CAGR Insights is a weekly newsletter full of insights from around the world of the web.

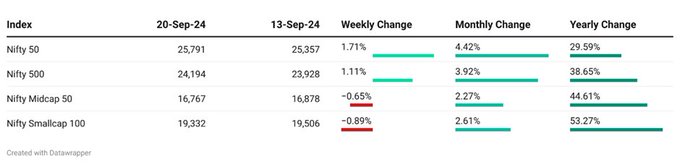

Chart Ki Baat

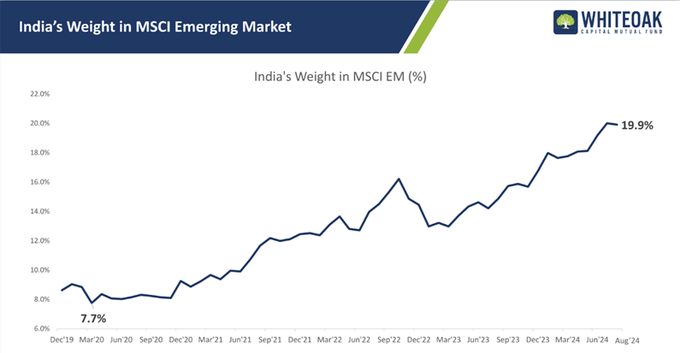

Source: RIMES, MSCI, Morgan Stanley Research as on 31st August 2024

Gyaan Ki Baat

We think this is the time when people have to focus on risks vs returns. It’s a challenge as the market goes up every month on a continuous basis, to tell people to focus on risk and not returns is a thankless job.

– S Naren

Here’s the list of curated readings for you this week:

Personal Finance

- Take Something Away: Think about it – training wheels help kids balance, but eventually, they need to be removed. It’s time to stop adding and start subtracting. Your life (and your portfolio) might just thank you. From investing to personal well-being, this article argues that removing the unnecessary can lead to better outcomes. Read here

- How to convert mutual fund units from physical to demat: A complete guide: Gone are the days of paperwork and branch visits for mutual fund conversions! Thanks to recent advancements, you can now easily convert your physical mutual fund units to a demat account online. Read here

- Eight income tax notices a salaried individual can get before or after ITR processing. Know your options: The income tax department is always on the lookout for errors in ITR submissions. If they spot a mistake, you might receive a tax notice. This article will help you understand the common reasons for these notices can help you prepare and respond effectively. Read here

Investing

- Unleashing the Value Hunter: A Tale of Contrarian Investing: Inspired by Benjamin Graham, Mark Burry is emphasising on the importance of value investing. He seeks undervalued, unpopular companies and holds them for long periods. By analysing financial metrics and understanding a company’s true worth, we can identify hidden opportunities and outperform the market over time. Read here

- Modification in framework for valuation of investment portfolio of AIFs: SEBI has revamped valuation rules for AIFs introducing new standards for transparency and consistency. These changes aim to improve transparency and consistency in the AIF industry. Read here

- Analysis of Investor Behaviour in Initial Public Offerings: Ever wondered what makes investors jump on the IPO bandwagon? SEBI has cracked the code! Their latest study dives deep into the minds of investors, revealing the factors that influence their decisions when it comes to these high-stakes market debuts. From risk appetite to market trends, discover the secrets behind the IPO frenzy. Read here

Economy

- A cut — and then what? The Federal Reserve is about to embark on a rate-cutting journey, but the road ahead for stocks, bonds, and the dollar is paved with uncertainty. Will it be a smooth ride, or will the economy hit a pothole? Read here

- India 3rd favourite spot for global real estate investments: Foreign investors are flocking to India’s real estate market, particularly in the industrial and warehousing sectors. To know what factors had made India a top destination for global capital. Read here

- India’s August inflation remains within RBI’s sweet spot. Sparks hopes of a rate cut: India’s retail inflation inched up to 3.65% in August, primarily due to food prices, but has stayed within RBI’s target. Although this and a likely rate cut in the US has tempered rate cut expectations in India, the central bank is likely to maintain its current policy rate at least for now. Read here

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 5 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 25 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.