Sonia Gandhi Limaye is the founder of Kalamwali and Rightwords Publications Pvt. Ltd. in Pune. Born and raised in a business family, she knew that she always wanted to be a business owner. But that said, she was also clear about establishing and running an organisation that would let her have a good work-life balance, for herself and for people working with her. Being very clear in her mind about not having to choose work over family, children, hobbies and social responsibilities, Sonia took the right steps towards founding her start-up.

Kalamwali was conceived as an idea in 2014 and relaunched in 2016. It is a platform for writers and an online publishing website that allows all kinds of writers to publish their work in the form of stories, experiences, poems, recipes, tips and much more. It’s a constantly growing community of readers and writers. Apart from an online existence, Kalamwali also conducts an array of literature related activities like storytelling and creative writing sessions for both kids and adults.

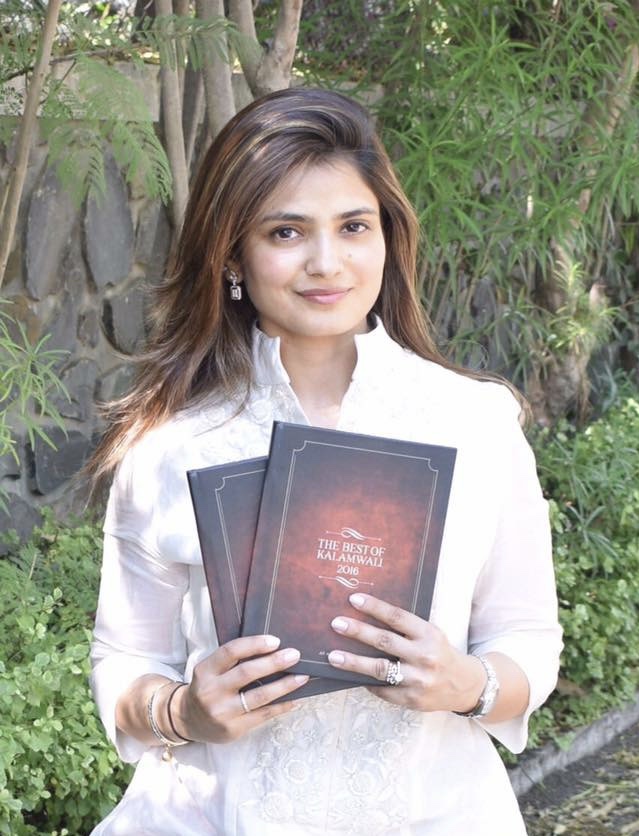

In 2016, Sonia released a self-published anthology called “The Best of Kalamwali” with the 50 best write ups on the company’s website. The book was a huge success and both the readers and the writers coveted its copies. This year she and her team are working towards publishing the second edition of the anthology.

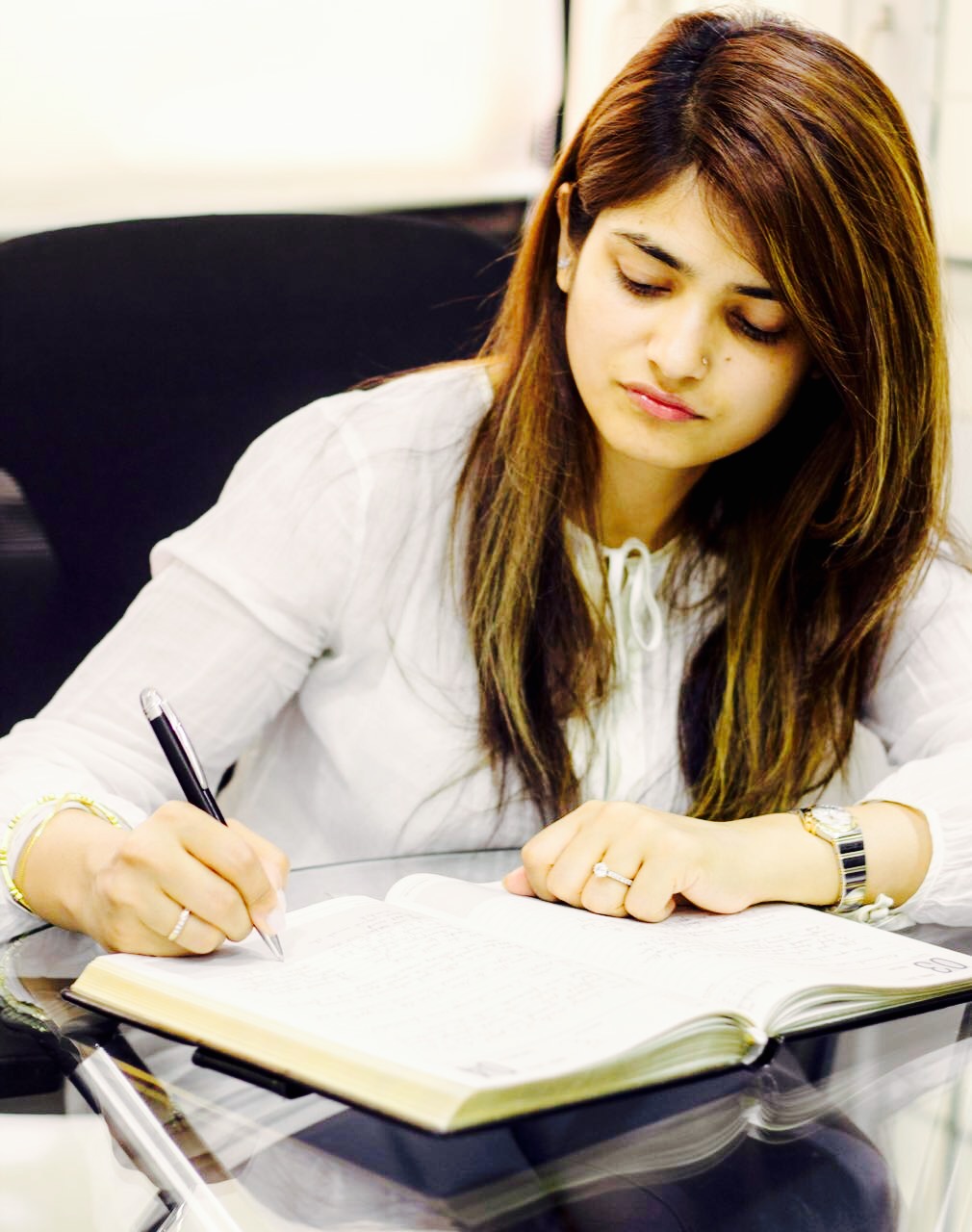

Since writing is her passion, she started Rightwords Publications Pvt. Ltd. in 2017. A small and intimate set-up, they are a humble enterprise with a strength of four. With a focus on content related work such as content strategy for websites, brochures, Social Media pages, they are currently working with four very well-known clients based out of Pune.

Sonia’s passion to translate ideas into possibilities was her main inspiration to become an entrepreneur. Besides, she did not see herself in a 9 to 5 job especially feeling averse to the monotony that she thought would be attached to it. However, she like many other entrepreneurs had her set of fears while starting out on her own. “Failure of not being able to explain my idea through my work. Fear of realising that work is boring for my employees and they hate their job. To face an unhappy client at the end of a job work.”, she states were some of them.

Sonia’s passion to translate ideas into possibilities was her main inspiration to become an entrepreneur. Besides, she did not see herself in a 9 to 5 job especially feeling averse to the monotony that she thought would be attached to it. However, she like many other entrepreneurs had her set of fears while starting out on her own. “Failure of not being able to explain my idea through my work. Fear of realising that work is boring for my employees and they hate their job. To face an unhappy client at the end of a job work.”, she states were some of them.

Sonia’s entrepreneurial journey has been slow and steady. She funded her business from her savings when she started off and now it’s almost self-sufficient. She explains that had her capital investment been high, she would have considered options to raise money. But that would have come with a lot of pressure to pay off. She shares from her experience what all should one be cautious of while starting off on their own, “Have a clear idea of what you want to do and what you want to achieve with that. Don’t get carried away into something that may look very lucrative or easy. There is no such thing as an ‘easy business’ or fast money or quick success. Let your dream take its own course of time. Don’t trust anyone blindly with your finances. Do as much research as you can on your own about the various options to manage your finances. Consult a financial planning advisor once you’ve done enough research on your own. Take things in your hands. As soon as you accumulate an amount, however small, reinvest it in your business or invest it in something that will grow. Do not depend fully on someone you have hired to do something for you. Make sure you know how to do it even if it’s a basic version.”

Sonia maintains a straightforward approach to manage her personal finances and those of her business. She pays herself a salary to keep that distinction. In case of accumulation of funds or receiving monetary gifts, she invests them immediately. She does not give or take loans, which she shares is a very recent improvement in her and that she has learnt to save before splurging.

With years of experience of setting up an enterprise and running it successfully, Sonia generously shares her tips for budding women entrepreneurs. She says, “Have a clear idea about your scope of work. And a tentative goal. Neither short term, nor too long term. Like a three-year goal which is not difficult to speculate or set. Write and rewrite the business plan at least 3 times for better clarity in scope of work. FAILURE in the initial stage is important so as to never become complaisant. Face it bravely. Have sleepless nights, anxiety, endless brainstorming sessions with different people who will ask you the questions you fear. Have immense belief in your idea and love your business like your child. Don’t let anyone tell you it’s not your cup of tea. Start taking your finances in your own hands and learn from scratch. Until 2015, I had never personally stepped into the bank for any bank work. I didn’t know how to write cheques or file returns. But I learnt from scratch and now even though I am not a master of it, I can do it by myself. Last but not the least, enjoy your work, and the wealth you’ll generate from it.”

This one is not to be confused with the famous girl band from the 90s. Singapore-based Namita Moolani Mehra is a mom of two and is the founder of

This one is not to be confused with the famous girl band from the 90s. Singapore-based Namita Moolani Mehra is a mom of two and is the founder of  Namita’s drive to make a difference was her main inspiration to become an entrepreneur. She wanted to give back and do something with meaning and purpose. Therefore, by creating something of her own that would be purpose-driven and make her feel excited about getting out of bed, she wanted to put her strengths in service of something meaningful. After working at one of the world’s best companies (Facebook) with the most incredibly talented people, and supported by tremendous resources, she was afraid of going off on her own. She was worried about not having the teams and resources to keep her motivated and productive.

Namita’s drive to make a difference was her main inspiration to become an entrepreneur. She wanted to give back and do something with meaning and purpose. Therefore, by creating something of her own that would be purpose-driven and make her feel excited about getting out of bed, she wanted to put her strengths in service of something meaningful. After working at one of the world’s best companies (Facebook) with the most incredibly talented people, and supported by tremendous resources, she was afraid of going off on her own. She was worried about not having the teams and resources to keep her motivated and productive.