CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 10-Feb-23 | 3-Feb-23 | Change (%) |

| Nifty 50 | 17,856 | 17,854 | 0.01 |

| Nifty 500 | 15,015 | 14,962 | 0.35 |

| Nifty Midcap 50 | 8,771 | 8,604 | 1.94 |

| Nifty Smallcap 100 | 9,526 | 9,415 | 1.18 |

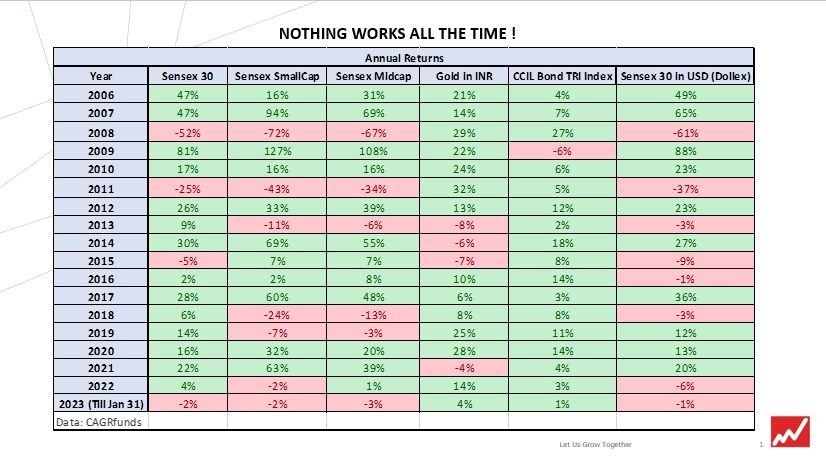

Gyaan of the week

Here’s the list of curated readings for you this week:

Personal Finance

- 10 major changes for salaries person in Budget 2023– Read here.

- No proposal on raising overseas limit for MFs yet– “Mutual funds and some of the market players have approached the RBI, and we have examined their requests, and as of now, we have not taken any positive decision on it… if we take a decision then we will inform. But as of now, no proposal has been made to increase the overseas limit,” Das said while delivering the monetary policy statement. Read here.

- Where do millionaires keep their money?– When it comes to how millionaires pick securities within an asset class, the answer is—diversification. If you look at the investment product choices that affluent households make, you will see that the vast majority use mutual funds (which tend to be diversified), with only one third of them owning any individual securities (i.e. individual stocks) Read here.

Investing

- First-principles approach to building Quant Framework in Indian Public Equities–This is a wonderful watch, so many ideas resonate here from our own experience of building a quant model. Watch here

- ITC — The Budget Stock – Duty hike for cigarettes not a big deal. While on average, people across the world smoke 800 cigarettes a year, India’s consumption of the legal variety is just 89 cigarettes. Most folks in India still prefer other tobacco products such as beedis and ghutkas. But if the tax regime remains more or less stable and as per capita incomes rise, we might see a gradual shift to cigarettes. It’s a long shot but it’s possible. Read here

- MSCI probes free float of Adani companies – India’s Adani Group faced fresh concerns on Thursday after financial index provider MSCI said it was reviewing the free float designation of some group company securities. Read here

- Time to go overweight duration– An interesting insight from DSP MF converse – when FX reserves dip, RBI hikes. And FX reserves have been on an uptrend. Read here

- Gilt market gets rate hike right, not rest of the policy– Some sections of the market had bet heavily on the RBI hitting the brakes on its rate hike cycle. Chatter before the outcome centred on a less severe monetary policy stance to ‘neutral’ from ‘withdrawal of accommodation’. Read here.

Economy

- Tepid growth in government’s revenue expenses may not spur demand– The budget does not provide any boost to the GDP growth through the government’s revenue expenditure. Its thrust is solely on the capital expenditure. Read here.

- Robust government capex may not crowd-in private investment- In 2020-21, the last year for which such data is available, while central and state governments together accounted for about 16 per cent of total GFCF, public sector enterprises accounted for nearly 11 per cent and private enterprises accounted for 35 percent. The largest share is held by the household sector which includes several small enterprises. Read here.

CAGR Speak

- RBI gave the Indian bond market a boost.. Read the linkedin post here.

- Some people have recently reached out asking what should they be doing as investors in the context of the Adani fiasco. Read the linkedin post here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you’d like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.