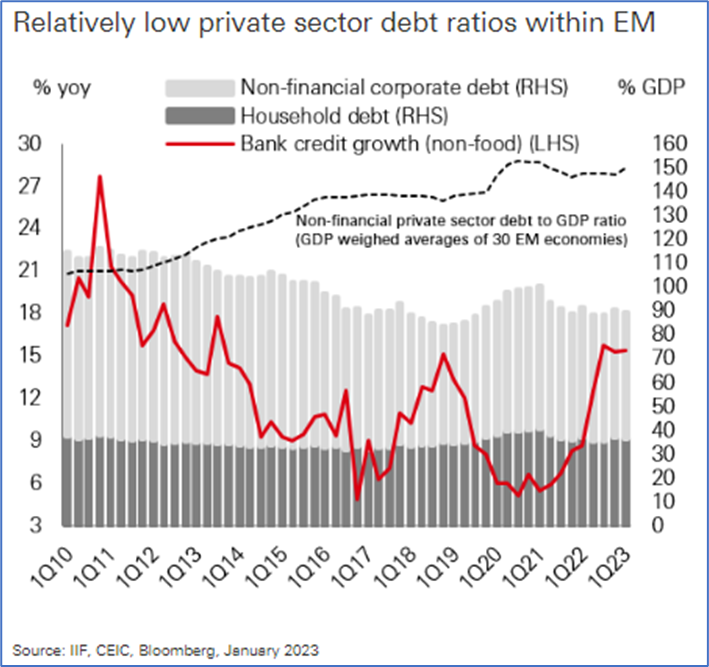

- India picks up pace amid global slowdown – India’s macro resilience is supported by cyclical and structural tailwinds. Improved corporate and bank balance sheets support credit growth and lay the groundwork for a pickup in the investment cycle, key to its medium-term growth sustainability. Read here.

- Monsoon seems to be struggling in India so far this year – We have seen close to 33% less than normal rainfall so far in the 1st-20th June period. Read here.

- Tweaking Indian banks’ key regulatory need may ease interbank cash market volatility – The Reserve Bank of India (RBI) should also de-stigmatise borrowing by banks at the Marginal Standing Facility (MSF) window, they said. Read here.

- UK Grants Equivalence to Clearing Houses Authorized By RBI – The United Kingdom Treasury has granted equivalence to central counterparties authorized by the Reserve Bank of India, marking a significant step in resolving a regulatory conflict between the Indian central bank and foreign authorities. Read here

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.