CAGR Insights is a weekly newsletter full of insights from around the world of the web.

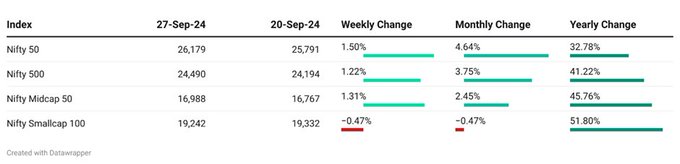

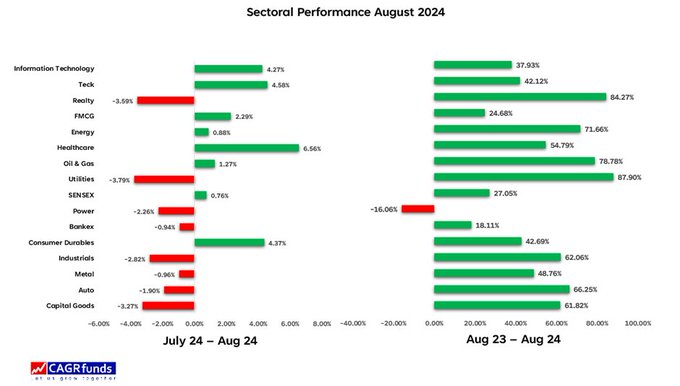

Chart Ki Baat

Gyaan Ki Baat

GDP Deflator

The GDP deflator is a price index, meaning it measures the average change in prices of goods and services produced in an economy over time. Unlike other price indexes like the Consumer Price Index (CPI), which focuses on consumer goods and services, the GDP deflator covers all goods and services produced within a country.

Nominal GDP measures the total value of goods and services produced at current market prices whereas Real GDP measures the total value of goods and services produced at constant prices, adjusted for inflation. It is measured as:

GDP Deflator = (Nominal GDP / Real GDP) * 100

Interpreting the GDP Deflator

GDP Deflator > 100: This indicates that prices have risen compared to the base year (inflation).

GDP Deflator < 100: This indicates that prices have fallen compared to the base year (deflation).

GDP Deflator = 100: This indicates that prices have remained unchanged compared to the base year.

Here’s the list of curated readings for you this week:

Personal Finance

- Who is required to conduct an income tax audit and submit its report on e-filing ITR portal by September 30? Eligible taxpayers must upload their income tax audit report by September 30, 2024. Not everyone is required to file an audit report, but those who are must meet the deadline to avoid consequences. Go through the article to learn how to ensure your tax audit is on track! Read here

- Older than 70 years? How to apply for an Ayushman Bharat card: The Ayushman Bharat Pradhan Mantri Jan Arogya Yojana now offers an extra Rs 5 lakh cover for senior citizens aged 70+, with flexible options for current plan holders. Explore how this expanded coverage can benefit you or your loved ones. Read here

- SEBI’s new rules from November 1: UPI now mandatory for bids up to ₹5 lakh in public debt issues: Starting November 1, individual investors applying for up to ₹5 lakh will be required to use UPI for fund blocking. This aligns with the existing process for equity shares and convertibles. The rules also shorten the subscription period for issuers and reduce the time for public comments. Read here

Investing

- S Naren shares his value investing mantra after turning Rs 10 lakh to Rs 5 crore in 20 years: Naren Sankaran, CIO of ICICI Prudential Mutual Fund, reveals the secrets to successful value investing in a volatile market. He shares his insights on navigating market downturns and capitalizing on undervalued opportunities. Discover why value investing remains a timeless strategy for long-term wealth creation. Watch here

- The stock market dipped after a historic Fed rate cut. Here’s what the experts think: The Fed cut rates by 50 basis points, but stocks fell due to concerns about the Fed’s longer-term outlook for interest rates. Some experts believe the Fed is behind the curve, while others argue that the economy is strong. Read here

- What’s the global market pricing in — geopolitical conflict or elections? In 2024, markets are swayed by AI, Nvidia, and interest rates, but political events, like elections in France and the UK, are creating more volatility than conflicts. Surprisingly, the Gulf’s markets remain stable. As deficits rise globally, investors must prepare for political risks—could this reshape your investment strategy? Read here

Economy & Sectors

- India Leads Global IPO Surge in 2024: Boom or Bubble? India’s IPO market is dominating 2024, with record-breaking oversubscriptions and global leadership—yet concerns about high valuations and regulatory scrutiny are rising. Want to know if this is the right time to invest or stay cautious? Click here for the full story! Read here

- India’s Toy Revolution: From Import Reliance to Global Export Powerhouse: India’s toy market, once dominated by imports, has now transformed into a net exporter. With traditional toys dating back over 500 years, Indian handmade toys are celebrated for their craftsmanship and cultural significance, along with a growing demand for eco-friendly and sustainable options. Curious to know how this transformation happened? Read here

- Housing Market Slowdown: Top 9 Cities Report 11% Decline In New Launches, Sales Down 18% in Q3: New housing launches and sales in India’s top nine cities saw a significant decline in Q3 2024, but demand remains robust. Dive into the detailed trends and understand what’s driving these shifts in the real estate market here! Read here

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 5 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 25 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.