CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 6-Apr-23 | 31-Mar-23 | Change |

| Nifty 50 | 17,599 | 17,360 | 1.38% |

| Nifty 500 | 14,759 | 14,558 | 1.38% |

| Nifty Midcap 50 | 8,551 | 8,467 | 0.99% |

| Nifty Smallcap 100 | 9,198 | 8,995 | 2.26% |

Chart Ki Baat

Bazaar Ki Baat

In this month’s edition of Bazaar ki Baat we discuss about Market Performance, the Sectoral change in NIFTY 50 over the years and its implications on valuation parameters and the much-discussed tax rule change on debt funds.

Over the years, the sectoral representation in Nifty-50 has undergone a sea change, largely in line with the changes in the underlying economy. This has significant implications for the comparison of valuation parameters with their historical averages.

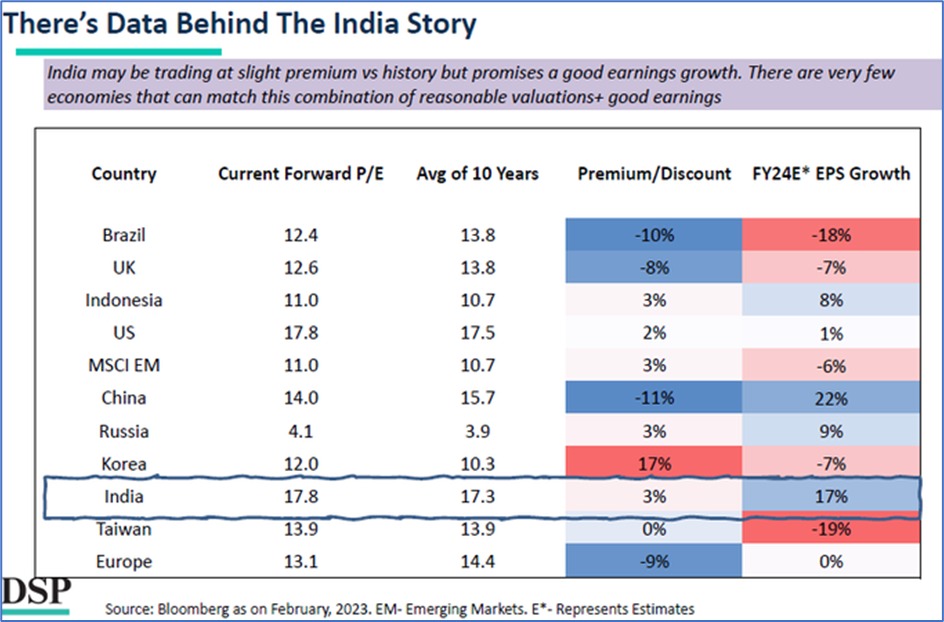

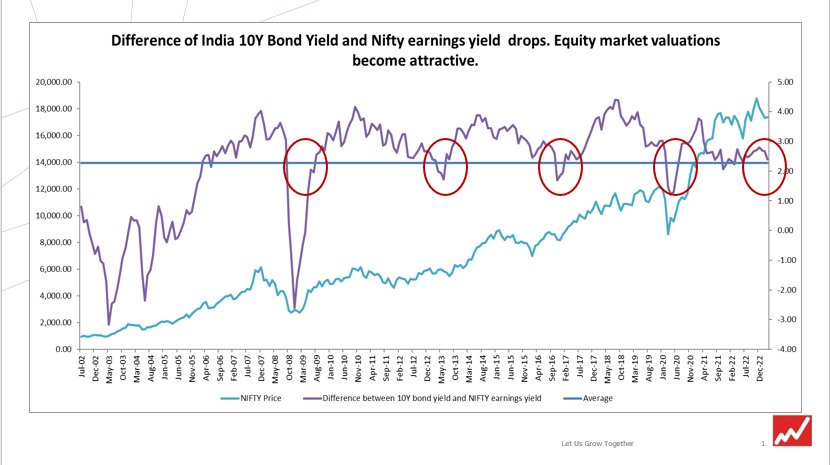

Nifty and Sensex have been flat in March and for FY23 overall. We believe that the recent corrections have made India market valuations attractive.

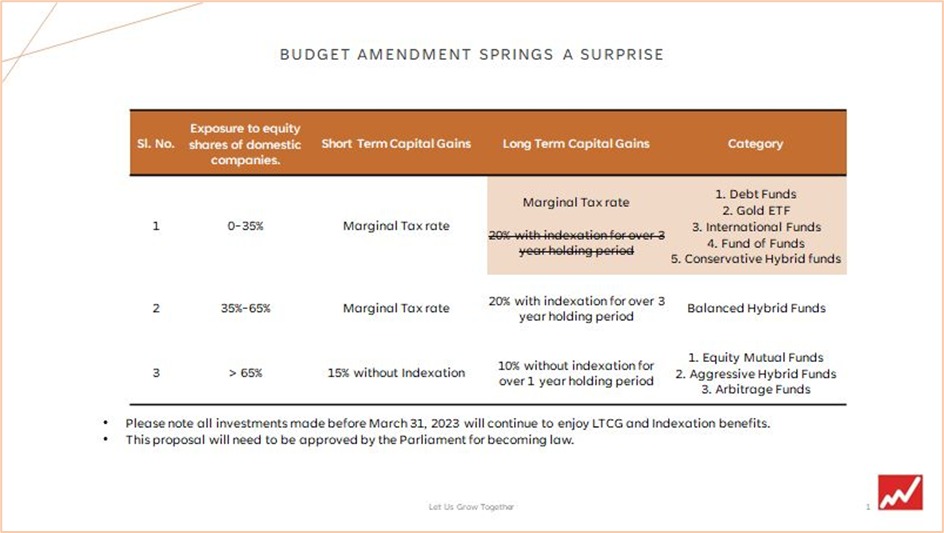

Further, the changes in debt tax rules may have taken some sheen out of the debt funds but we believe still a place for them in the investors’ portfolio.

Do watch and let us know your opinion.

Gyaan Ki Baat

Pradhan Mantri Jan Arogya Yojana (PM-JAY) is the biggest heathcare scheme sponsored by the government. This scheme is designed keeping in mind universal health coverage. This is a family floater scheme. This scheme is specifically designed for people belonging to lower income category.

- Eligibility – The Ayushman Bharat Yojana Eligibility is designed with pre-conditions so that only the underprivileged people of the society benefit from the initiative. The scheme does not cover government employees, owners of 2,3 or 4 wheelers , holder of Kisan cards, monthly earning of more than Rs. 10,000, individuals living in decently built houses etc.

- Coverage – This is a family floater scheme with a sum assured of INR 5 lakhs per family. The scheme provides coverage for medical examination, treatment and consultation fee. It covers up to 3 days of pre-hospitalization and 15 days post-hospitalization expenses such as diagnostics and medicines All pre–existing conditions are covered from day one

This can be a useful government policy for low-income individuals around us. Do spread the word.

Here’s the list of curated readings for you this week:

Personal Finance

- IRDAI introduces direct plans in insurance – Direct plan in insurance will have reduced premium amount as it will deduct agents’ commission from the gross premium amount. Read here.

- How can short term capital loss from Debt MF be used for reducing tax outgo – You can set off your short term capital loss from equity mutual funds with your short term capital gains from debt mutual funds. Read here.

- GPT-4 Is a Reasoning Engine – GPT models are constrained by the knowledge databases it uses, its a reasoning engine but it is cannot invent new things. Read here.

Investing

- Maxims of Analytical Thinking – Talk at CFA Society based on the wonderful book on Richard Zeckhauser by Prof Sanjay Bakshi. Watch here

- India’s Premium Over EMs Washed Off – India was trading at a 90% premium to its emerging market peers six months ago. A 10% correction in Indian stocks, a sharp rally in EM peers, and a catch up in earnings have reduced this premium. Read here

- Invesco has slashed Swiggy’s valuation from $10.7 billion to $8 billion – Invesco devalued its stake in Swiggy in October last year, just 10 months after it invested in the company at a $10.7 billion valuation, filings accessed by TechCrunch showed. Read here.

Economy

- India pauses rate hikes in surprise decision, but door open for more – While the central bank has taken the decision to pause rate hikes in light of global macroeconomic and financial conditions, “our job is not yet finished and the war against inflation has to continue”, Das said. Read here

- India’s surging services exports may shield economy from external risks – The recent growth in services exports has been largely powered by global capability centres, which have started to offer global clients a range of high-end and critical solutions such as accounting and legal support. Read here

- Reverting to Old Pension Scheme: A move at the expense of the poor – Reversing to the OPS, would therefore, result in a reallocation of resources away from the state’s development expenditure which benefits the poor, and towards a much smaller group of people who have benefitted from a secured and privileged job throughout their working life. Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.