CAGR Insights is a weekly newsletter full of insights from around the world of the web.

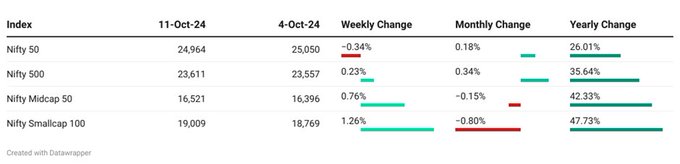

Chart Ki Baat

Gyaan Ki Baat

The Power of Perception

In 2008, Saeed Khouri, an Abu Dhabi businessman, made headlines worldwide for his extravagant purchase: a license plate for $14.5 million. The plate’s unique feature was a single digit, “1,” which was valued at $7.2 million on its own. While many considered him foolish, Khouri saw an opportunity that others had overlooked. We often overlook the potential value of things based on their intrinsic worth, but it’s the perception of value that truly drives the market.

Here are some key takeaways:

Investment Opportunities:

- Appreciation: License plates have shown significant appreciation in value over time, making them attractive investments.

- Liquidity: These plates can be easily bought, sold, or transferred, providing liquidity and flexibility.

- Tax advantages: In the UAE, there is no capital gains tax, making profits from plate sales even more attractive.

Factors Driving the Market:

- Auctions: Elaborate auctions held by the Roads and Transport Authority (RTA) create excitement and drive-up prices.

- Government backing: The UAE government’s regulation and support legitimize the market and increase buyer confidence.

- Emotional value: Owners often develop strong emotional attachments to their unique plates, which can further drive prices.

Conclusion:

Saeed Khouri’s investment in a single-digit license plate may have seemed irrational at the time, but it has proven to be a shrewd move. This move demonstrates the power of perception, scarcity, and cultural context in driving value. By understanding these factors, investors can identify and capitalize on unique investment opportunities.

Here’s the list of curated readings for you this week:

Personal Finance

- DA Hike Of 3% Expected In Next Cabinet Meeting, Says Employee Union: Central government employees are expecting a dearness allowance (DA) hike of at least 3% in the next Cabinet meeting. This will help offset inflation and provide a boost to their salaries. The hike is expected to be announced just before Diwali. Read here

- World Financial Planning Day: Money mistakes that can derail your financial future: Tired of living pay check to pay check? Avoid common financial mistakes and take control of your money. Start building a brighter future today! Read here

- RBI flags NBFCs’ ‘growth at any cost’ approach: Retail borrowers would do well to heed the message: Don’t get carried away by festive season discounts! The RBI warns of risky lending practices by NBFCs. Plan your budget, avoid unnecessary debt, and focus on responsible spending. Read here

Investing

- India, South Korea Join Major FTSE Russell Index After Bond Market Reforms: India and South Korea have joined the FTSE Russell Bond Index. This means billions of dollars will flow into their economies. South Korea worked hard to impress investors, while India’s efforts were more low-key. To learn why the inclusion of these countries is a big deal for global finance.Read here

- The timeless wisdom of investing: Focus on asset allocation, risk profile and time horizon: Tired of chasing market trends? Focus on the fundamentals: asset allocation, risk profile, and time horizon. Discover the proven strategy that experts use to build wealth consistently. Read here

- Why the surge in Chinese equities is not convincing? Global investors are skeptical of China’s stock rally. They doubt Beijing’s commitment to stimulus and believe some stocks are overvalued. They’re waiting for more concrete action before investing. To know why they are so sceptical about the Chinese Market Read here

Economy & Sectors

- Amid Ongoing Festive Season, RBI Leaves Repo Rate Unchanged At 6.5%: The Reserve Bank of India (RBI) has maintained the status quo on interest rates for the tenth consecutive time, leaving the policy repo rate unchanged at 6.5%. This decision has left borrowers wondering if they will ever see a reduction in their loan costs. Read here

- Car Inventory Surges To All-Time High As Retail Sales Slump Nearly 20%: Indian car dealerships are bursting at the seams with unsold vehicles, while retail sales have taken a nosedive. With the crucial festive season looming, the pressure is mounting on carmakers and dealers to avoid a stockpiling disaster. The question remains: Can they weather this perfect storm of excess supply and dwindling demand? Read here

- Ken Andrade Sees India as a Teflon-Coated Economic Powerhouse: Renowned investor Ken Andrade paints a positive picture of India’s economy. He highlights the country’s strong financial foundation, robust manufacturing growth, and potential for global leadership in aviation and services. While challenges remain, Andrade’s analysis suggests a promising future for India. Read here

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.