CAGR Insights is a weekly newsletter full of insights from around the world of web.

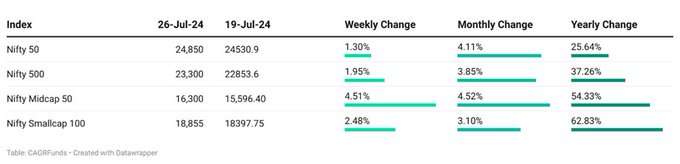

Chart Ki Baat

What is an Economic Moat?

An Economic Moat is a concept in business and investing that refers to a sustainable competitive advantage that allows a company to protect its market share and maintain healthy profitability for an extended period of time. Economic Moat and Competitive Advantage and High Entry Barriers are essentially identical.

Professor Michael Porter calls barriers to market entry that a business may have as ‘sustainable competitive advantage’. He says, “We have to have a business with come inherent characteristics that give it a durable competitive advantage”.

Warren Buffett and Charlie Munger call them ‘economic moat’. Buffett puts is as, “The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors”

Here’s the list of curated readings for you this week:

Personal Finance

- Why Lifestyle Creep is Mostly a Myth: Lifestyle creep. Keeping up with the Joneses. Raising your spending after an increase in your income. No matter what you call it, lifestyle creep is one of the most talked about topics in personal finance. And you won’t find a shortage of financial gurus warning you against the dangers of it. But is lifestyle creep a real concern for most people? Read here

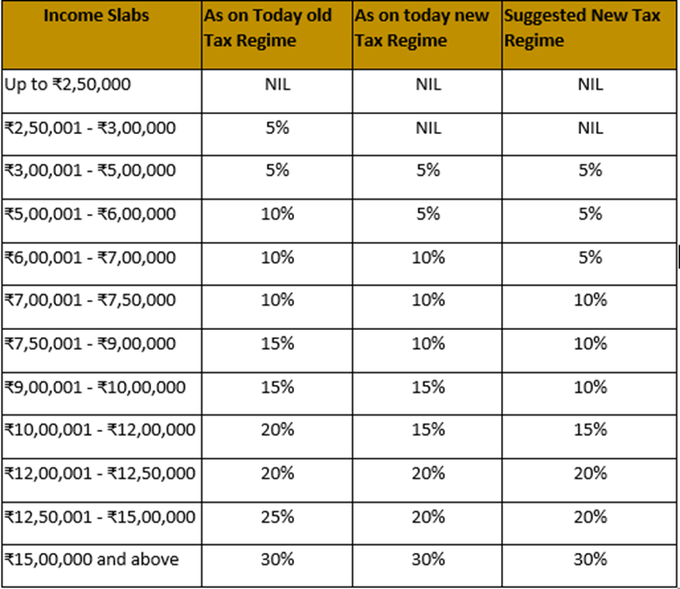

- Union Budget 2024: Here’s How It Affects Your Finances: The Union Budget 2024-25 outlines several measures impacting personal finances. The new tax regime introduces revised income tax rates, while other changes include new EPFO-linked schemes and the elimination of angel tax. Read here

- Which financial tool is most suitable for different types of emergencies? When unexpected costs pop up, are you ready to roll with the punches? Emergency funds, credit cards, and personal loans are your financial superheroes. Knowing your options empowers you to choose the right financial weapon for any battle.Read here

- Decoded: What Budget 2024 means for the middle-class, investors, and more:

India’s recent budget aims to stimulate economic growth and job creation. It includes tax changes affecting individuals and businesses, with a focus on the middle class. Investments in infrastructure and social programs are also highlighted. Read here

Investing

- A Top Pension Fund Wants to Bet Bigger on India. What’s Stopping It? APG, a huge company that handles people’s retirement savings, is interested in putting more money into India. India is growing fast, but APG is worried about some risks. They like the idea of investing in Indian businesses directly, rather than buying stocks. Other big investors are already putting lots of money into India. Read here

- Holding Period for REITs Reduced to 12 Months from 36 Months to Qualify as Long-Term Assets: The 2024-25 Union Budget revised the holding period for long-term capital gains. While previously, investments in listed financial assets like stocks and REITs required a three-year holding period, the new rules shorten this to one year. Read here

- What is margin of safety and why do you need it? Margin of safety is like buying something on sale, but for stocks. It means buying a stock at a price lower than what you think it’s truly worth. This extra cushion protects your money if the stock price drops. Read here

- Indian Households Embrace Equity, Funds: A New Era of Investing: Indian households are shifting investment habits. While bank deposits still dominate, there’s a sharp rise in equity, mutual funds, insurance, and pension investments. Total financial wealth has surged, boosted by both asset price gains and new savings. Importantly, increasing debt is balanced by growing assets, keeping the household leverage ratio stable. Read here

Economy

- India’s Changed — and Changing — Equity Markets: India’s equity market has emerged as a key indicator of global economic changes post-COVID-19. Its increasing weight in the MSCI Emerging Markets Index, reaching a record 20% in June 2024, has significantly benefited investors. This growth underscores India’s growing global influence. Read Here

- Economic Survey 2024: Indian economy grows over 7% for a 3rd consecutive year; 10 key highlights: India’s real GDP grew by 8.2 per cent in FY24, posting growth of over 7 per cent for a third consecutive year, driven by stable consumption demand and steadily improving investment demand. Read Here

- Improving access to finance for MSMEs is key to a $5-trillion Indian economy: MSMEs are the backbone of India’s economy, powering growth, employment, and exports. These small businesses are crucial for reducing income disparities and industrializing rural areas. As key drivers of economic progress, MSMEs are instrumental in realizing India’s vision of a developed ‘Viksit Bharat’ by 2047. Read here

****

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 20 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 40 across the smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.