CAGR Insights is a weekly newsletter full of insights from around the world of web.

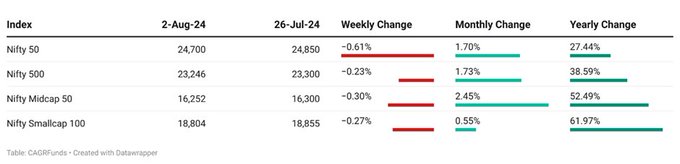

Chart Ki Baat

Behavioural Finance: Your Money, Your Mind

We often say, “Money is money, what’s there to think about?” But the truth is, we treat our money the same way we treat other aspects of our lives. Our thoughts, feelings, and habits dictate how we handle our finances. This is called behavioural finance – understanding how your thoughts, feelings, and habits influence your financial decisions.

Loss Aversion: Losing ₹1000 feels worse than earning ₹1000. This is why we often avoid risks.

Herd Mentality: If everyone is buying, we buy too. If everyone is selling, we sell. But this isn’t always right. Every investment is different.

Overconfidence: We think we can beat the market. But the reality is, very few people can.

Anchoring: We stick to old prices. If you bought a share for ₹100 and it’s now ₹200, you might think it’s expensive, even if it’s actually cheap.

Before making a financial decision, it’s essential to step back and assess your motivations. Are your choices driven by fear, greed, or a well-considered plan? Remember, your financial well-being is the result of your hard work and careful planning.

Build a good relationship with your money!

Here’s the list of curated readings for you this week:

Personal Finance

- ITR filing deadline: Who can file income tax return after July 31, 2024? A late fee of ₹1,000 will be charged to individuals whose annual salary is less than ₹5 lakh, and a late fee of ₹5,000 will be imposed on those whose annual salary exceeds ₹5 lakh. The deadline for filing ITRs has been extended to October 31, 2024, for individuals and businesses whose accounts require auditing. Read here

- RBI’s new rules for two-factor authentication of digital payments; Check alternative methods proposed: In order to allow the ecosystem to use different forms of authentication, the RBI has announced a draft on “Framework on Alternative Authentication Mechanisms for Digital Payment Transactions”. Read here

- Why it’s Hard to Create the first Rs 1 CR? Let’s face it, saving a crore isn’t child’s play. This page spills the beans on why it’s tougher than it seems. It’s all about breaking bad spending habits and smart saving moves. Read here

Investing

- The Intelligent Investor Small stocks are having a moment, outshining their larger counterparts. This shift away from big tech companies has investors buzzing. While its exciting, experts warn against getting carried away. The article also highlights the importance of smart investing and being cautious about hyped-up technologies like AI. Read here

- Crypto absurdity: WazirX plan to socialise losses deeply flawed: WazirX is under fire for its plan to share the losses from a recent hack among all its users. Critics argue that this is unfair and that the exchange should bear the responsibility for the security breach. Read here

- Joel Greenblatt: Is Stock Market Investing Right for Your Personality Type? Joel Greenblatt argues that investing is like sailing. It’s not just about reaching a destination (financial goal), but enjoying the journey. The key to successful investing is finding pleasure in the process. Read here

Economy

- Heatwaves Push India’s Global Electricity Demand to New Highs: It’s super-hot outside, right? Well, everyone’s turning up their air conditioners to stay cool. This is causing a big spike in electricity use. It’s like a whole bunch of people are hogging the power at once! Read Here

- Factory activity maintains solid growth in July, PMI shows: India’s manufacturing activity expanded at a solid pace in July thanks to continued robust demand, according to a survey that also showed cost pressures were high as prices charged to clients rose at the steepest rate in over a decade. Read here

- Why is the Indian Economy Resilient Even Amid a Global Slowdown? India’s economy is bucking the global trend with impressive growth. Despite a worldwide slowdown, India’s GDP surged 8.2% in FY24, making it the fastest-growing major economy. Read here

****

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 20 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 40 across the smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.