CAGR Insights is a weekly newsletter full of insights from around the world of web.

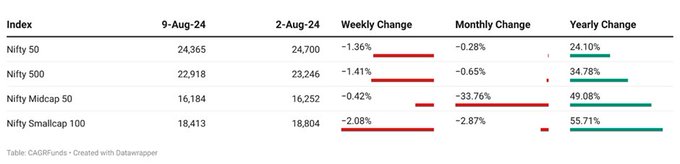

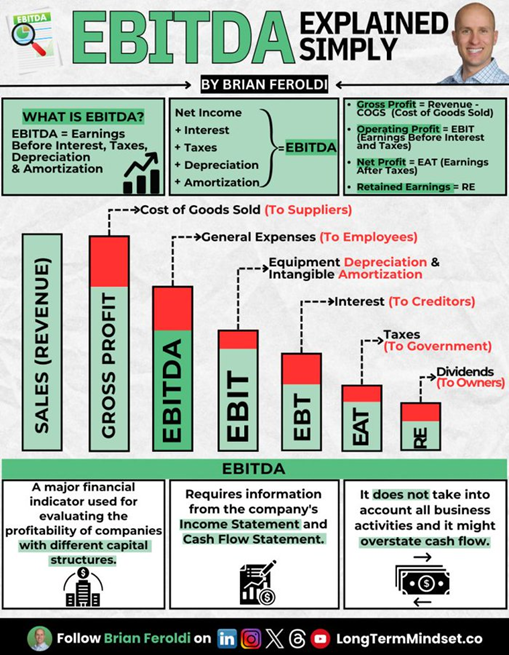

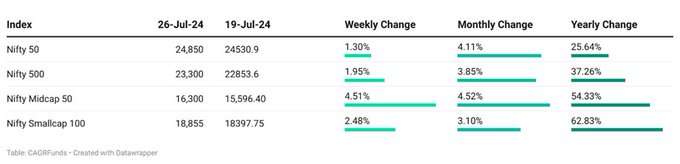

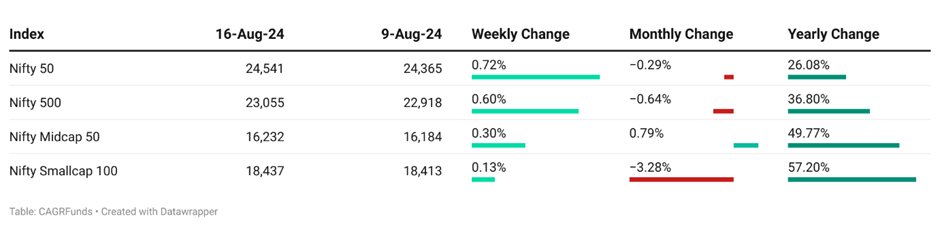

Chart Ki Baat

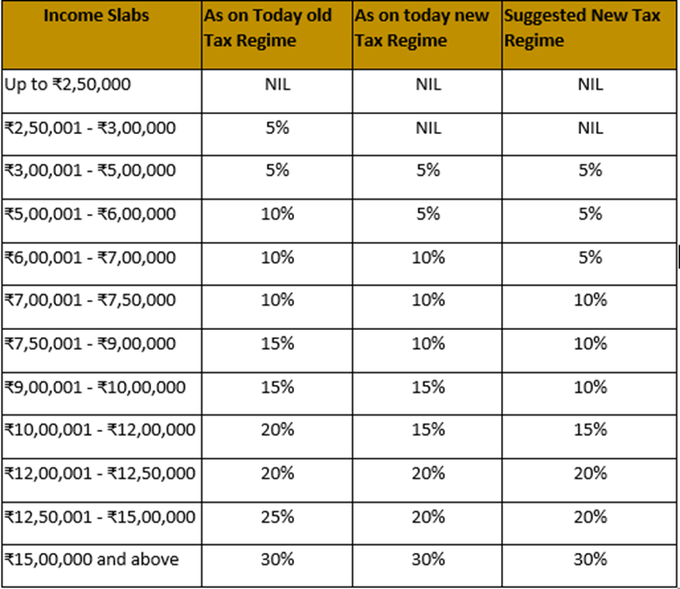

Source: Anker capital management

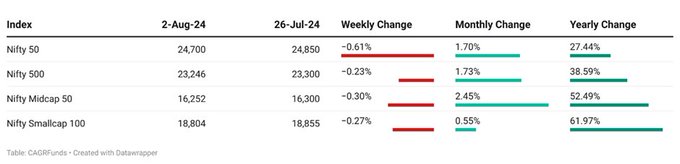

Gyaan Ki Baat

Life actually is quite long in the grand scheme of things; we just don’t use our time wisely. When we dream, we often dream in years and forget about the decades. A year feels short yet a decade is a profound a period of time. You can do a lot in a decade. We overestimate what we can do in a year and underestimate what we can do in a decade.

Dream in decades. A year away can be forecasted, but a decade can’t. You can do anything you want in a decade if you work towards it. So, expand your horizons and think where you want to be in ten years. The possibilities are endless, then take the actions needed today to get one tiny step closer.

When you dream that far in the future, your ambition can grow in orders of magnitude. You don’t constrain yourself, because literally anything is possible in that time frame. We don’t zoom out enough. We are often laser-focused on what is in front of us and don’t take the time to look at things from broader perspective.

So, take time to think that far in the future. What person do you want to be? What do you want to be doing? It’s exhilarating to reflect upon. You can master skills, leave your mark on the world, and totally uproot your life. It’s thrilling.

Forget about the short term. Set yourself up for the long term.

Imagine the possibilities and always keep them in mind. Today may feel like slog or you may not have done what you wanted so far this year. Incrementally improve. Zoom out. You can do anything as long as you keep the decades in mind. Keep dreaming.

Author: Tyler Bruno

Here’s the list of curated readings for you this week:

Personal Finance

- A Few Little Ideas And Short Stories: Success depends on substance over style. Quality products, genuine focus, and deep understanding of customers are essential. Avoid hype and short-term thinking. Learn from history’s lessons: the value of hard work, the dangers of unchecked optimism, and the importance of long-term perspective. True success often lies in overlooked areas, requiring resilience and patience. Read here

- Share buyback tax regime to change from October 1: What this means for you? There will be significant changes to India’s share buyback tax regime from October 1, 2024. The new rules will shift the tax burden from companies to shareholders, fundamentally altering the landscape for buyback strategies. Read here

- Should young earners repay loans first before they start investing? Is paying off debt or investing your money the smarter move? This is an age-old financial dilemma faced by young earners. An insightful piece that explores the financial challenges faced by young earners. Read here

Investing

- At the Money: The Right and Wrong Way to Approach Investing: Investing is not easy. How do you pick the correct asset class? Which sectors do you buy? How do you know which are the right stocks or bonds to own? Do you use leverage? Do you hedge? Do you time? What about private equity, hedge funds, venture capital? Read here

- Talk on Floats: Float is essentially customer money held by a company before it’s used. Companies with strong moats often generate large floats due to their market power. This float can be used to fund operations, invest in growth, or simply earn interest. Examples include Costco’s membership fees, bank deposits, and upfront payments in various industries. Read here

- MF investors rush into ‘hot sectors’, draw caution: Thematic and sector schemes have received more than half of the investor money into equity mutual funds in the past three months thanks to a slew of product launches. Read here

Economy

- ‘A major shift in consumer preferences towards larger homes’, says Anarock report: The average flat sizes in India’s top seven cities have surged by 32% over the past five years, with the National Capital Region (NCR) witnessing a significant 96% growth, the Anarock Group said in the latest report. Read here

- Fishing in a Very Large Pond: India’s burgeoning market cap is a reflection of its rapid economic growth. The country’s GDP is on a trajectory to surpass major economies, driving corporate earnings and market capitalization higher. While market cap to GDP ratios can be misleading, the overall trend suggests a vast investment opportunity.Read here

- CPI Inflation in July Declines To 3.54%, Lowest Since August 2019; IIP Grows 4.2% in June: Inflation in India’s consumer prices eased to a nearly five-year low of 3.54% in July, with food price rise moderating to 5.4% from a six-month high of 9.4% in June, thanks to base effects from last July when retail inflation stood at 7.4% and the food index was up 11.5%.Read here

***

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 20 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 40 across the smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.