CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 29-Sep-23 | 22-Sep-23 | Change |

| Nifty 50 | 19,638 | 19,674 | -0.18% |

| Nifty 500 | 17,293 | 17,261 | 0.18% |

| Nifty Midcap 50 | 11,612 | 11,495 | 1.02% |

| Nifty Smallcap 100 | 12,749 | 12,476 | 2.18% |

Gyaan Ki Baat

Volatility Index (VIX) – This is a real-time market index that represents the market’s expectations as to volatility over the next 30 days. When markets rise or fall dramatically, the VIX rises during this period and falls when the market is less volatile. A rising VIX does not indicate where the market will go. Investors often get confused about the VIX and the market index, the market index provides the direction of the market while the VIX measures volatility in the market.

For example, if the Indian VIX is in the 20s, the Nifty could move up or down 20% from its current level over the next 12 months. This means that if the Nifty is currently at 17,500 and the Indian VIX is at 20, the Nifty could fall as low as 14,000 or as high as 21,000 in the next 12 months.

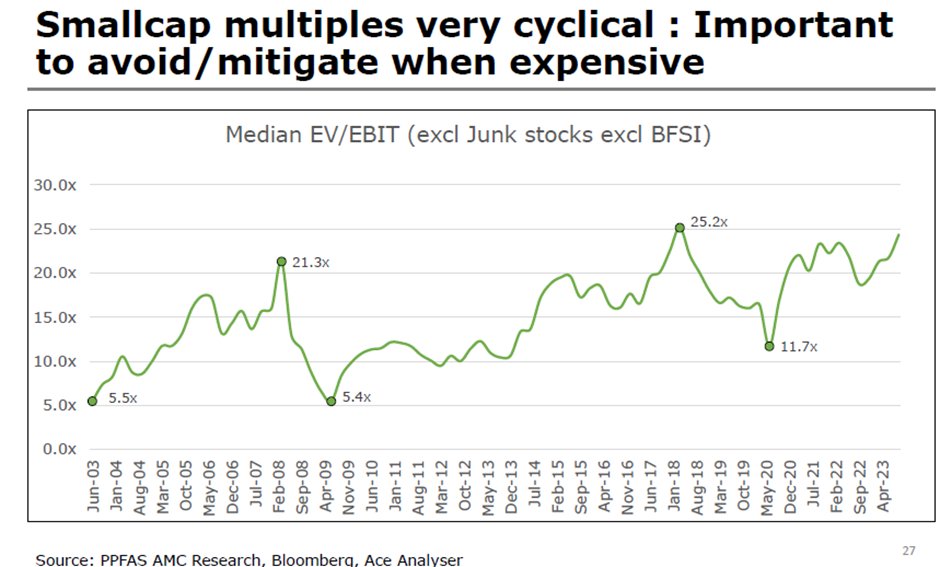

Chart Ki Baat

Courtesy: PPFAS financial Opportunities forum presentation by Rukun Tarachandani

Here’s the list of curated readings for you this week:

Personal Finance

- 24 Things I Believe About Investing – Here are some things I believe about investing. Read here

- Zerodha turns 13 – The Bengaluru-based company said it gets a bulk of its revenue from futures and options traders. Talking about the trading activity in F&O, Kamath said the total number of people trading F&O is still not that large in India. Read here.

- Why does international investing make sense for you? – A domestic-only portfolio hinges on the expectation that the domestic market will do better than global markets, which may be a risky bet. A geographically diversified portfolio enables an investor to participate in regional rallies but, more importantly, helps reduce volatility in the long term. Read here.

- Navigating the smallcap landscape – PPFAS – In recent years, the Smallcap sector has garnered significant attention. This presentation employs a data-driven perspective to delve into the Indian smallcap equity market. The presentation aims to determine if there’s a genuine opportunity within this segment and, if so, explore the challenges in capitalizing on that opportunity. Watch here

- Why Selling is so Hard to Do – What is it that keeps us from selling a stock? Whether it’s gone up or down, many times, what we’re worried about is regret. We’ll feel stupid if the stock goes up afterward. Even worse, the stock we bought instead might go down while the one we sold goes up. Read here.

- The rise of crazy rich Indians – Marcellus – A new generation of around 200,000 super rich families (or 1 million individuals) are making their spending muscle felt. It behooves us, therefore, to tilt our portfolios away from ‘mass’ and towards ‘class-based consumption. Read here

- Is it different this time? – Solidarity – It is not different this time, just the behavioural cycle at play in Small caps and select sectors. However, some nuance is required on ascertaining fair value. One should be willing to pay a “small” premium for “certain” companies at present. But for most companies in the market, one should not break valuation discipline and wait out the euphoria. Read here.

Economy

- India’s inclusion in J.P. Morgan GBI-EM Global index to lead to inflows of at least $18 -22 billion in FY2025, auguring well for G-sec yields and INR. Read more.

- India is not only growing but it is doing so efficiently – It’s crucial to assess whether the capital injections into the economy are yielding proportionate outcomes. Over the past decade, India has made significant strides in this regard, with the ICOR decreasing from 7.5. In the fiscal year 2022-23, the ICOR reached an impressive low of 2.1, marking a decade-long record. Read here.

- India has a demographic advantage, but, demographics alone may not become destiny –To live up to its aspirations, India needs a healthy and well-educated workforce. Only then demography become destiny. Read here.

- India falls short of FTSE Russell government bond index inclusion – Areas for improvement in the Indian government bond market structure highlighted by international investors remain largely unchanged from the previous March 2023 review,” FTSE said in its annual country classification review. Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.