CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

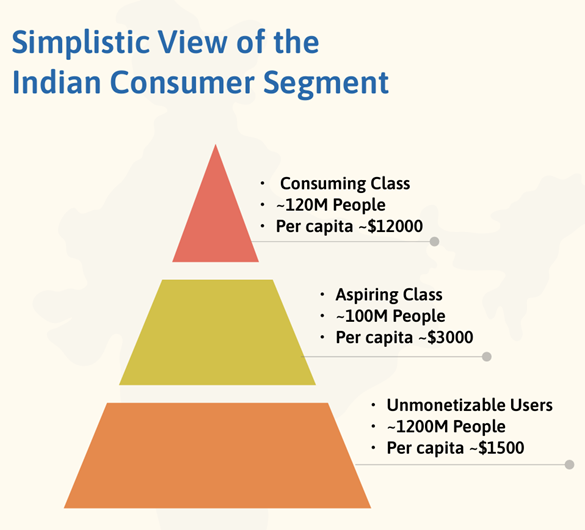

(Source: Accel, Bessemer, Blume, Fireside, Lumikai)

Gyaan Ki Baat

Fed Rate Cut: A Hawkish Move

The recent decision by the Federal Reserve (Fed) to cut interest rates by 0.25 percentage points is a pivotal development in U.S. monetary policy. This reduction, which marks the third consecutive cut in 2024, brings the federal funds rate to a range of 4.25% to 4.5%. The Fed’s objective with this move is to manage inflation while fostering economic growth.

Why Did the Fed Cut Rates?

- Stimulating Economic Activity: Lower interest rates reduce borrowing costs for consumers and businesses, encouraging spending and investment. This can lead to increased economic activity, which is crucial for job creation and overall economic health.

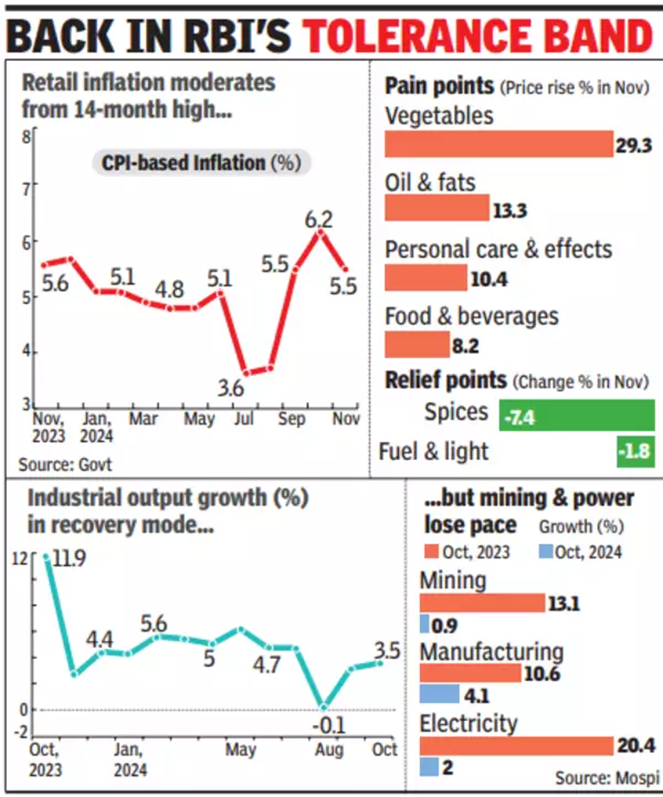

- Inflation Concerns: Despite the rate cuts, inflation remains a significant concern. As of November 2024, inflation was reported at 2.7%, above the Fed’s target of 2%. The central bank aims to strike a balance between supporting growth and keeping inflation in check.

Global Considerations:

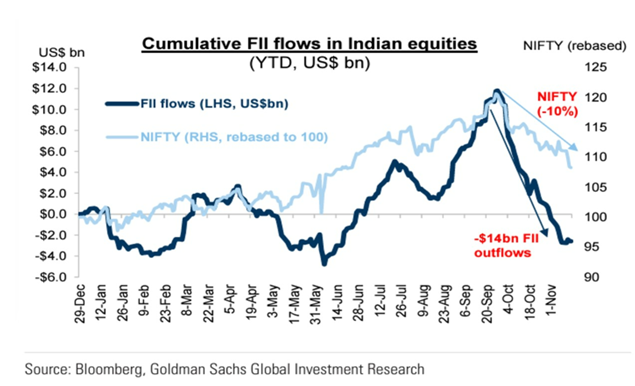

The Fed’s monetary policy has ripple effects beyond U.S. borders. Emerging markets, including India, are particularly sensitive to changes in U.S. interest rates, as they can influence capital flows and exchange rates

Personal Finance

- Learning from Mistakes: Mistakes are vital for growth, teaching valuable lessons through reflection and iteration. Separating ego from errors fosters objectivity, enabling improvement in investing and creativity. Embrace mistakes as opportunities to refine processes, enhance decision-making, and discover transformative insights. Read here

- Do As I Say, Not as I Did: The best investment lessons often hide in plain sight, but are we really looking in the right places? Success leaves clues—but not always in the advice given. This article uncovers what truly matters. Read here

- EPFO gives employers till Jan 31 to submit pending forms for higher pension: The EPFO has extended the deadline for employers to process pending higher pension applications until January 31, 2025. Employers must submit replies by January 15 for 466,000 cases requiring clarification. The extension addresses a significant backlog in pension claims. Read here

Investing

- Three Things I Think I Think – Strategic Reserves and Stuff: Forget Bitcoin, the US government should invest in American innovation! Cullen Roche slams the proposed Bitcoin reserve as a “scam,” while marvelling at US market dominance that’s spooking even him. Meanwhile, while partisan politics rage, the silent majority (Independent voters) remain surprisingly level-headed about the economy. Read here

- The 3 Best Inflation Hedges: Inflation may feel like a silent thief, but with the right strategies—like growing your income, locking in housing costs, and investing wisely—you can turn the tables and come out ahead. Read here

- Sebi Board Decides to Tighten SME IPO Norms, Revise Investment Banking Rules, Expand UPSI Definition: Sebi approved measures including stricter SME IPO norms, revised investment banking regulations, and expanded UPSI definition. It introduced reforms for Debenture Trustees, ESG rating providers, and financial entities, along with mandatory electronic payments for demat accounts and AI compliance safeguards. Read here

Economy & Sectors

- Will India’s economic growth pick up pace? Nirmala Sitharaman answers: Finance Minister Nirmala Sitharaman acknowledged that July to September was a challenging period for the economy but called the slowdown a ‘temporary blip’. Read here

- Indian economy to grow 6.6 pc in FY26: Ind-Ra: India Ratings projects 6.6% GDP growth for FY26, up from 6.4% in FY25. Investments will drive growth, reversing the cyclical slowdown. Despite easing monetary conditions, fiscal and external tightening are expected to persist, impacting the economy. Read here

- In 2025, the hurdles to India’s growth: India may overtake Japan as the fourth-largest economy by 2025, but risks include lower growth and fiscal contraction. The private sector’s investment role is uncertain, while global volatility, inflation, and protectionist trade policies challenge economic stability. Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.