CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

Gyaan Ki Baat

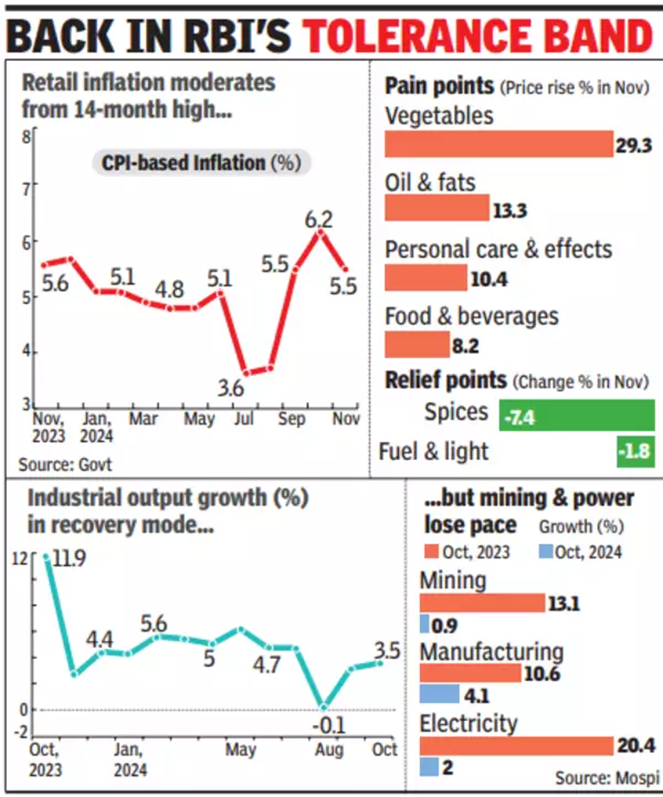

November Inflation Eases to 5.48%

In November 2024, India’s retail inflation showed a significant decline, easing to 5.48% from 6.21% in October. This decrease brings inflation within the Reserve Bank of India’s (RBI) target range of 2-6%, which is a crucial indicator for monetary policy decisions, particularly regarding interest rates.

Key Highlights of November Inflation:

CPI Trends: The Consumer Price Index (CPI) inflation fell primarily due to a reduction in food prices, which had surged in previous months. The year-on-year inflation rate for food was recorded at 9.04%, with notable declines in the prices of vegetables, pulses, and other essential commodities.

Urban vs. Rural Inflation: Urban areas experienced a lower inflation rate of 4.83%, while rural inflation was higher at 5.95%. This disparity highlights the ongoing challenges in rural economies, where food prices remain a significant concern

Personal Finance

- Transparency in Insurance: Why Honest Declarations and Partner Involvement Matter: Insurers share key consumer details, making honesty crucial in insurance declarations. Radha’s case revealed her late husband’s non-disclosure of health issues, leading to claim rejection. Read here

- Bank account, bank locker rule change: Lok Sabha passes new Banking Amendment Bill, allowing up to 4 nominees in savings, locker accounts: The Lok Sabha has passed the Banking Laws (Amendment) Bill, 2024, allowing up to four nominees for bank accounts, deposits, and lockers. This change simplifies fund distribution and ensures smoother access for nominees after the account holder’s death. Read here

- New SIP rule: SEBI mandates MF companies to process cancellations in 2 days: SEBI has reduced SIP cancellation processing to two working days from ten, effective December 1, 2024. The reform ensures uniform timelines, faster control, transparency, and operational efficiency, enhancing investor convenience and trust in the mutual fund ecosystem. Read here

Investing

- FPI participation in Indian equity-derivative markets rising: SMC Global: Foreign Portfolio Investors (FPIs) are returning to Indian markets, attracted by steady economic growth and opportunities in equities and derivatives. SMC Global reports rising FPI participation, complemented by expanding domestic trading from tier-3 and tier-4 cities via mobile apps. Read here

- Investing in 2025: Headwinds and tailwinds: After tripling since 2020 lows, markets face uncertainty in 2025 amid global economic risks, Trump’s unpredictable policies, and high valuations. US tariff threats, rising dollar strength, and cautious investors challenge emerging markets, including India. Read here

- Gold Price Outlook 2025: Key Trends Shaping the Future of Gold: Gold has surged 28% in 2024, driven by central bank buying, geopolitical risks, and market volatility. Modest 2025 growth is expected, with potential upside from central bank demand and risks from monetary policy shifts and China’s economic dynamics. Read here

Economy & Sectors

- India needs USD 2.2 trillion investment on infra to become a 7$ trillion economy before 2030: Real estate consultant Knight Frank India released a report, ‘India Infrastructure: Reviving Private Investments’, which mentioned that “ an estimated investment of USD 2.2 trillion into infrastructure development is imperative to support India’s GDP size to expand to USD 7 trillion by 2030.” Read here

- 69% growth in rural female employment during 2018-23, says government report: India’s female labour force participation (LFPR) rose significantly, driven by government schemes like Mudra loans and SHGs. Rural LFPR surged (~69%), with interstate variations, while urban gains were modest. Marital status, age, and childcare significantly influenced LFPR trends. Read here

- India In 2030: $7 Trillion Economy Dream Needs $2.2 Trillion Investment In Infrastructure, Says Report: India needs $2.2 trillion infrastructure investment to reach a $7 trillion economy by 2030. Private sector participation has dropped significantly, stressing government finances. Addressing delays, financing issues, and revenue risks can revive private investments and ensure sustainable growth. Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.