CAGR Insights is a weekly newsletter full of insights from around the world of the web.

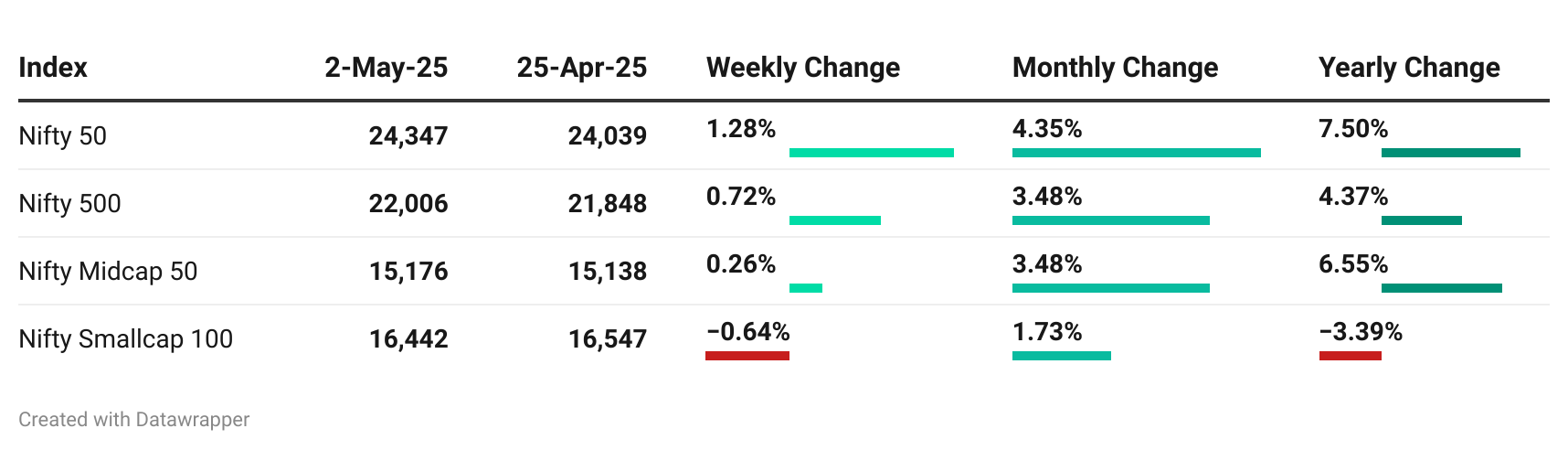

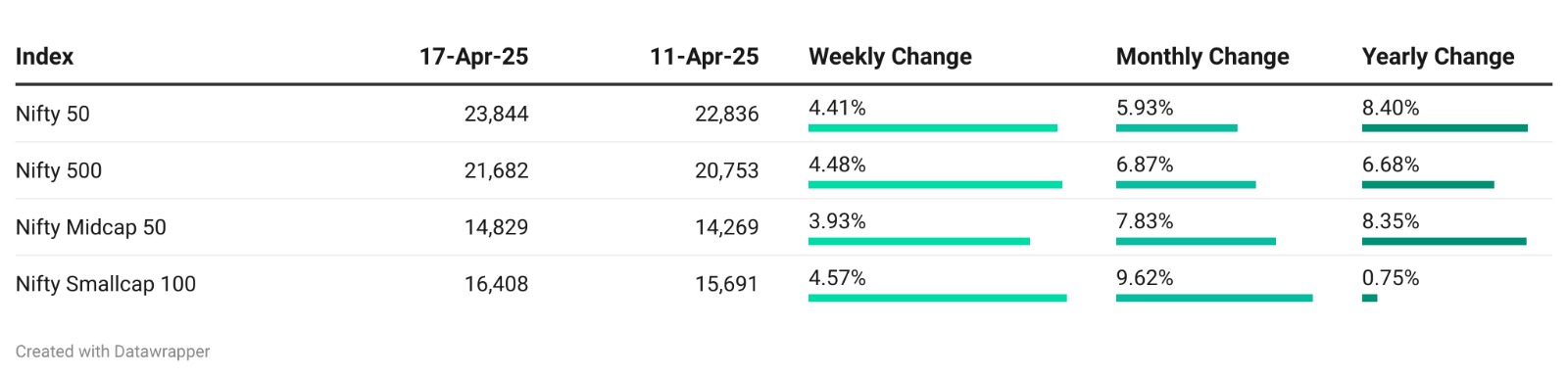

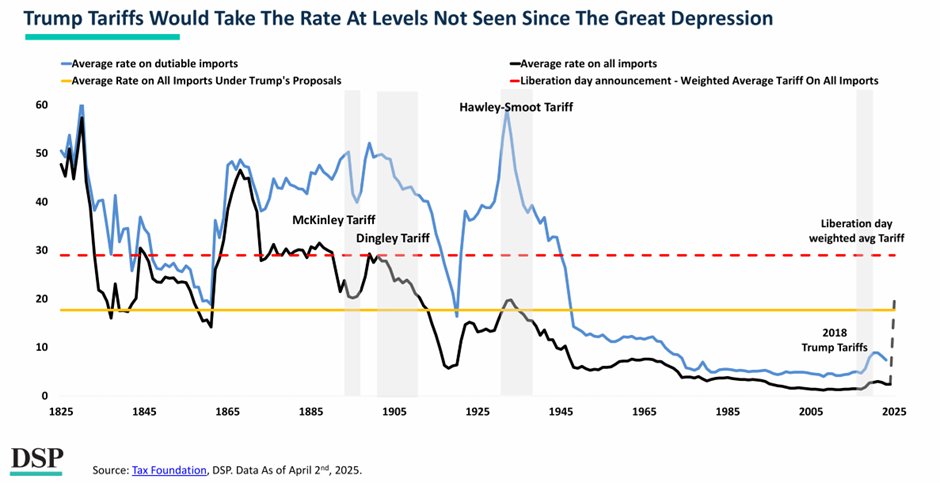

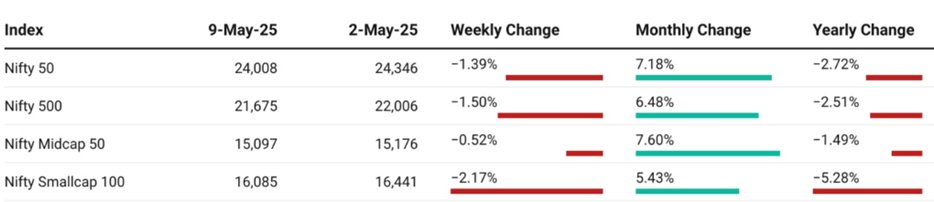

Chart Ki Baat

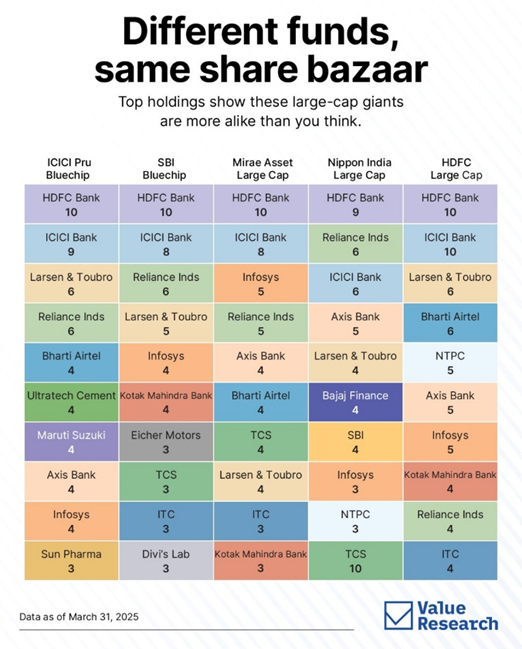

Gyaan Ki Baat

War Times & Wallet Sense

When the world shakes, your money shouldn’t.

With India and Pakistan locked in a tense conflict, markets react faster than missiles. Panic is natural—but smart investors don’t panic, they prepare. Here’s your financial war plan.

- Don’t make knee-jerk moves: Markets hate uncertainty. But selling in fear usually means locking in losses. Stay invested if your goals are long-term.

- Review your emergency fund: Now’s the time to ensure you have 6–12 months of expenses parked safely. Wars can trigger job losses or economic slowdowns.

- Diversify beyond borders: If you’ve only invested in Indian assets, consider global exposure. A little diversification can act like a financial bulletproof vest.

- Avoid big-ticket expenses: Postpone that car upgrade or luxury purchase. Liquidity is king during uncertain times.

- Don’t stop your SIPs: Systematic investments are built for volatility. You’re buying more units at lower prices—thank the market later!

Remember: Wars may shake headlines, but smart money stays calm, calculated, and committed.

Personal Finance

- The 10 Best Ways the Middle Class Can Build Wealth That Actually Work: Want to know how middle-class families build wealth? Discover 10 proven strategies—from smart investing to income streams—that can transform your financial future. Start your journey to financial freedom now! Read here

- Operation Sindoor: Should mutual fund investors brace for impact or stay the course? Despite current market jitters due to Operation Sindoor, historical trends show that India’s markets recover post-conflict. Mutual fund investors should continue their SIPs, avoid emotional decisions, and consider strategic investments to capitalize on market fluctuations over the long term. Read here

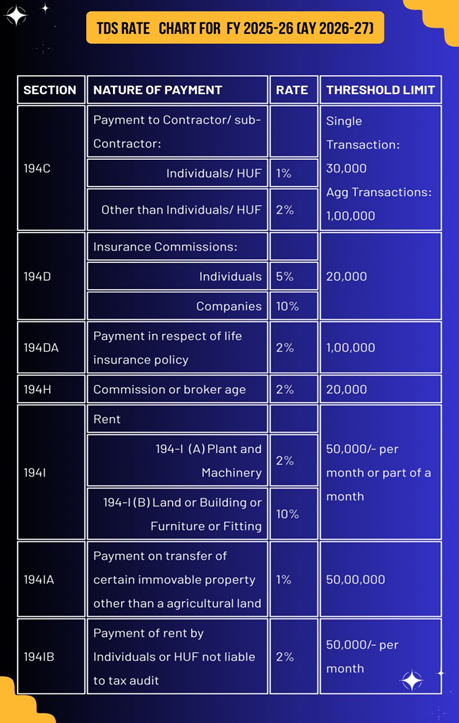

- Volatile markets? Here’s how to make your losses work and save taxes for you: Did you know a recent tax tribunal ruling could save you thousands in capital gains tax this year? Here’s how savvy investors are using short-term losses to their advantage. Read here

Investing

- Borrowing From Your Future Can Cost You Everything: Why borrowing from your future self might be the most dangerous financial move you can make, or if you’re aiming for something curiosity driven. This one flawed assumption ruins both your saving and investing plans—here’s how. Read here

- Will this adage hold true for the Indian equity market in May 2025: With geopolitical tensions intensifying and their repercussions on economic growth, and corporate earnings, will the adage, “Sell in May and go away” hold true?Read here

Economy & Sector

- UK trade deal to benefit India’s services, labour-intensive sectors: The India–UK FTA boosts exports in textiles, engineering, and IT services with duty-free access. Key sectors benefit while sensitive imports stay protected. No major immigration or carbon tax concessions. Find out which industries stand to gain the most. Read here

- IMF’s April Outlook projects India to become fourth largest in 2025: India is poised to surpass Japan with a projected GDP of $4.19 trillion, says IMF. As global rankings shift, discover how India’s economic rise is reshaping the global order. Read here

- Will rising Indo-Pak tensions dent foreign investment inflows to India? Despite recent military action, analysts see minimal impact on Indian markets due to strong domestic fundamentals, limited trade with Pakistan, and past resilience. Will India’s booming economy continue to defy geopolitical shocks? Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.