CAGR Insights is a weekly newsletter full of insights from around the world of the web.

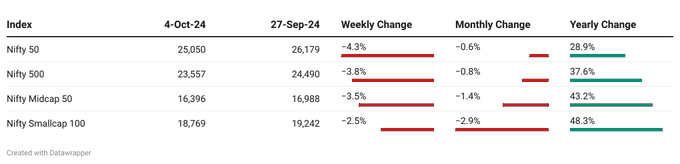

Chart Ki Baat

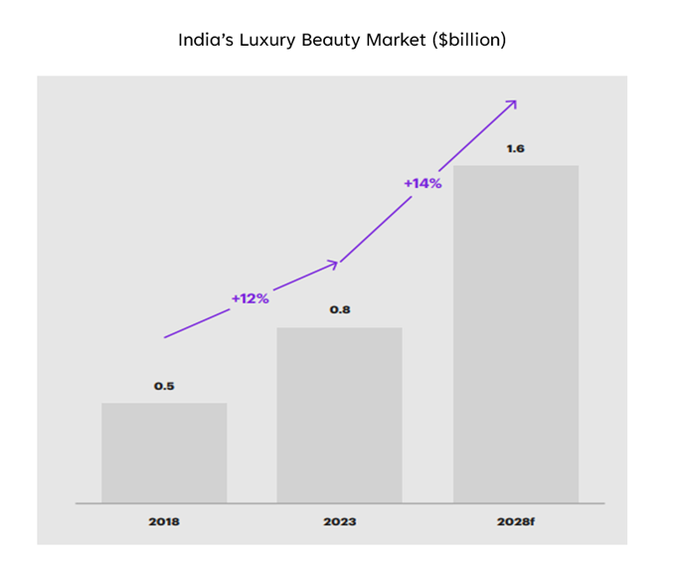

Source: Kearney and LUXASIA Analysis

Gyaan Ki Baat

SSGR stands for Self-Sustainable Growth Rate. It’s a financial metric that measures the maximum rate at which a company can grow without resorting to external financing (like issuing new debt or equity). In essence, it’s a measure of a company’s internal growth potential.

SSGR = (Net Profit Margin * Net Fixed Asset Turnover * (1 – Dividend Payout Ratio) – Depreciation Rate) * 100

Where:

- Net Profit Margin: Measures the profitability of a company’s operations.

- Net Fixed Asset Turnover: Indicates how efficiently a company uses its fixed assets to generate revenue.

- Dividend Payout Ratio: The percentage of net profits paid out as dividends.

- Depreciation Rate: The rate at which a company’s fixed assets are depreciated.

Why is SSGR Important?

- Financial Health: A high SSGR indicates a company’s ability to grow organically, which is often seen as a sign of financial health.

- Investment Decision: Investors often use SSGR to assess a company’s growth potential and its reliance on external financing.

- Risk Assessment: A company with a high SSGR may be less risky as it’s less dependent on external factors for growth.

Here’s the list of curated readings for you this week:

Personal Finance

- New NPS investment option: Opportunity to earn higher returns from equity for these investors: The National Pension System (NPS) just got more exciting! The PFRDA has added a new ‘Balanced Life Cycle Fund’ to the NPS, offering private sector subscribers a new investment option tailored to their retirement needs. Read here

- Here’s why term insurance is a must-have in every family’s financial plan: Don’t let life’s uncertainties catch you off guard. Term insurance is a vital safety net that ensures your family’s financial future remains secure, even in the face of the unexpected. To learn more about term insurance and find the best plan for your needs. Read here

- Avoiding Financial Fraud And QR Code Scams This Festive Season: The festive season is here, but so are the scammers! Be aware of the growing threat of QR code scams, phishing, and online pay ment frauds. Protect your hard-earned money and enjoy a safe and hassle-free shopping experience. This article dives into how to stay safe online. Read here

Investing

- FPIs pump Rs 86,000 crore in Indian equities in Q2, highest since December 2020: Despite global economic uncertainties, foreign investors continue to flock to India’s stock market. In the September quarter, they pumped over ₹86,000 crore into Indian stocks, the highest in 15 quarters. This surge is a testament to India’s growing appeal as a prime investment destination. Read here

- Swiggy vs Zomato: Which is better investment bet? Morgan Stanley weighs in: Swiggy and Zomato: The culinary titans are locked in a battle for food delivery supremacy. While Swiggy’s unit economics are improving, Zomato’s larger scale and higher margins give it a competitive edge. Which food delivery app will reign supreme? Will Swiggy’s IPO shake up the market? Read here

- Sebi tightens F&O rules to curb derivatives market frenzy, protect small investor: The Securities and Exchange Board of India (SEBI) has tightened the norms for equity derivatives trading, raising the entry barrier and making it more expensive for retail investors. The new rules will come into effect from November 20, 2024. Read here

Economy & Sectors

- India has emerged as one of the best global markets for the long haul. Here are the drivers—and how to play the rally. India’s stock market is on fire! Investors are flocking to the country’s booming market, driven by strong economic growth, infrastructure investments, and a tech-savvy banking system. With its potential for long-term outperformance, India is emerging as a top investment destination. Don’t miss out on this exciting opportunity! Read here

- Israel-Iran War: How Conflict In Middle East Will Impact Indian Economy? Explained: A major conflict in the Middle East could disrupt global trade, impacting India’s economy by raising freight costs and crude oil prices. With India heavily reliant on oil imports, this may spike inflation and slow growth. Discover how this could reshape the global economy and affect your finances. Read here

- The key to India’s economy? Making women safer: India’s economic future hinges on women’s safety, with experts saying that empowering more women in the workforce could unlock massive growth potential. Learn how protecting women can drive transformative growth in India’s economy. Read here

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 5 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 25 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.