CAGR Insights is a weekly newsletter full of insights from around the world of the web.

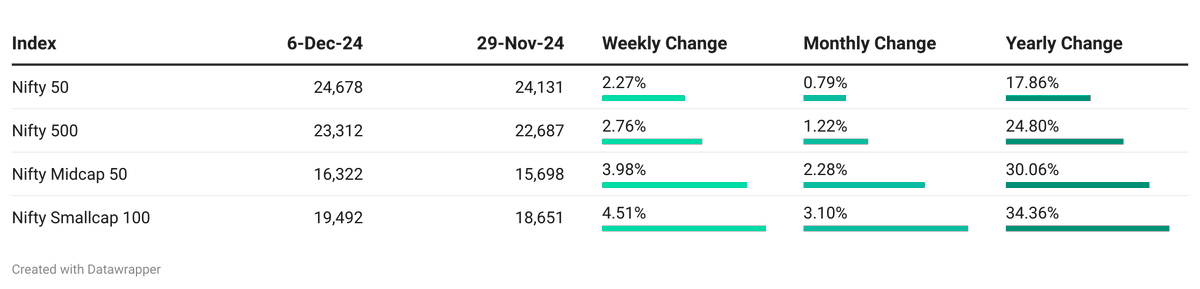

Chart Ki Baat

Gyaan Ki Baat

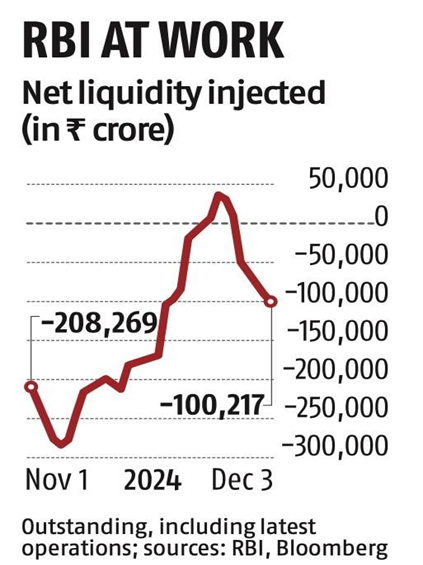

The Reserve Bank of India (RBI) held its Monetary Policy Committee (MPC) meeting on December 6, 2024, where several significant decisions were made:

- Repo Rate Maintained: The RBI decided to keep the repo rate unchanged at 6.50%. This decision comes amid rising inflation and slowing GDP growth, reflecting a cautious approach to monetary policy in light of economic challenges.

- Cash Reserve Ratio (CRR) Cut: The RBI announced a 50 basis points cut in the Cash Reserve Ratio (CRR), reducing it to 4%. This move is expected to release approximately ₹1.16 lakh crore into the banking system, aimed at enhancing liquidity and stimulating credit growth.

- Inflation Concerns: Inflation for FY25 is projected at 4.8%. For Q3, it is expected to rise to 5.7%, but it is anticipated to decline to 4.5% in Q4. The RBI’s mandate is to keep inflation within a target range of 2-6%, and the current figures are above this threshold.

- GDP Growth Outlook: India’s GDP growth for the July-September quarter fell to 5.4%, the lowest in seven quarters, prompting discussions about potential rate cuts in future meetings if economic conditions do not improve.

- Governor’s Term Conclusion: This MPC meeting is particularly notable as it may be the last chaired by Governor Shaktikanta Das, whose term ends on December 10, 2024. Speculation surrounds his potential extension, which could influence future policy directions.

These highlights underscore the RBI’s balancing act between managing inflation and supporting economic growth amid challenging conditions.

Personal Finance

- How To Build a Robust Retirement Portfolio: A Data-Driven Approach: Retirement planning becomes more critical as you near the end of your career, with risks higher in retirement. Monte Carlo simulations offer a way to explore various financial outcomes, helping you adjust your strategy based on uncertainty and assumptions. Read here

- Retirees, a Rich Life Does Not Require Spending More Money: Retirement isn’t about spending more money but finding contentment in life’s simpler pleasures. While financial advisors emphasize higher withdrawal rates, true fulfilment comes from enjoying time, peace, and personal satisfaction. Read here

- EPFO Changes Provident Fund Rules, Aadhaar No Longer Mandatory for PF Claim: EPFO has removed the mandatory Aadhaar linking for PF claims. Employees without Aadhaar can use alternative documents like passports or PAN cards for verification. Claims above Rs 5 lakh will require employer verification, and UAN consistency is advised for faster processing. Read here

Investing

- Silver Buying Opportunity: Gold’s higher price compared to silver is driven by central banks hoarding gold as a monetary asset, giving it unmatched demand. Silver, though abundant and industrially essential, lacks this prestige, making it a hidden gem—ready to shine when financial chaos sparks a rush for precious metals. Read here

- Factor Analysis: A Hands-On Introductory Workshop Using Indian Market Data: Dive into the world of quantitative fund analysis with Rajan Raju, visiting faculty at IIM Ahmedabad and a veteran banker. In this insightful workshop, Rajan explores key models such as the CAPM and Fama-French Model, using live examples from Indian funds to provide practical understanding. Perfect for finance enthusiasts and professionals looking to sharpen their analytical skills. Watch here

- Nifty 50 after US Elections: Historical trends indicate a bullish 2025 for the Indian stock market: The Nifty 50 is poised for a bullish outlook in 2025, supported by historical trends showing strong performance following US elections and in odd-numbered years. A favorable technical setup, including a bullish head-and-shoulders pattern, further boosts optimism for significant gains. Read here

Economy & Sectors

- Services sector growth drops; inflation at 12-year high: India’s services sector growth slowed in November, with the Purchasing Managers’ Index (PMI) dropping to 58.4 from 58.5 in October. Despite weaker new orders and output growth, employment surged to its highest pace since the survey began in 2005, driven by increased hiring of both permanent and temporary staff. Read here

- India has miles to cover before cashing in on China’s big loss: India has struggled to capitalize on the “China Plus One” strategy compared to countries like Vietnam and Thailand, due to factors like labor costs and tax laws. However, it has opportunities to enhance manufacturing, particularly in high-tech industries, amid global shifts away from China. Read here

- Karnataka to soon have circular economy policy: Karnataka is developing India’s first circular economic policy, mandating 20% sustainable construction materials. Minister Priyank Kharge emphasized Karnataka’s potential in proptech and real estate, aiming for sustainable growth with collaboration between industry, government, and the realty sector. Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.