CAGR Insights is a weekly newsletter full of insights from around the world of the web.

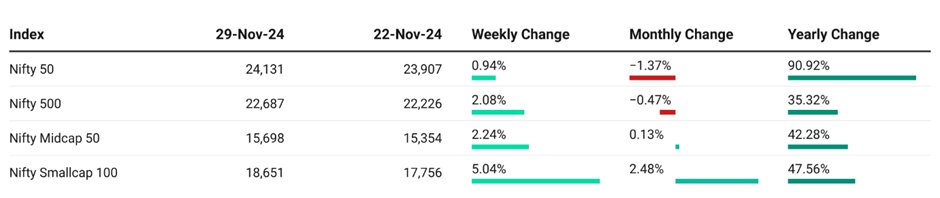

Chart Ki Baat

Gyaan Ki Baat

As we are close to wrapping up 2024, the Indian financial scene is vibrant and dynamic, offering both challenges and opportunities for investors. Here’s what you need to know to make informed decisions:

1. Gold: The Shining Asset

Gold has always been a safe haven, and recent trends reinforce this. The Reserve Bank of India (RBI) has purchased 78 tonnes of gold this year, bringing total reserves to 882 tonnes—the highest share since 1999. With gold imports skyrocketing to $7.13 billion in October alone, driven by festive demand, now might be a great time to consider adding gold or gold-related investments to your portfolio. Gold ETFs are also seeing record inflows, with INR 19.6 billion invested in October.

2. Foreign Investment Trends

Despite recent volatility, foreign direct investment (FDI) in India surged by 23.3% in 2023-24, with the U.S. leading the charge. This indicates strong international confidence in India’s growth story. As an investor, look for sectors attracting FDI, such as technology and renewable energy, which are poised for significant growth.

3. Infrastructure Opportunities

The Finance Minister’s call for faster capital investment rollout is crucial, with only ₹50,069 crore approved out of an allocated ₹1.5 lakh crore for infrastructure projects this fiscal year. This presents a golden opportunity for investors in construction and related sectors as the government seeks to boost economic activity.

4. Interest Rates and Inflation

With inflation concerns still on the radar, keep an eye on the Reserve Bank of India’s monetary policy decisions. Changes in interest rates can significantly impact your investment returns and borrowing costs.

Personal Finance

- Cabinet approves PAN 2.0: Will you have to apply for a new one? PAN 2.0 is here. Transforming taxation with faster processing, seamless data integration, eco-friendly paperless systems, and enhanced security—bringing a smarter, more efficient way to manage your financial identity. Read here

- India may soon announce EPFO 3.0 plan; subscribers likely to get option to withdraw PF via ATMs: The government plans EPFO 3.0, offering features like lifting the 12% contribution cap, ATM withdrawals by 2025, and higher pension contributions. The goal is greater flexibility and improved retirement benefits for subscribers. Read here

Investing

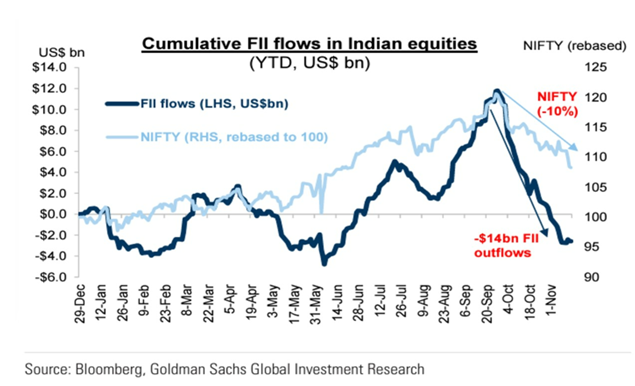

- Market Turmoil: Can Domestic Flows Counter $55B Equity Surge and FII Exodus? Will India’s surging $55B equity supply outpace record SIP inflows and FII exits? Learn what’s driving market volatility and where the next big opportunities lie! Read here

- Here’s how Warren Buffett says he’d start investing today: Warren Buffett suggests looking for hidden opportunities in smaller, overlooked companies, where significant value might be lurking. In these under-the-radar stocks, there’s potential for surprising returns, though success requires deep knowledge and a bit of risk. Read here

- Why Indian equities are thriving while global markets are grappling with declines: Amid global economic uncertainty, India’s equity markets remain resilient, driven by strong domestic institutional investments and improving sentiment. While global markets face declines, India’s stability, attractive valuations, and growth prospects make it an appealing investment opportunity. Read here

Economy & Sectors

- India’s gig economy could add 90 mn jobs enabled by large multinationals: The gig economy in India is projected to grow to $455 billion by 2024, contributing 1.25% to GDP and creating 90 million jobs. It supports sectors like e-commerce and delivery, with efforts to improve worker conditions and promote inclusive growth. Read here

- Indian economy to bounce back for 3 big factors: Here’s what Morgan Stanley forecasts: India’s economy is expected to recover, with GDP growth forecasted to reach 6.7% in Q4 FY25. Government spending, food inflation moderation, and a recovering job market are key drivers, while Q3 slowdown was attributed to reduced government spending. Read here

- India’s Defence Sector Presents Long Runway of Growth: India’s defence sector is poised for substantial and sustained growth, driven by increasing capital expenditure, according to global investment banking firm JP Morgan. Key factors underpinning this growth include rapidly expanding defence exports, a significant emphasis on domestic manufacturing, high returns on capital employed (RoCE), and robust cash flows. Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.