CAGR Insights is a weekly newsletter full of insights from around the world of web.

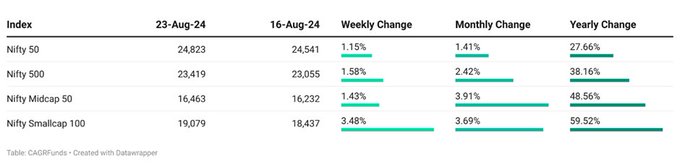

Chart Ki Baat

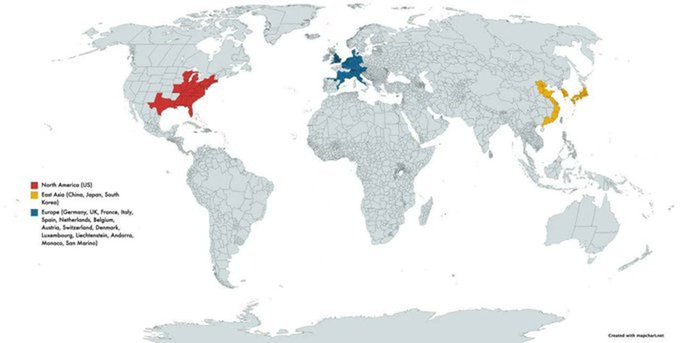

Regions that make up 50% of World GDP (Source: EpicMaps)

Gyaan Ki Baat

Promoter holding is the percentage of a company’s shares owned by its founders. Promoters are usually the largest shareholders in a company and have a significant amount of control over its operations and decision-making.

A significant promoter stake often signifies a strong alignment of interests between the promoters and the shareholders. This alignment can foster a sense of stability and confidence among investors. A substantial promoter holding suggests that the promoters have faith in the company’s future and are committed to its success.

Investor in stock should therefore consider Promoter Holding as important parameter in decision making. However, it’s essential to consider other factors – If a significant portion of the promoter’s shares are pledged as collateral for loans, it could raise concerns about financial stability. Additionally, changes in promoter holdings, such as buying or selling shares, can signal their confidence or lack thereof in the company’s future.

Source: SEBI Official Website

Here’s the list of curated readings for you this week:

Personal Finance

- CBDT says tax clearance certificate not mandatory for all: Tired of hearing about new travel restrictions? Good news: most Indian travellers don’t need to worry about the income-tax clearance certificate (ITCC). The CBDT has released a report in which they’ve confirmed only those with serious financial issues need to apply. Read here

- UPI rules: How to get money back if paid a wrong UPI address. Here are RBI’s guidelines: The Reserve Bank of India (RBI) has released comprehensive guidelines addressing the scenario where Unified Payments Interface (UPI) users erroneously transfer funds to an unintended recipient.Read here

- All You Need to Know About Tax on Gifts in India: Giving and receiving gifts is an integral part of India’s cultural heritage. While in most cases, the value of such presents is nominal, but in some cases, the value of gifts can be substantial and subject to taxation. This blog will discuss various rules and regulations regarding how gifts are taxed in India. Read here

Investing

- What does India’s benchmark inclusion mean for investors: The inclusion of Indian government bonds in the JP Morgan Emerging Market Global Bond Index has attracted significant foreign investment in India. However, this article presents a balanced view of the implications of JP Morgan’s decision, highlighting both the potential benefits and risks for India and investors. Read here

- P2P lending cannot be sold as an investment product says RBI: The RBI has directed peer to peer (P2P) lending platforms not to promote their product as an investment product. To know more regarding the new regulations on P2P lending platforms Read here

- Regulatory Halt at GIFT City: Indian Authorities Tighten Controls on Family Office Investments: Indian regulators halted family office fund approvals in GIFT City due to tax evasion and capital control concerns, hindering its goal of becoming a key overseas investment hub. There are many more implications of this decision on India’s financial landscape and the future of GIFT City. Read here

Economy

- Where’s the money flowing? India’s passive MFs surpass Rs 10 lakh cr in AUM: The mutual fund industry in India has experienced a phenomenal surge in the past decade, with assets under management growing over seven times. To discover the key trends driving this growth and understand where the money is flowing. Read here

- India’s Inflation Eases: Inflation is a rise in prices affecting purchasing power. Recent data shows inflation easing, but it’s still important to manage finances effectively to combat its impact. For more detailed insights on how to beat inflation in 2024. Read here

- Railways to install AI-enabled CCTV cameras on locomotives, yards: Railway Board Chairperson announced CCTV cameras with AI on locomotives and key yards to reduce accidents. Learn how AI is transforming the rail industry in India. Read here

***

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 20 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 40 across the smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.