CAGR Insights is a weekly newsletter full of insights from around the world of web.

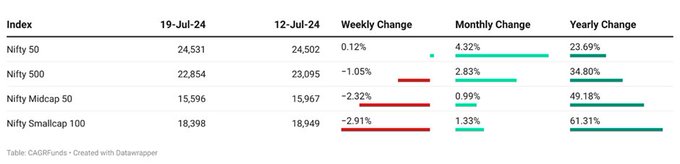

Chart Ki Baat

Gyaan Ki Baat

On July 19, 2024, one of the world’s major global systems outages ever occurred caused disruptions to the functioning of airlines, stock markets, certain media broadcasts, and payment gateways across time zones.

What is Global Azure?

An international community-driven event centered around Microsoft Azure, the company’s cloud computing platform, is called Global Azure. Usually, it consists of a number of concurrently held conferences, workshops, and meetups in different parts of the world. The software giant announced that it was resolving a problem that was impeding users’ ability to access Microsoft 365 services and apps.

Here’s the list of curated readings for you this week:

Personal Finance

- EPF update: Finance ministry approves EPF annual interest rate of 8.25% for FY2024-25; some members get their payments: The Union Finance Ministry on Thursday announced that it has approved the annual interest rate of 8.25% for provident fund deposits. In February this year, the Employees’ Provident Fund Organisation (EPFO) said the interest rate for the financial year 2023-24. The EPFO increased the interest rate to 8.25% for 2023-24 from the previous year’s rate of 8.15%. The rate revision decision impacts millions of EPF members across the country. Read here

- Difference between ITR-1 and ITR-2 forms? When filing your income tax return, you must use either ITR 1 or ITR 2, depending on your sources of income for the year. Filing with the wrong form can result in a notice from the tax department, asking you to correct it. It’s important to use the correct form to avoid this issue. Read Here

- Benefits of using Bharat Bill Payment System (BBPS): Bill payments just got easier in India! BBPS is a one-stop shop to pay all your bills anytime, anywhere. You can use it online, on apps, or even at stores. BBPS reminds you about due dates and keeps your financial info safe. Plus, you can choose how to pay with options like UPI or debit card. It’s fast, convenient, and secure! Read here

- Looking to send money abroad? Open foreign currency accounts in GIFT City: Indian residents can now open foreign currency accounts in International Financial Services Centres (IFSCs) like GIFT City which will allow you to hold foreign currency like US Dollars. Earlier, there were limitations on how Indian residents could use the Liberalised Remittance Scheme (LRS) for international transactions. Read here

Investing

- Base Rate Neglect & Absurd Valuations: We often get carried away by the hype around certain companies and end up paying too much for their stocks. The focus is on the few companies that become super successful and the fact that most companies don’t make it big is ignored. This is like betting on a long shot in a horse race without considering the odds. It’s important to be realistic and not get blinded by excitement when investing.Read here

- Contrarian Investing and First Principles: Insights from Rajeev Thakkar | PPFAS AMC: In this interview, Rajeev Thakkar, CIO of PPFAS AMC, credits his father and the 1992 market boom for sparking his interest in value investing. He emphasizes the importance of first-principles thinking, instilled by PPFAS founder Parag Parikh, which encourages questioning conventional wisdom and basing decisions on logic. Thakkar recommends books by Peter Lynch and Benjamin Graham for those wanting to delve deeper into value investing. Watch here

- Finding Ideas Before Others: The article compares finding stocks to Robert Ballard finding the Titanic. There are 3 main ways to find stocks: brute force (looking at everything), screens (narrowing down based on criteria), and research. Networking and relationships are also important to find good stocks. The key is to be persistent and develop an idea generation process. Read here

Economy

- India has potential to become world’s 2nd largest economy by 2031: RBI Dy Governor: Given the country’s innate strengths, it is possible to imagine India striking out into the next decade to become the second largest economy in the world not by 2048, but by 2031, and the largest economy of the world by 2060, RBI Deputy Governor Michael Debabrata Patra has said. Read Here

- The next decade belongs to Bharat | Insights by Neelkanth Mishra: Economist Neelkanth Neelkanth Mishra, an economic expert, spoke about India’s future at WMG Bharatnomics. He warned of a shrinking workforce due to falling birth rates and the challenges of rising inequality. Mishra emphasized the need for better city infrastructure, innovation, and affordable energy to achieve India’s ambitious growth goals. Watch here

- NBFC’s set for bigger play: NBFC’s are important to help India’s economy grow to $5 trillion. There were some problems for NBFCs in the past, but they are doing well again. The RBI makes sure the NBFCs follow the rules. NBFCs are also finding new ways to get money. In the future, some big NBFCs might even be able to become banks. Read here

****

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 20 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 40 across the smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.