CAGR Insights is a weekly newsletter full of insights from around the world of the web.

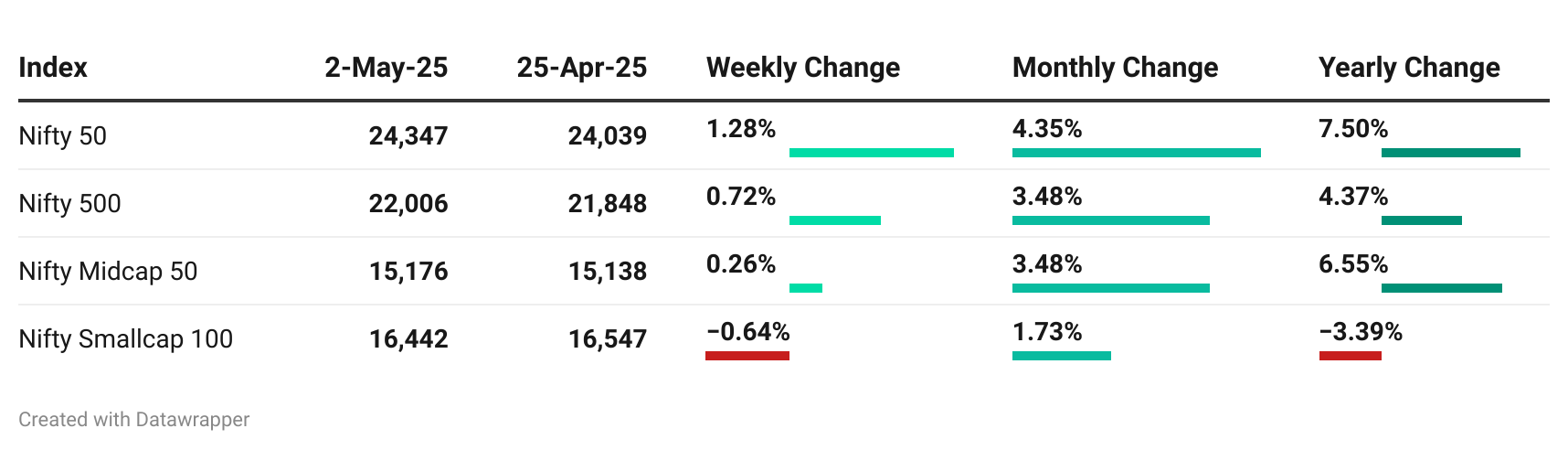

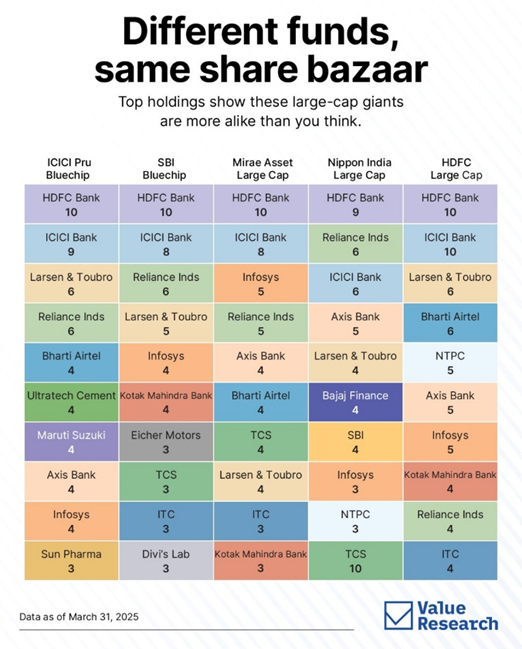

Chart Ki Baat

Gyaan Ki Baat

Mastering the Market – It’s All About Self-Awareness

In the world of investing, we often focus on charts, trends, and predictions. But the key to success is understanding ourselves. As market volatility rises, our psychological responses play a huge role in how we navigate market corrections.

Here’s why self-awareness is crucial in investing:

- The Real Risk Isn’t in the Market, but in Our Minds: The market correction between September 2024 and February 2025 revealed that the difference between successful investors and those who suffered losses was often about self-awareness. It’s not about predicting the market, but about controlling our emotional responses.

- Psychological Biases Are Dangerous: Fear, greed, overconfidence, FOMO, and herd mentality can cloud judgment. When prices fall sharply, we tend to chase speculative bets, ignore valuations, and get swept up in sector hype. These biases often lead to disastrous outcomes.

- Overconfidence During Bull Markets: During periods of growth, psychological biases are often rewarded. But when markets turn, those biases are exposed. As Warren Buffett said, “Only when the tide goes out do we discover who’s been swimming naked.”

- The Power of Emotional Control: To make better decisions, we must recognize and manage our psychological vulnerabilities. By identifying biases like FOMO, overexposure to micro-caps, or momentum chasing, we can avoid these traps and build a more resilient investment strategy.

- Create a Framework to Protect Yourself: Don’t just rely on stock picks. Focus on processes that prioritize valuation, fundamentals, and long-term goals over short-term trends. This reduces emotional decision-making and helps maintain discipline, especially during market dips.

- Self-Awareness = Better Long-Term Outcomes: The key to successful investing is not timing the market but timing our emotions. Recognizing our biases and implementing strategies to counter them is more valuable than any market forecast.

In summary, invest in your self-awareness—it’s the most powerful tool you have in protecting your investments from emotional decisions.

Personal Finance

- How Sahil aims to achieve a 30-40X corpus in the next 10 years: Sahil tracks every rupee with precision—investing 70%+ of income, beating market returns with lower volatility, and growing his net worth 40% in FY25. He’s hit 10x expenses, but house prices worry him. Curious how he does it? Read here

- 7 key lessons from John Bogle’s classic, ‘The Little Book of Common-Sense Investing’: John Bogle’s timeless wisdom in The Little Book of Common-Sense Investing champions low-cost index funds, long-term discipline, and diversification. Want to build lasting wealth without chasing trends or timing markets? These 7 lessons could change your game. Read here

- Feeling the squeeze? These 5 money moves may help survive the sandwich life: Caught between caring for parents and kids? If you’re part of the ‘sandwich generation’, these common money mistakes could be quietly draining your future — here’s how to avoid them. Read here

Investing

- Be Minimally Extractive: Jack Bogle revolutionized investing, saving everyday investors over $1 trillion through low-cost index funds and a philosophy of minimal extraction. His legacy reshaped the industry—click to see how Vanguard changed the game for your portfolio. Read here

- What To Look for from The Fed’s May Meeting: The Fed may hold rates on May 7, but a June cut is in play. With U.S. inflation high, growth slowing, and tariff uncertainty rising, Indian markets are watching closely—could global cues trigger FII moves and impact your portfolio? Read here

Economy & Sector

- Manufacturing to lead India’s $5 trillion economic growth: India’s manufacturing GVA is set to triple to $1.6 trillion by FY2034, fuelled by massive Capex, PLI schemes, and global supply chain shifts. With exports booming and sectors like electronics, autos, and chemicals surging, this is India’s big factory moment. Want to know which states and sectors are leading the charge—and how VCs are cashing in? Read here

- India’s rising concert economy: A new era of live entertainment: India’s live entertainment sector just hit ₹12,000 crore in 2024—and it’s only getting started. With Coldplay’s Ahmedabad concert drawing 222,000 fans and creating a ₹641 crore impact, India’s cities are emerging as global live music hotspots. Can your city be the next concert capital? Here’s why investors, fans, and creators are tuning in. Read here

- India’s service sector: The war horse gallops ahead: India’s service sector is the backbone of its economy, contributing 54.7% to GDP. As IT, fintech, and AI drive growth, shifts in the workforce and new challenges arise. How will India stay ahead in the global services race? Read here

****

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

- CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

- CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.