CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 28-Apr-23 | 21-Apr-23 | Change |

| Nifty 50 | 18,065 | 17,624 | 2.50% |

| Nifty 500 | 15,219 | 14,847 | 2.51% |

| Nifty Midcap 50 | 8,962 | 8,731 | 2.65% |

| Nifty Smallcap 100 | 9,672 | 9,369 | 3.23% |

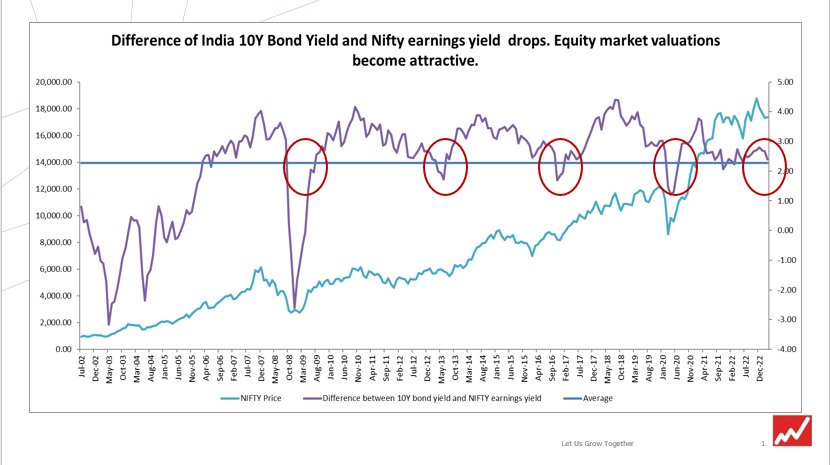

Chart Ki Baat

Gyaan Ki Baat

What is a REIT?

A Real Estate Investment Trust or REIT operates similarly to how a mutual fund works. Here, retail investors give money to a fund manager, in this case, a REIT manager who then does the job of finding and investing in good income-producing properties. The bundle mainly consists of commercial properties although managers can also look at hospitals, malls, and even residential spaces. These properties earn rental income for the REIT which is then transferred to investors in the form of dividends and that’s pretty much how a REIT operates.

A REIT makes investing in commercial real estate a lot more affordable. It simplifies investing and one doesn’t need to maintain the property or pay taxes on it, and they are managed professionally. Most importantly, the Securities & Exchange Board of India, SEBI regulates and monitors REITs in India

Units in REITs can be bought or sold in the secondary market via any trading platform. It works a lot like how a share is bought and with the buying quantity now reduced down to just 1, you can invest in real estate via REITs starting at just around INR 10000 – INR 15000.

Here’s the list of curated readings for you this week:

Personal Finance

- Indian regulator plans to allow mutual funds with performance-based fees – As part of the proposal, the Securities and Exchange Board of India (SEBI) wants to allow additional charges if a fund consistently outperforms a relevant benchmark index and gives higher annualised returns, according to an internal SEBI document. Read here

- Why Branded apartments are making a comeback? – Branded residences are back in the market because the buyer today wants more than just a plain-vanilla apartment. There’s also confidence on account of RERA being in place, unlike in 2017 when a lot of people burnt their fingers. Read here.

- 5 things about Retirement that we haven’t thought about –. Read here

- The winner’s edge – When the cost of failure is low, too much pessimism prevents you from trying. When the cost of failure is high, too much optimism encourages unwarranted risk.. Read here

- Points to consider while investing in an AMC business – PPFAS MF CIO Rajeev Thakkar elaborates on what to look for, while investing in an Asset Management Compan. Watch here

- Broking is a winner takes it all business – There is a low income per client and increasing fixed costs for tech and compliance. So only with scale, you can survive. Read here

- A rambling of a frustrated investor, looking through some of the common themes in investor letters/blogs. Read here

- How to do Business Analysis of Organised Retail Companies – Dr. Vijay Malik helps to understand the factors that impact the business of retailers and the characteristics that differentiate a fundamentally strong retail company from a weak one. Read here

Economy

- Govt not keen to list gilts on global indices now – India is not very keen to list government bonds on global indices now as the disadvantages outweigh benefits, a senior finance ministry official said. Read here

- Chile Stuns Markets And EV Makers By Nationalizing Lithium Industry Overnight – The nationalization poses a fresh challenge to electric vehicle (EV) manufacturers scrambling to secure battery materials, as more countries look to protect their natural resources. Read more here.

- Rural Wage Growth Sustains Its Rebound In Recent Months – Rural wages are trending upward for agricultural and non-agricultural workers. Rural wages rose by over 7% for agricultural workers this year, easing by 6.7% in February.Read here

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.