Yesterday, I was scrolling through Facebook and chanced upon this really funny ad starring Akshay Kumar and Sumeet Vyas. While the deceased Sumeet pleads the new age Yamraaj (aka Akshay) to give him another life in lieu of “behen ki shaadi, beti ki padhai, ghar ka kharcha, gaadi ki EMI”, he is asked a very simple yet daunting question – “Term Insurance nahi liya tumne?” To which comes the aptest reply – “Bhul Gaya”.

See the ad here

I did some research and the statistics shocked me. Although the insurance industry in India is growing at a fast pace, only 4% of our population has insurance coverage. Which means that 96 out of every 100 people have not safeguarded their dependents in an unfortunate eventuality of their death. I shudder to think of a family where the father is the sole bread earner and should anything happen to him, what was to be the future of his wife and kids. Add to that, cases where several liabilities in the form of a home loan, vehicle loan etc. are ongoing. Indeed, our priorities are completely misplaced.

But let us not blame the tendency to procrastinate as the only driver behind the low penetration. While a lot of people understand the importance of Term Insurance, they often struggle to figure out which plan is apt for them.

So I decided to do a mini survey. I went around asking 22 of my neighbours as to what had they done about Life Insurance? Well, 6 of them had not thought about it, 8 of them had thought but

got confused between the available options, 7 of them were covered by Endowment Plans and ULIPs and only 1 person was covered by a Term Insurance Plan.

Let me try and focus on the people who are covered or the ones who are thinking about coverage but are not fully aware of all the alternatives. Therefore, let us first understand what Endowment Plans and Term Insurances are.

Endowment Plans

Endowment plans, a bulk of which are sold by LIC, are a mix of Insurance and Investment. This means that you get some life insurance coverage in exchange for an annual or quarterly premium and after a certain maturity period, you get your premiums back, and maybe some bonus amount. That sounds quite appealing. You get back what you pay for. So you get insurance for free!

That is the pitch that agents make to us and like 11 out of 10 people, we scamper for anything and everything that is marked as “FREE”. Let us analyze them in more details a little later.

Term Insurance

Term Insurance is pure insurance. You pay only what is required to pay for Insurance. In case of death, the nominees get the full insured value. But you get nothing for staying alive.

Why are we even talking about Term Insurance then?

Let us see a small comparison.

|

Endowment Plan |

Term Insurance |

| Insurance Cover |

1,00,00,000 |

1,00,00,000 |

| Policy Period |

30 years |

30 years |

| Annual Premium |

3,24,734 |

8,279 |

| Total Amount Paid |

97.4 lacs |

2.5 lacs |

Note: The above details are for a 30 year old, male, non-smoker.

Term Insurance Benefit 1: You pay only for Insurance, the cost of which is quite low. When compared to an Endowment Plan, everything being paid over and above the cost of Insurance is either getting allocated towards charges or are being invested.

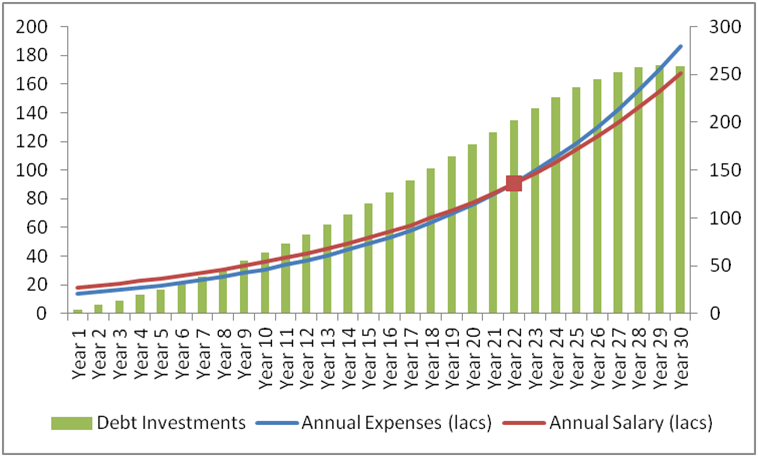

Now when you are paying for investment, you ideally should also expect some return on the money getting invested. Historically, Endowment Plans have not given more than 4-6% annual returns. And this is true for a period when Fixed Deposits in Bank were giving around 7-8% annual returns and equity surpassed 15-16% annual returns. So basically, had you taken a plain Term Insurance and left the remaining money as a fixed deposit every year, you would have still made more money than your Endowment Plan did.

Therefore, Term Insurance Benefit 2: You can separate your investment objective and get better returns by following the right investment strategy.

So what do people do?

In most cases, we do not witness people taking an endowment plan with an insurance coverage of more than 10-20 lacs. This is because, for a vast majority of the middle class, an annual premium of approximately 50-70K towards insurance is a big amount. And if this is true, then let us revisit our objective of Insurance. If something were to happen to the bread earner of the family today, will a Life Insurance coverage of 10-20 lacs be sufficient to safeguard the family? In most cases, that is highly unlikely.

So, Term insurance Benefit 3: Get adequate coverage for a low premium.

But if that is so straightforward, why don’t people take Term Insurance?

- Comfort with familiarity: A lot of people have seen their parents and grandparents taking endowment plans. It feels like home to them. Change results in resistance.

- Affinity for “FREE”: We seldom do the math to figure out how much are we giving up over a period of time to get something for free now. Endowment Plans demand much higher premiums as compared to term Insurance but at some point in time, we get it all back. However, what we do not take into account is the time value for money. A 4-6% return over premiums paid is essentially capital destroyed. With that kind of return, you really did not generate any additional wealth, thereby defeating the whole concept of investing.

- Dislike for “Expense”: We don’t like anything that we don’t get back. Term Insurance premiums albeit low are an expense. If we don’t die, we don’t get back anything. And this is one of the most prevalent reasons why people stay away from Term Insurance. Even though it makes no logical sense for them to manage their hard earned money in this way. If you want to experience this in real, next time someone sells you an Endowment Policy, ask him or her the annual return that you will make.

Our Recommendation:

Insurance shouldn’t be used as an investment vehicle. One should always go for a plain vanilla Term Insurance Policy and plan out his investments separately. Mixing the two creates a lack of transparency towards allocation to charges and leads to lower potential returns.

If you have any further queries, feel free to call us on +91 9769356440 or email us at contact@cagrfunds.com .