CAGR Insights is a weekly newsletter full of insights from around the world of the web.

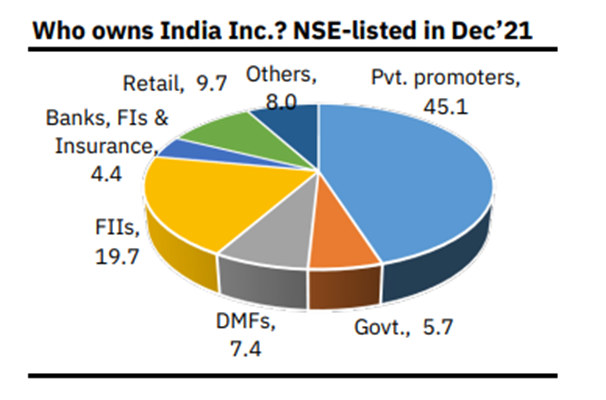

Chart Ki Baat

Source: NSE India

Gyaan Ki Baat

Why is the sugar industry booming post the lifting of the ethanol ban?

The recent lifting of the ban on ethanol production from sugarcane has proven to be a sweet deal for the sugar industry. This policy shift has not only revitalized the sector but has also had far-reaching implications for the economy.

Understanding the Sweet Synergy

Increased Demand for Sugarcane: The ethanol industry’s increased demand for sugarcane has provided a significant boost to sugar mills. This has led to higher sugarcane prices, benefiting farmers and the overall agricultural economy.

Diversification of Revenue Streams: By producing ethanol, sugar mills have diversified their revenue streams, reducing their dependence solely on sugar production. This has made them more resilient to fluctuations in the sugar market.

Contribution to Renewable Energy: Ethanol is a cleaner alternative to fossil fuels. Its production and use contribute to India’s renewable energy goals, reducing the country’s carbon footprint.

Rural Development:The growth of the sugar and ethanol industries has created employment opportunities in rural areas, leading to economic development and poverty alleviation.

Here’s the list of curated readings for you this week:

Personal Finance

- Income Tax return refund delayed: Know likely reasons and solutions: You may submit your Income Tax return (ITR) on time but getting a refund may take time. The Income Tax has to do multiple checks before it approves a refund. Have a look at the reasons for delayed returns. Read here

- Retirement Planning: With UPS in the fray soon, is it the time for govt employees to exit NPS? Union Government is set to roll out the Unified Pension System (UPS) from April 1, 2025, to give fixed, inflation-linked pensions to subscribers. Want to know which option is right for you? This article talks about the key differences between NPS and UPS. Read here

- RuPay, Visa or MasterCard? From September 6, you’ll have the power to choose your credit card network: From today you will have the flexibility to select your preferred credit card network when applying for a new credit card and on renewal. Previously, your bank determined the network for your credit card, but now you can select the one that best fits your needs and spending habits. Why did RBI issue a guideline allowing users to choose a credit card network? Read here

Investing

- Berkshire Hathaway: There May Be Something Big Going On Behind Buffett’s Selling: Berkshire’s recent stock sales could signal a strategic shift, potentially paving the way for a significant acquisition like Chubb. Intrigued? Delve deeper into the intricacies of Berkshire’s strategic maneuvers and discover the potential implications for investors. Read here

- SEBI set to streamline foreign investment in Indian government bonds: To bolster foreign investment, SEBI is re-evaluating its registration requirements for overseas investors interested in Indian government bonds.Learn more on how this change could impact India’s economy and investment landscape.Read here

- The Most Successful Investments Are Really Obvious: Joel Greenblatt emphasizes the importance of clarity and simplicity in investment ideas. According to him, truly compelling investment opportunities should be easily understandable without extensive analysis. Want to learn how to spot winning investments? Read here

Economy

- Global Economic Outlook: DSP From China’s overproduction crisis to the resurgence of nuclear energy, the document offers valuable insights into a wide range of topics. Also explore the latest trends in retail trading, the challenges facing the banking sector, and the future of the agrochemical industry. This essential resource is a must-read for anyone looking to stay informed about the global economy. Read here

- India saw slower growth in Q1, but consumption, non-government investment, and manufacturing were reassuring: India’s GDP growth in Q1 FY 2024-25 slowed to 6.7%, but key areas like private consumption, manufacturing, and non-government investment show positive momentum. Despite a dip in India’s Q1 growth, private consumption and investments are bouncing back—could a stronger rebound be on the horizon? Read here

- India’s growth story remains intact, says RBI Governor at FIBAC 2024: RBI Governor Shaktikanta Das reaffirmed India’s robust growth trajectory at FIBAC 2024, emphasizing strong recovery post-COVID and continued momentum in key sectors. Find out how private consumption and investments are driving the economy towards a 7% boom! Read Here

***

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 20 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 40 across the smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.