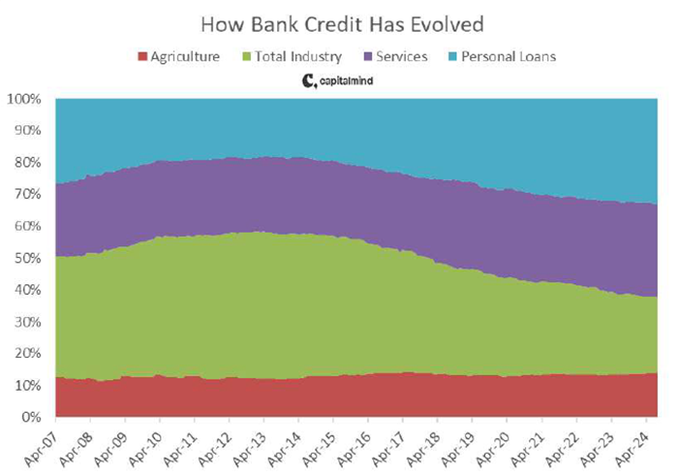

Chart Ki Baat

Source: CapitalMind

Gyaan Ki Baat

Mansa Musa, the 14th-century emperor of Mali, had a net worth of $400–700 billion today, making him far wealthier than today’s richest individuals. He expanded his empire through strategic trade, not battles. During his 1324 pilgrimage to Mecca, he traveled with 60,000 people, distributing so much gold that he caused hyperinflation in Egypt. Musa transformed Timbuktu into a cultural hub by building schools and the University of Sankore. His legacy emphasizes that true wealth lies in investing in people and creating lasting impact.

Mansa Musa’s story transcends time and geography, offering the following valuable insights that resonate even in today’s world:

- Wealth with Purpose: True wealth isn’t just about accumulation; it’s about making a positive impact. Mansa Musa demonstrated that investing in people and infrastructure can create lasting change and prosperity.

- The Power of Generosity: Musa’s generosity changed economies and lives. This reminds us that giving back can have ripple effects, influencing communities far beyond our immediate surroundings.

- Prioritizing Knowledge: The emphasis on education and learning paved the way for innovation and cultural exchange. In today’s fast-paced world, fostering a culture of knowledge can drive progress and creativity.

- Strategic Leadership: Musa expanded his empire not through war, but through diplomacy and trade. His leadership style teaches us the importance of collaboration and smart decision-making in achieving our goals.

- Cultural Richness: Embracing diversity and facilitating cultural exchange enriches societies. Mansa Musa’s reign illustrates that the blending of ideas and traditions can lead to a vibrant and thriving community.

- Historical Awareness: Understanding the past allows us to recognize shifts in power and prosperity. History is not static; it reminds us that today’s leaders can emerge from anywhere, and that we must remain open to new perspectives.

Here’s the list of curated readings for you this week:

Personal Finance

- A Message From the Past (Thoughts on Nostalgia): Morgan Housel discusses the phenomenon of economic nostalgia, where people often romanticize the past and forget the challenges and uncertainties they faced at the time. He suggests that understanding this phenomenon is crucial for investors and individuals alike, as it can help them manage expectations and navigate the present challenges. Read here

- Sebi’s New Move: A Game-Changer for Debt Investors: Sebi has introduced a new liquidity window for debt securities, allowing investors to sell them back to issuers before maturity. This aims to address the illiquidity of the corporate bond market and encourage greater retail investor participation. Will this liquidity window unlock the potential of India’s debt market? Read here

- New ITR E-Filing Portal 3.0 to Launch Soon: IT Dept Invites Suggestions: The Income Tax Department is introducing a new e-filing portal (Project IEC 3.0) to streamline the tax filing process. The revamped platform promises faster ITR processing, improved user experience, and enhanced security. The department is seeking public feedback to ensure the portal meets taxpayer needs.Read here

Investing

- Investing during geopolitical unrest & market sensitivities: Geopolitical tensions, China’s stimulus, and domestic concerns are rattling financial markets. Rising oil prices, capital outflows, and F&O losses are adding to the volatility. Despite these challenges, investors can navigate this turbulent landscape with a dynamic strategy and protect their portfolios. Are you ready to take control of your investments? Read here

- These 2 factors to act as ’suit of armour’ against emerging risks in Indian market, says Motilal Oswal Private Wealth: Motilal Oswal Private Wealth (MOPW) addresses rising market volatility, advising a cautious, staggered investment approach. They emphasize resilience, highlight opportunities in specific sectors, and offer insights on navigating current economic challenges while balancing growth prospects with potential risks.Read here

- Four investment mistakes you really don’t want to repeat: In this insightful column, the author explores key investment blunders—from clinging to bad bets to mistiming the market—using personal and historical examples. Learn how cognitive biases can derail financial decisions and discover valuable lessons to avoid costly investment mistakes. Read here

Economy & Sectors

- “Entrepreneurs Face Unprecedented Opportunities, But Must Focus and Navigate Wisely”, Says Infosys Co-Founder Nandan Nilekani: Nandan Nilekani, Infosys co-founder, believes there are more entrepreneurial opportunities today than ever. He encourages young people to focus on key areas and highlights energy transition, especially small-scale solutions, as promising but cautions that it requires market knowledge and expertise. Watch here

- India’s Green Hydrogen journey chugging along! India is emerging as a leader in Green Hydrogen, with trials for the country’s first hydrogen-powered train expected by December. This eco-friendly fuel source has the potential to revolutionize industries, reduce emissions, and boost energy security. Green Hydrogen is transforming India’s energy landscape from steel plants to maritime shipping.Read here

- Pvt equity investment in real estate down 4% to $2.3 bn in Apr-Sep: Anarock Private equity in Indian real estate drops 4%, but a game-changing $1.5 billion Reliance-ADIA/KKR deal reshapes the landscape—find out how global trends are impacting the market! Read here

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.