CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 30-Jun-23 | 23-Jun-23 | Change |

| Nifty 50 | 19,189 | 18,666 | 2.80% |

| Nifty 500 | 16,430 | 16,012 | 2.61% |

| Nifty Midcap 50 | 10,127 | 9,807 | 3.26% |

| Nifty Smallcap 100 | 10,837 | 10,624 | 2.00% |

Chart Ki Baat

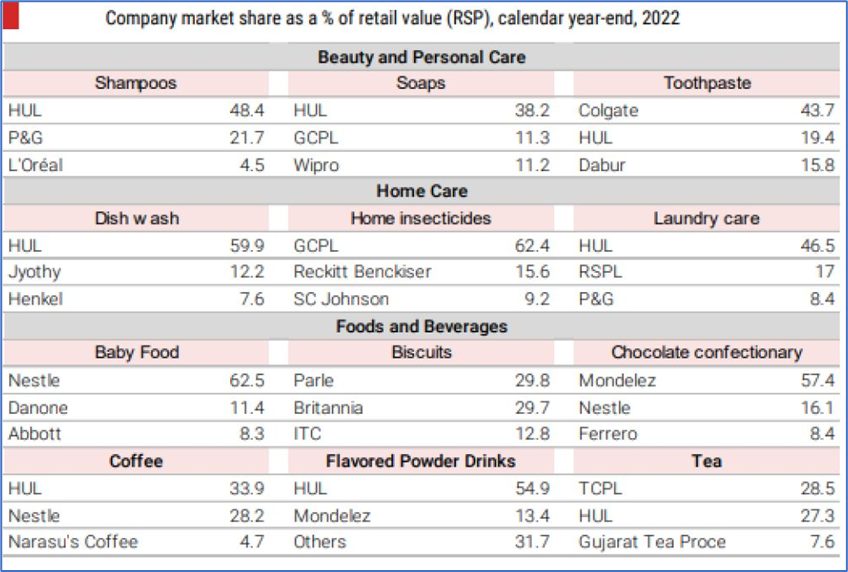

Indian Consumer Market: The Dominance of HUL. Courtesy: Euromonitor, Kotak Institutional securities.

Gyaan Ki Baat

Quant funds use mathematical and statistical model-based computer algorithms to plot their investment strategy. Quant-styled mutual funds follow a partly active partly passive investing approach.

What it means is that while the fund manager is in charge of the eventual investment decision, their actions are guided by a set of rules that decide the course of action. There are essentially three steps in constructing a quantitative – fund the input system, the forecasting engine, and the portfolio construction.

The first step is where all the necessary input is provided. This includes data points like interest rate, inflation, consumer sentiments, a company’s revenue growth earnings, cost of capital, and dozens of other variables. Then, initial screening is done to remove all the undesirable factors like high volatility, unmanageable debt, inefficient capital allocation, etc., which then leaves us with a curated list of acceptable companies.

The second step in the process is the forecasting stage and this is where the model rules are defined along with an estimation for the expected return price risk parameters and other related metrics.

The final step is portfolio construction where a model portfolio uses optimizers and heuristic-based systems to explain which stock to buy and at what percentage should it be bought. This gives us a curated objective and templated portfolio which is also referred to as the quant fund model portfolio.

Here’s the list of curated readings for you this week:

Personal Finance

- Women and their relationship with Money – Episode 2 – Shruti speaks with Saumya Sinha about how her approach to savings and investments has transitioned over time. Watch here and Part 2 here.

- The Bollywood star who launched a family office – Vivek Anand Oberoi, Bollywood actor and chair of Oberoi Family Office, reveals the principles guiding his Indian private equity investment business. Read here.

- Sebi defers decision on overhaul in total expense ratio for mutual funds– Armed with more granular data that SEBI got from the MF industry as part its feedback to the May 18 consultation paper, SEBI chairperson said that its proposals needs a rethink. Read here.

- India pushes back plan to collect 20% tax on overseas spending beyond a certain cap- India has pushed back plans to collect a 20% tax on annual overseas spending of more than 700,000 Indian rupees ($8,500) by three months to provide banks with more time to prepare their system. Read here.

- Sebi halves IPO listing time to 3 days – This will ensure that issuers have faster access to the capital raised, thereby enhancing the ease of doing business, the market regulator said. Read here.

- NRI Series – Investment options in India – The most common query which we have received from our NRI clients and friends is where can we invest in India. Watch here.

- Analyst Estimates are useful- As a budding equity investor, I started my investing journey reading/learning from the great value investors Graham, Buffet, Lynch, and others. And, it got drilled into me that analyst estimates, predictions, etc. are useless and should be ignored as noise. Well, it turns out they have utility after all.Read here

- Tata’s runway success – The pilots’ unions at Air India that once struck fear in the heart of the government and the airline’s potential suitors have been grounded. How did Tatas pull this off? Read here

- On investment firms, brand & reputation- Nalanda Capital – Investment firms may not have a brand, but certainly have a reputation. It may well be the most valuable thing we have. Read here

- Promoters missing at the markets – When startups launch IPOs, their founders abruptly change their classification from promoters to public shareholders. SEBI worries about its impact on public confidence, but the trend is all pervasive Read here.

- Corporate Arm twisting at MCX – MCX renewed the contract with 63 Moons for a sum of Rs 125 crore per quarter for two quarters, totalling Rs 250 crore. MCX and 63 Moons, formerly Financial Technologies India Ltd., were both founded by Jignesh Shah, who had quit from the board of India’s largest commodity exchange after a payments crisis at the National Spot Exchange Ltd., a subsidiary of FTIL. Read here

Economy

- India’s improving Asset quality moves closer in line with global levels – In FY23, the SCBs GNPA ratio fell to 3.9%, a decadal-year low. The asset quality has improved due to recoveries, higher write-offs by banks, rising advances, etc. The slippages have declined across bank groups in FY23 indicating lower accretion of fresh NPAs. The PSB GNPA ratio (4.97% in FY23) continues to remain significantly higher than the private banks’ GNPA ratio (2.35% in FY23).Read here.

- Gujarat’s MSMEs reel under loss of demand – MSMEs contribute 33 percent of India’s GDP, 50 percent of its exports, and 19 percent of its employment. Read here.

- Pakistan Gets IMF Initial Approval for $3 Billion Loan Program – Pakistan is one of the biggest customers of the IMF with almost two dozen bailouts since the 1950s. Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.