CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

Gyaan Ki Baat

Navigating Drawdowns in the Current Indian Market

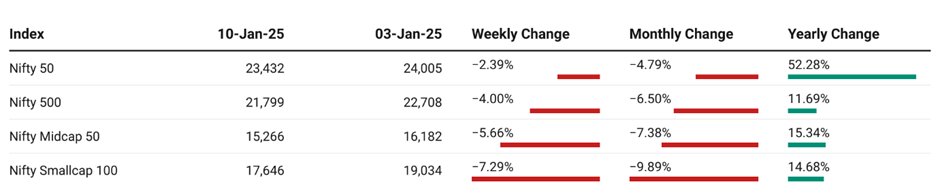

As we step into 2025, many investors in India are grappling with drawdowns in their portfolios. A drawdown refers to the decline in an investment’s value from its peak, and it serves as a crucial indicator of risk. Currently, the Indian stock market is experiencing volatility, with the BSE Sensex down approximately 12% from its September 2024 peak. Factors such as high valuations, slowing growth, and significant foreign institutional investor (FII) selling—amounting to around ₹1.15 trillion—have contributed to this downturn.

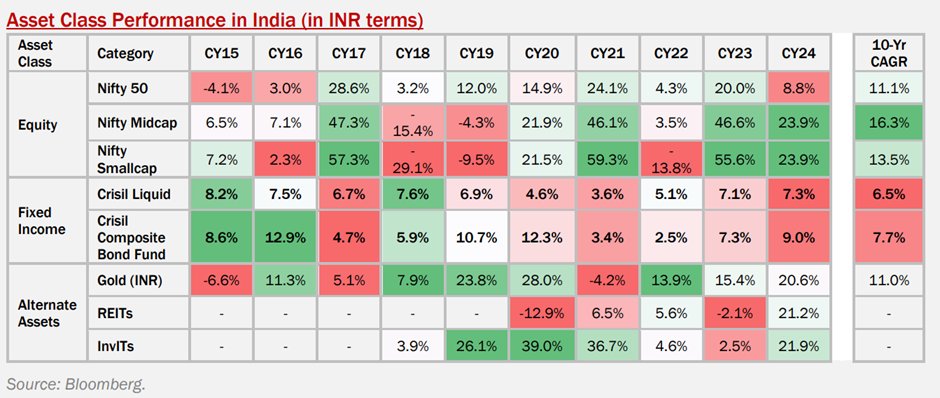

This environment underscores the importance of understanding drawdowns and their implications for investor sentiment. For those facing portfolio drawdowns, it’s vital to reassess risk and maintain a balanced approach. Keeping cash reserves can provide opportunities to buy during market corrections, which often yield better long-term returns. As history shows, markets tend to recover from downturns, rewarding disciplined investors. In conclusion, while drawdowns can be challenging, they also offer valuable lessons and opportunities. By staying informed and strategic, investors can navigate these turbulent times and position themselves for future growth. Remember, patience and a well-thought-out strategy are key to overcoming market fluctuations.

Personal Finance

- Investing in your 40s, 50s and Retirement Planning: Are you in your 40s and 50s and wondering how to invest wisely for a secure retirement? 💼💰 Shruti and Vikas break down the essentials of retirement planning in the latest episode of Finance Ke Funde!Watch here

- India Post Launches Aadhaar-Based Digital KYC for Savings Accounts: India Post has implemented Aadhaar-based authentication for Post Office Savings Accounts (POSA) operations, introducing a paperless Know Your Customer (KYC) process that became operational on January 6, 2025. Leverage this convenient, government-backed system to diversify your savings while benefiting from financial inclusion initiatives. Read here

- EPFO set to introduce self-attestation facility for completing KYC: In a major relief for its 80 million active members, the Employees Provident Fund Organisation (EPFO) is set to introduce a self-attestation facility starting in June that will do away with the need for approval from employers to complete the Know Your Customer (KYC) process. Read here

Investing

- Sebi issues new guidelines for research analysts, investment advisers: SEBI has issued updated guidelines for research analysts (RAs) and investment advisers (IAs), introducing deposit requirements, AI disclosure mandates, client segregation rules, compliance audits, dual registration protocols, and transparency measures to strengthen regulatory oversight and ensure investor protection. Read here

- SIPs surpass fixed deposits, equities as India’s preferred investment choice: Mutual funds In India are gaining popularity as inflation and rising interest rates reduce returns on traditional investments like FDs and RDs. Improved financial literacy, digital access, and SIP flexibility have fueled this shift, with mutual fund participation rising to 62% in 2024, up from 54% in 2023. Read here

- Bond Market Outlook 2025: What retail investors need to know: India’s bond market is set for some changes in 2025. A mix of stable macroeconomic factors, shifting investor trends, and global influences will define the landscape. Read here

Economy & Sectors

- Indian Micro Finance sector grows by over 2,100% in 12 years: The Micro Finance Institutions (MFI) industry has grown over 2176%, from Rs. 17,264 crores in 2012 to Rs. 3.93 lakh crore in 2024. Operating in 723 districts, including 111 aspirational ones, MFIs serve 8 crore borrowers, contributing 2.03% to GDP. Challenges include raising low-cost long-term funds and governance improvements. Read here

- India’s economy likely to grow 6.6% in 2025, 6.7% in 2026: UN report: Keeping its 2025 growth forecast unchanged from its mid-2024 estimates, the UN report said, “In India, the public sector continues to play a pivotal role in funding large-scale infrastructure projects, physical and digital connectivity, and social infrastructure, including improvements in sanitation and water supply. Strong investment growth is expected to continue through 2025.”Read here

- How Budget 2025 can propel India’s economic growth to 7%: The Modi government’s first full budget in its third term will need strong policy support to boost demand and achieve 7% economic growth in FY26, up from an expected 6.3% in FY25. Measures to enhance revenue expenditure, income tax policies, and demand-side policies are essential to address challenges and drive growth.Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.