CAGR Insights is a weekly newsletter full of insights from around the world of the web.

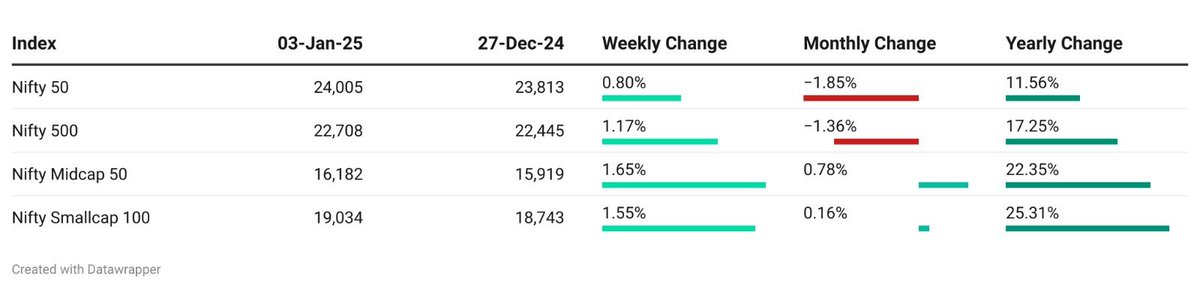

Chart Ki Baat

Gyaan Ki Baat

Understanding Operation Twist in Monetary Policy

Operation Twist is an innovative monetary policy tool used by the Reserve Bank of India (RBI) to influence interest rates and stimulate economic growth. This approach involves the simultaneous buying of long-term government securities while selling short-term securities.

The primary goal is to lower the yields on long-term bonds, making borrowing cheaper for consumers and businesses. The concept originated in the United States in 1961 and was later adopted by the RBI during challenging economic times, particularly in 2019 and 2020. By purchasing long-term securities, the RBI increases their demand, which in turn raises their prices and lowers their yields. Conversely, selling short-term securities increases their supply, leading to a rise in their yields. This “twist” in the yield curve helps to flatten it, encouraging investments by reducing the cost of long-term borrowing.

The necessity for Operation Twist arose from the limitations of traditional monetary policy tools. For instance, even after significant cuts to the repo rate, banks were slow to pass on these benefits to consumers, resulting in sluggish credit growth. By implementing Operation Twist, the RBI aims to enhance liquidity in the market and stimulate economic activity through more accessible financing options.

Personal Finance

- Don’t bet against biology: In 2024, the big takeaway was not to bet against biology. Just as physical decline accelerates with age, neglecting health can impact long-term financial goals. Prioritizing health ensures the wealth you build remains valuable throughout your life. Read here

- New EPS Rule From January 1: Pensioners Can Now Withdraw Monthly Pension from Any Bank Branch: Pensioners under the (EPS), 1995, can withdraw their pensions from any bank branch across India from 1st Jan 2025. This transformative move aims to make pension disbursement more convenient and accessible for over 70 million beneficiaries. Read here

- Taxes 2025: How to reduce tax liability in FY25; check these investment options: It is January 2025, and taxpayers have nearly three months to review their tax payments and obligations. It is crucial for taxpayers to assess their financial situation and proactively reduce their tax liabilities. Read here

Investing

- F&O Trading Is India’s Largest Casino, Focus On Businesses Surviving Tough Periods: Sanjay Bakshi: What sets great investors apart? Sanjay Bakshi shares insights on patience, market understanding, and the principles that guide his investment journey in this rare and thoughtful conversation. Watch here

- No One To Blame: Investing is brutally personal—sell winners too soon, hold losers too long, or chase bad stocks. But blaming others—markets, management, or luck—only masks your mistakes. Own them. Growth comes when you face the mirror, not excuses. Read here

- RBI seen loosening stranglehold on rupee in 2025: The Reserve Bank of India will need to rethink its foreign exchange strategy and loosen its hold on the rupee in 2025, economists said, with the currency at its strongest against peers in at least two decades in trade-weighted terms. Read here

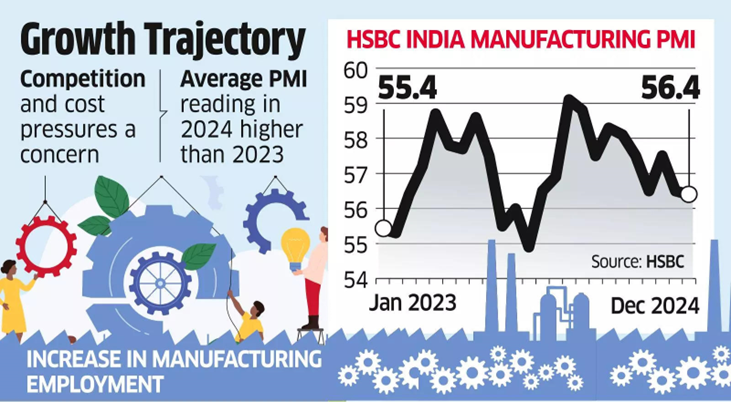

Economy & Sectors

- India’s electronics manufacturing set to hit $140 billion in FY25, exports drive growth: India’s electronics manufacturing sector is expected to grow 15% in FY25, reaching $135-140 billion, up from $115 billion in FY24, according to industry sources. While robust exports are fuelling this expansion, stagnant domestic demand presents challenges to sustaining overall growth momentum. Read here

- India’s Economy in 2024: GDP Growth and Global Ranking: In 2024, India continued with economic expansion, ensuring its status as an emerging global economic powerhouse. With a 6.6 percent gross domestic product (GDP) growth rate, the country retained its position as the world’s fifth-largest economy, steadily narrowing the gap with Germany, which ranks fourth at present. This performance showed India’s consistent trajectory of growth, marked by strategic initiatives and focused economic policies. Read here

- 2025 Forecast: What’s coming for the Indian economy in 2025 as it seeks more purple patches?

India will have to navigate geopolitical headwinds, tame domestic inflation and nudge the private sector to further loosen their purse strings as the world’s fastest-growing major economy seeks more purple patches in 2025, leaving behind September quarter growth blues. Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.