CAGR Insights is a weekly newsletter full of insights from around the world of the web.

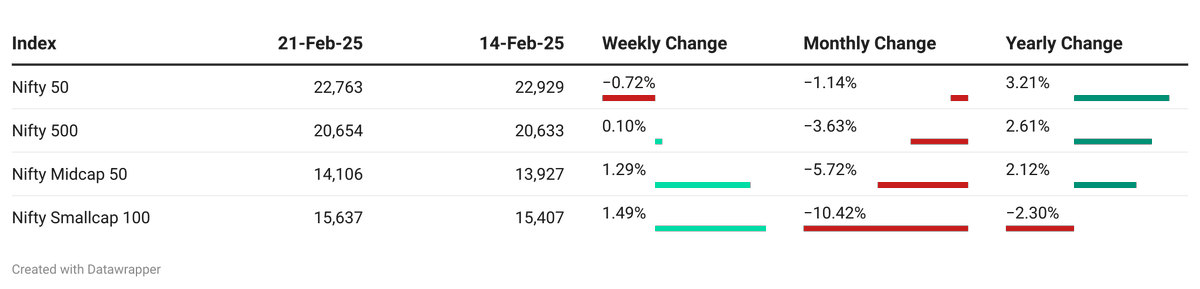

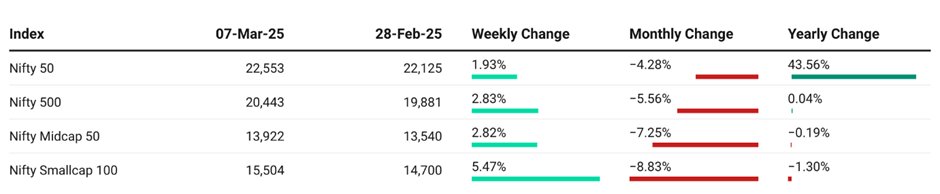

Chart Ki Baat

Gyaan Ki Baat

From Saving to Investing – A Financial Evolution for Women

For generations, women in India have been celebrated as excellent savers, skilfully managing household budgets and planning for future needs. However, saving alone is no longer sufficient to secure financial independence in today’s world. The transition from saving to investing is not just a financial necessity but a step toward empowerment and wealth creation.

- Why Investing Matters

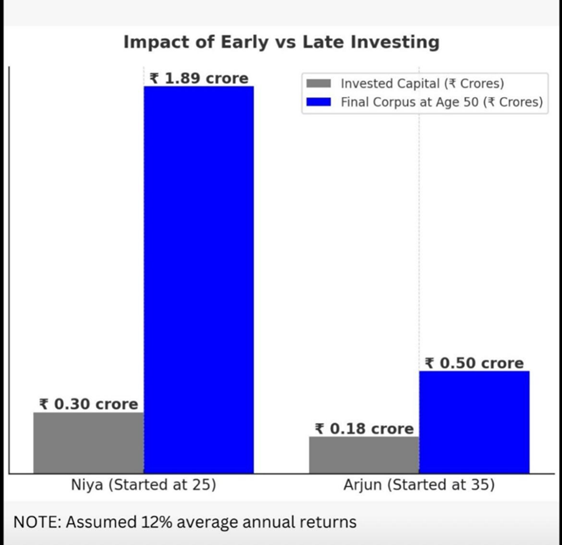

The difference between saving and investing lies in their outcomes. While savings provide security, investments offer growth. With inflation eroding the value of money over time, merely saving in traditional forms like fixed deposits or cash cannot ensure long-term financial well-being. Investments, on the other hand, allow money to grow and compound, building wealth over time.

- Breaking Stereotypes

Historically, women have been discouraged from investing due to outdated notions like “finance is too complex” or “investing is risky.” However, these myths are being shattered as women increasingly take charge of their financial futures. Recent data highlights this shift:

– Women’s share in mutual fund investments has grown significantly, with their Assets Under Management (AuM) rising from ₹98,000 crore in 2017 to ₹7.5 trillion by 2024—a 33% share of total individual investors’ AuM.

– Approximately 79 lakh women now hold mutual fund folios, marking a 25% increase in the women investor base over the past year.

– SIPs (Systematic Investment Plans) are particularly popular among women, with 26% of all live SIPs attributed to them in 2023.

- Lessons from the Past

In the 1980s, women relied on creative strategies to save and invest within their means. Some hoarded spare change that grew into significant savings over decades, while others invested in real estate—then the most accessible form of wealth creation. These stories remind us that women have always been resourceful with finances; they simply lacked access to modern investment tools.

- The Path Forward

Today’s women have more opportunities than ever to grow their wealth:

1. Start Small: SIPs allow investments with as little as ₹500 per month.

2. Diversify: Spread investments across equities, mutual funds, gold, and real estate for balanced growth.

3. Leverage Technology: Use digital platforms for easy access to financial products and real-time portfolio management.

4. Educate Yourself: Financial literacy is key to making informed decisions.

- Conclusion

The growing participation of women in India’s investment landscape is a testament to their evolving financial independence and empowerment. By embracing investing alongside saving, women can ensure not just stability but also prosperity—for themselves and future generations. This Women’s Day let’s encourage every woman to take that first step toward becoming a smart investor!

Personal Finance

- Income-tax bill 2025: When can tax officials check your email, social media, trading and bank accounts? As per the Income-tax Bill 2025, if tax officials have reasons to believe that you are deliberately hiding details of an undisclosed income then they may ask you provide access to your virtual digital spaces. If you fail to provide access or assist them in their investigation, then they may break into them to find out. Read here

- Women’s share in mutual funds doubles in five years, now at 33% of total assets: Women now hold 33% of mutual fund AUM, doubling investments to ₹11.25 lakh crore in five years. SIP adoption, financial independence, and rising single women numbers drive growth, with more women in both urban and smaller towns actively managing their wealth. Read here

Investing

- Scams, Damn Scams, and Investors: The financial world is full of clever scams—misleading charts, cherry-picked stock picks, and false promises of outperformance. Think you can spot them? Think again. Before you invest, ask yourself: are you being played? Read on to uncover the truth! Read here

- Tired of buying the dip? 3 survival strategies for investors trapped in bear market: The buy-the-dip mantra, which fuelled retail investors after the Covid crash, is now under fire as stock market bulls struggle to regain footing after five months of relentless declines. With the Nifty PE slipping below 20 for the first time in 32 months and valuations normalizing, the big question is: what next? Read here

- The wisdom of inattention: Sensex tumbles, experts panic, and investors ask—“Is this time different?” Spoiler: It’s not. Markets have survived crashes, scams, and crises. SIPs win because they cut out emotions. Read here

Economy & Sector

- The retirement savings gap in India will rise to $96 trillion by 2050: India’s pension market, just 3% of GDP, has huge growth potential as NPS adoption rises. With tax benefits, AI-driven fund management, and innovative schemes like NPS Vatsalya, retirement savings are set to grow. As India’s aging population increases, a stronger pension system is crucial to bridging the retirement savings gap. Read here

- Battle for growth: On India’s economic trajectory: India’s Q3FY25 GDP grew 6.2%, driven by the primary sector, but manufacturing and services lagged amid global trade risks. While consumption and government spending rose, concerns over data revisions and inflation persist. Can India sustain growth? Read here

- U.S. eyes zero tariff on cars in India trade deal as Tesla entry nears: India is unlikely to relent to U.S. demands to reduce tariffs on auto imports to zero immediately, it has been priming the industry to prepare for a lower tariff regime and be open to competition. Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.