CAGR Insights is a weekly newsletter full of insights from around the world of the web.

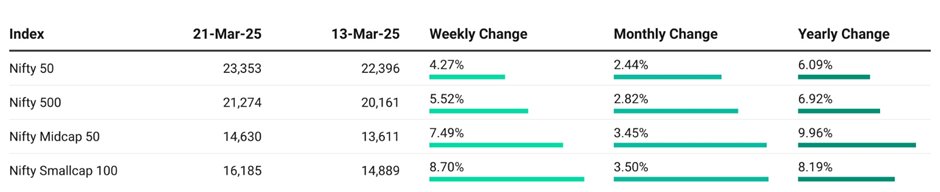

Chart Ki Baat

Gyaan Ki Baat

Patience is the Key to Investing Success

Investing is much like growing a Chinese bamboo tree. For years, the tree shows no visible growth above the ground. But during this time, it is quietly building a strong root system underground. Then, almost miraculously, it shoots up to towering heights in just weeks. The lesson? True success in investing requires patience and a solid foundation.

When you invest for the long term, your money works silently behind the scenes—compounding, weathering market fluctuations, and building financial stability. Just like the bamboo tree, your portfolio needs time to establish its “roots” before delivering visible results. Impulsive decisions and chasing quick returns can uproot your progress.

Remember, patience allows you to harness the power of compounding, ride out market volatility, and achieve sustainable growth. Stay focused on your long-term goals because, just like the bamboo tree, your investments will eventually grow tall and strong if nurtured with time and discipline.

Personal Finance

- PFRDA notifies assured pension scheme for govt employees: How loss from equities could help you save more tax: Want to legally avoid paying capital gains tax on equities? Tax harvesting can help you save big! Learn how to offset losses, maximize exemptions, and carry forward gains for 8 years. Don’t miss out on this smart tax-saving strategy! Read here

- I have a group term life insurance plan. Will this be adequate to meet my family’s financial needs? A general guideline is having a life cover of at least 10 to 11 times your annual salary, but this can vary based on unique factors. To learn more Read here

- How may a travel fund SIP change the way people save for vacations? Saving for a vacation often feels like an afterthought — many people either use their credit cards or dip into their savings at the last minute. But what if there was a structured way to save for travel while locking in the best deals?Read here

Investing

- How Not to Invest: Investment success often comes from avoiding mistakes rather than seeking big wins. How Not to Invest highlights common errors, like overconfidence in private investments, timing markets based on tax policy, and laziness in managing money, offering valuable lessons for all investors. Read here

- I have Rs 20 lakh. Here’s how I plan to reach Rs 1 crore: Abhay, a casual investor, accumulated Rs 20 lakh by 32 through unplanned investments. Realizing the need for strategy after marriage, he decided to change his approach. To learn from Abhay’s story.Read here

- How should I start investing? If you’re a young graduate eager to start investing, prioritize building an emergency fund first, then aim to invest 15% of your income in a diversified portfolio, focusing on equities and high-growth sectors. Plus, discover how mediation can save you time and money in legal disputes— to learn more! Read here

Economy & Sector

- India’s economic indicators and consumption trends shows sustained growth momentum: India’s economy shows resilience, with projected 6.5% growth in 2024-25, fuelled by strong private consumption, government spending, and sectoral performance. Key industries like construction, financial services, and trade thrive, positioning India as a stable growth leader globally. Read here

- The Future of Decentralized Autonomous Organizations (DAOs) In the Indian Economy: DAOs are redefining business, finance, and governance in India by enabling transparency, financial inclusion, and decentralized decision-making. From crowdfunding to supply chains, they promise efficiency and innovation—but regulatory clarity and adoption challenges must be addressed for their full potential to unfold. Read here

- India to dethrone Germany as world’s third-biggest economy by 2028: India is poised to surpass Germany and become the world’s third-largest economy by 2028, driven by robust economic growth, strong policy frameworks, and improving infrastructure, according to a recent Morgan Stanley report. Read here

****

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.