CAGR Insights is a weekly newsletter full of insights from around the world of web.

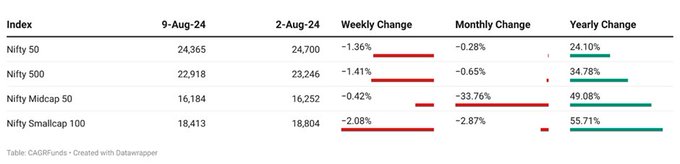

Chart Ki Baat

Gyaan Ki Baat

Sector Rotation

Sector Rotation involves shifting investment capital between different stock market sectors based on economic cycle stages. As the economy moves through expansion, peak, contraction, and trough, sectors perform differently. For instance, technology and consumer discretionary sectors often excel during expansion, while defensive sectors like utilities and healthcare tend to do better in downturns. Investors use this strategy to capitalize on these changes by reallocating funds from underperforming sectors to those expected to benefit from current conditions. This approach aims to enhance returns and manage risk by aligning investments with the prevailing economic environment.

Here’s the list of curated readings for you this week:

Personal Finance

- Relief for real estate under LTCG regime: Govt to allow taxpayers to avail either lower rate of 12.5 percent without indexation or higher 20 percent rate with indexation if property acquired prior to July 23, 2024. Read here

- Sustainability is the only path: Sustainability is important in various aspects of life, such as dieting, exercise, and investing. Temporary solutions often lead to failure, as they are not maintainable in the long run. Sustainable strategies are crucial for long-term success. Rather than chasing quick gains or trendy stocks, investors should focus on a disciplined approach that aligns with their goals and risk tolerance. Read here

- Why it’s Hard to Create the first Rs 1 CR? Let’s face it, saving a crore isn’t child’s play. This page spills the beans on why it’s tougher than it seems. It’s all about breaking bad spending habits and smart saving moves. Read here

Investing

- BoJ’s Uchida: We won’t hike rates when markets are unstable: Bank of Japan Deputy Governor Shinichi Uchida expressed his view on the bank’s interest rate outlook, exchange value and the current market volatility. Read here

- Bonds: 10-year Treasury yield dives to the lowest since December after weak jobs report: U.S. Treasury yields slid after a weaker-than-expected jobs report for last month added to fears that economic growth is slowing. The yield on the benchmark 10-year Treasury was last at 3.796%, down more than 17 basis points. Earlier, yields hit a low of 3.790%, the lowest level since December 2023. Read here

- Why bond yields matter for equities: Poor economic news and corporate performance caused a sharp decline in stock prices. Surprisingly, this led to a significant increase in bond prices (lower yields). Understanding the future relationship between stocks and bonds is crucial for investors. Read here

- FTSE Russell unlikely to include Indian bonds in index as concerns over ratings, taxation remain: Global index provider FTSE Russell is unlikely to include Indian bonds in its government bond index as concerns over India’s ratings and taxation remains, market experts close to the development said. Read here

- Post-FOMC Update: The Fed and the Market Shifts: Central banks shifted gears this week. Japan tightened monetary policy while the US Fed prioritized job growth. Recent weak job data raised recession fears but overall aligns with the Fed’s view of a cooling labor market. Read here

Economy

- Piyush Goyal asks leather sector to aim $50 billion in exports by 2030: Union Commerce and Industry Minister Piyush Goyal on August 8 asked the country’s leather and footwear industry to target $50 billion in exports by 2030. He also asked the industry to take advantage of various free trade agreements (FTAs) signed by India and focus on manufacturing world class products to tap global markets. Read Here

- RBI focuses on aligning CPI with target amid resilient domestic growth: The Monetary Policy Committee (MPC) decided by 4:2 majority to keep the repo rate unchanged at 6.5 percent, in line with expectations. The MPC also decided by a majority of 4 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation aligns with the 4 percent target, while supporting growth. Read here

- Govt. of India on track to reduce fiscal deficit: Fitch Fitch Ratings on Friday exuded confidence that the Government of India should be able to achieve its enhanced goal of reducing the fiscal deficit to 4.9% of GDP this year, and further below 4.5% of GDP next year, but noted that the post-election Budget did not provide much clarity on medium-term targets. Read here

****

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 20 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 40 across the smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.