A few months ago, I was out taking an evening walk when I happened to run across my old school friend, Gaurav. We both were elated to see each other after more than a decade and decided to grab some coffee and dinner. We walked into a nearby café and started marvelling over how the past 10 years seem to have flown by.

After graduation, Gaurav got his pilot’s license and started working for a well-reputed airline. He was making a comfortable 30 lacs p.a. with no dependents. I was pretty impressed with how well his career had panned out so far.

We both finished our meal and decided to leave. He offered to pay the bill with his credit card and drop me home in his car. I obliged.

While on our way to my house, I saw him being very callous about his spending. He had unnecessary add-ons in his car, designer seats, expensive smartphones, etc. He was also too generous with his tipping to the Barista and the Petrol Pump Attendant. I asked him how he could afford all of this. He replied with a grin, ‘EMIs’.

I was shocked. On further enquiry, I found out he had EMIs for everything – Cars, Mobile, Laptops, and even his clothes! I asked him if he saved anything at the end of the month and he simply replied with a small ‘No’.

Worried, I asked him if he was investing any money in assets.

He replied, ‘Of course! Look at this expensive phone, my car, my house, these are all my assets!’

I frowned as I went on to explain to him how assets are those that generate income or appreciate in monetary value.

Being a finance graduate myself, I decided to help my friend organize his finances. We met over the weekend and decided to plan his journey towards financial independence.

Step 1. Budget and Analyze

We listed down some of his EMIs:

| Expense | Loan Amount | Interest | Tenure | Monthly Cost |

| Home Loan | INR 10 lacs | 9.00% | 20 years | INR 90,000 |

| Car Loan | INR 8 lacs | 10.00% | 10 years | INR 10,572 |

| Laptop | INR 70K | 12.00% | 3 years | INR 2,325 |

| Phones | INR 65K | 12.00% | 3 years | INR 2,159 |

| Designer Suits | INR 50K | 12.00% | 3 years | INR 1,661 |

| Home Renovation | INR 2 lacs | 14.00% | 5 years | INR 4,654 |

And his other monthly expenses:

| Expense | Monthly Cost |

| Restaurants | INR 35K |

| Movies | INR 4.2K |

| Electricity | INR 2K |

| Water | INR 600 |

| Fuel | INR 4K |

| Mobile Bill | INR 1.5K |

| Maintenance | INR 5K |

| Misc. | INR 15K |

His total monthly expenses came to INR 178,671. His income being around INR 180,000.

We now decided to split his expenses into three categories:

A: Important and Unavoidable expenses. (Example: Rent, EMIs, Insurance, Investments)

B: Expenses that can be postponed. (Example: New clothes, new furniture)

C: Unnecessary expenses. (Example: Luxury Items, High-end dining)

I asked him to only spend money in categories A and B for a month and indulge in minimal wants (category C).

Gaurav managed to save INR 20,000 in just this one month!

Step 2. Emergency Fund

Many of us often end up taking personal loans to cover for unexpected expenses such as medical emergencies, car repair, home repair, etc. These increase our monthly expenses and leave us with lesser money to grow our assets. This problem can be solved by having an emergency fund. This money can be used during times of such unexpected emergencies and will not cost you any additional interest. Therefore, we decided to keep INR 5000 per month, in a Liquid Debt Scheme as an emergency fund.

Step 3. Insurance

With the rising costs of health care and other expenses, buying insurance is unavoidable. Gaurav had no insurance since he stopped being covered under his parents’ insurance. Insurances, although are being unwanted goods, are necessary for everyone to save you on rainy days. I asked him to get health insurance and car insurance that can help him out in times of crisis. It cost him INR 10,000 for both.

Step 4. Investing

The final part of handling personal finances is investing. Money saved will depreciate in value over time. Money invested, will grow and earn for you forever (thanks to the magic of compounding). We decided to start a small SIP of INR 2,000 and build from there. The leftover money was deposited in his Savings Account.

Soon, he started understanding the unnecessary expenses and callous attitude that was costing him all his money. He gradually increased his investments and savings to pay off his massive EMIs.

As of today, his investments have already reached INR 30,000 and continue to grow. Just the past few months, gave him enough incentive to save for his future, thus becoming completely financially independent in the coming 15 years.

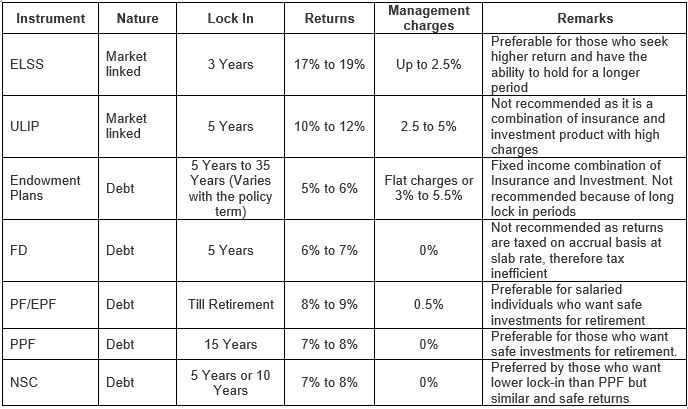

ELSS will therefore be appealing to an investor who has a higher risk appetite as ELSS funds have the potential to outperform and generate better returns than FDs, NSCs, and PPF/EPF.

ELSS will therefore be appealing to an investor who has a higher risk appetite as ELSS funds have the potential to outperform and generate better returns than FDs, NSCs, and PPF/EPF.