CAGR Insights is a weekly newsletter full of insights from around the world of the web.

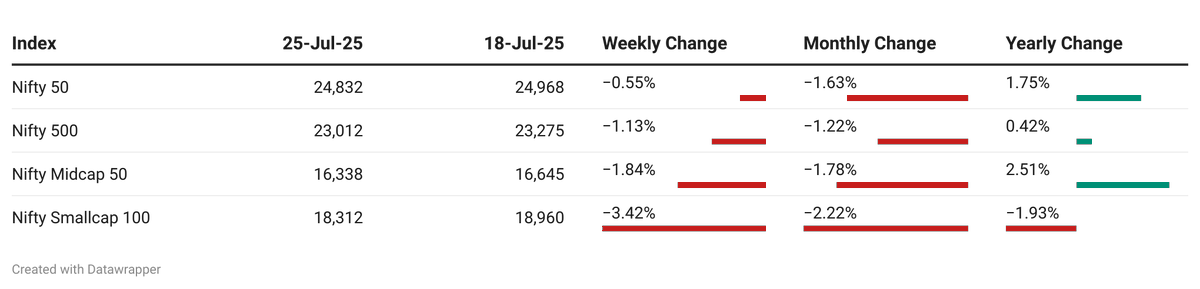

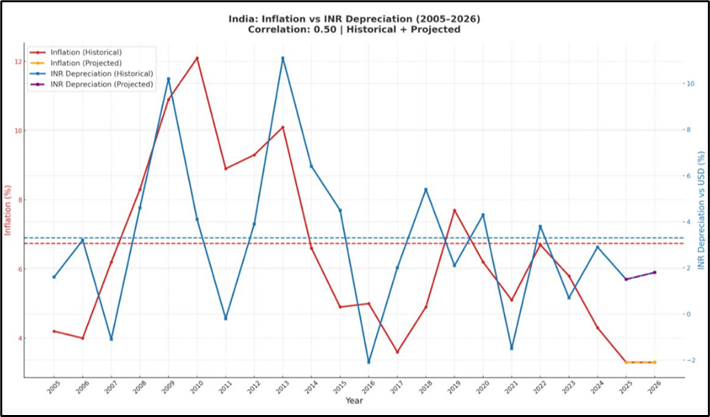

Chart Ki Baat

Gyaan Ki Baat

Hitting Pause Without Hitting Panic

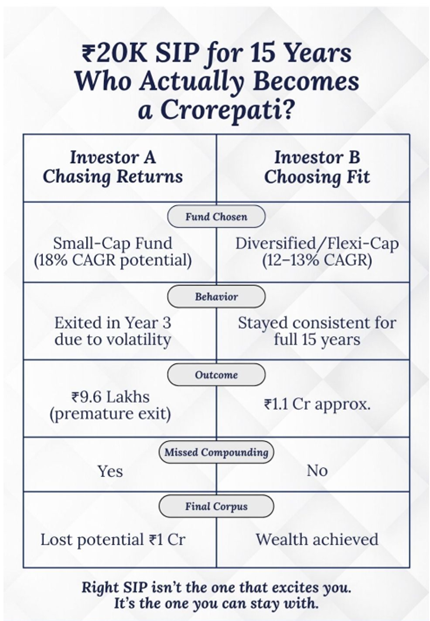

Life doesn’t always follow a fixed plan—and neither should your SIP. Just ask Sheena. A disciplined investor with her monthly SIPs running like clockwork, Sheena never thought she’d need to stop. But life had other plans. A sudden family emergency made her question everything. “Should I cancel my SIP? Will that mess up my goals?”

Here’s the truth: Pausing your SIP is not the end of your investment journey—it’s just a thoughtful pit stop.

Yes, mutual funds today allow you to pause SIPs for up to 6 months without penalties. It’s a smart option when you’re facing temporary setbacks like a job loss, medical emergency, or a cash flow crunch. Think of it like putting your investments on silent mode while the rest of your life plays loudly.

But here’s the twist: don’t pause your SIP just because the market looks scary. SIPs work best when you stay consistent regardless of market noise. That’s how rupee cost averaging builds wealth over time.

Also, remember—pausing is better than skipping payments randomly. If you default on 2-3 SIPs, the fund house may cancel it altogether, and your bank might charge you too. So if you really need a break, go the official pause route.

Like Sheena, give yourself breathing space without giving up on your dreams. Because in investing—and in life—it’s okay to pause, as long as you don’t quit.

Stay invested, stay informed. That’s how you build wealth with peace of mind.

Personal Finance

- Instagram reel wali financial planning ke side effects: Instagram finance will give you clarity for 30 seconds. Then life will happen All the neat rules such as ₹500 a day SIP, 50-30-20, spend less on rent, sound good until rent is already 50%, income is variable, and savings are irregular. What looks practical on a reel often feels unrealistic in a real month. Read here

- 5 biggest money regrets people have, and how to avoid them: 5 common money regrets: Delaying investments, skipping an emergency fund, ignoring financial basics, taking lifestyle loans, and avoiding money talks. Learn early, invest smart, and talk money—your future self will thank you! Read here

- Staying invested works, but drawdowns deserve your respect too: The challenge for investors is not just in enduring volatility but also in discerning when a drawdown presents a real opportunity—and when it signals structural decline.Read here

- Want financial freedom? Ditch impulse buys, embrace money maps: As household savings in India hit record lows, personal finance experts urge earners—especially young professionals—to curb impulse spending and embrace structured financial planning. Read here

Investing

- The Wealth Ladder: One-size-fits-all advice doesn’t work for money. The Wealth Ladder offers tailored strategies across six wealth levels—from debt to financial freedom—so you can build wealth smartly, starting exactly where you are. Read here

- Are Bear Markets Becoming a Thing of the Past? Since 2010, bear markets have become rare—only 4–6% of the time. Is this long calm the new normal, or just a pause before the next storm? Read here

- Are We Entering an Era of Gold Dominance? Central banks are buying gold again—absorbing a third of global supply—yet gold still forms just 17% of reserves. With real prices catching up and demand rising, this trend could last. Read here

Economy & Sector

- Will the Brown Revolution 2.0 bring the next big step in growth of Indian economy? India’s “Brown Revolution 2.0” aims to leverage cow dung as an economic and environmental asset, potentially boosting rural income, energy security, and organic farming. Read here

- India, UK seal historic trade deal: India and the UK sign a game-changing trade deal slashing tariffs, doubling trade by 2030, boosting jobs, and opening doors for sectors like textiles, EVs, seafood, and Indian professionals abroad. Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.