CAGR Insights – 24 May 2024

CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 24-May-24 | 17-May-24 | Change |

| Nifty 50 | 22,951 | 22,465 | 2.16% |

| Nifty 500 | 21,475 | 21,061 | 1.97% |

| Nifty Midcap 50 | 14,646 | 14,510 | 0.93% |

| Nifty Smallcap 100 | 16,880 | 16,859 | 0.12% |

CAGR Insights – 28 Jun 2024

CAGR Insights is a weekly newsletter full of insights from around the world of web.

CAGR Insights – 5 July 2024

CAGR Insights is a weekly newsletter full of insights from around the world of web.

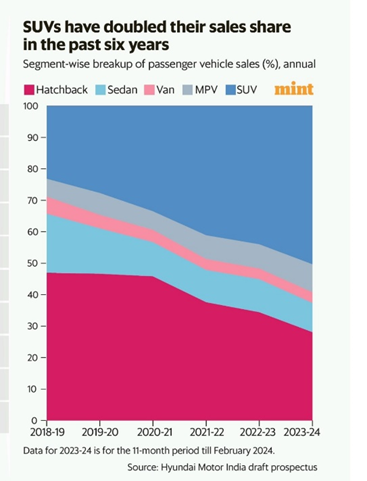

Chart Ki Baat

Gyaan Ki Baat for this week:

What are Small Finance Banks?

Small finance banks are a special category banks in India which aim to promote financial inclusion by serving underserved segments like small businesses and low-income households.

Regulated by the RBI, they offer basic banking services, loans, and use technology for efficiency. Their mission is to provide accessible banking solutions, including savings accounts, fixed deposits, and remittance services, with a focus on rural and remote areas.

These banks must meet RBI’s capital requirements and operate under stringent regulatory frameworks, playing a vital role in economic development by extending financial services to marginalized communities.

Here’s the list of curated readings for you this week:

Personal Finance

- How long you may live is one of retirement planning’s biggest unknowns. How experts say to get the best estimate: Retirement planning needs to consider not just your savings but also how long you might live. Financial advisors typically use 95 as the life expectancy for planning, but this might not be enough. Generally, the better your health, the longer you might live and the bigger your nest egg should be. Read here

- Finding the right international market for your investments: In India, few people use financial instruments like stocks and bonds for retirement savings, with only 3% investing in the stock market. Diversification across sectors and geographies is essential for reducing volatility and achieving long-term success. Investors compare international markets based on liquidity, efficiency, protection, and currency risks. Developed markets, particularly the US, are preferred for their stability and returns. Interest in European markets and residency-linked investments is growing, driven by desires for better opportunities and quality of life. Read here

- 72% of women making final decisions on their investments, survey reveals: Women are investing 37% more in mutual funds, showing strong dedication to wealth accumulation. This trend may be due to long-term financial planning or higher risk tolerance. The report indicates women prefer long-term investment strategies, aligning with mutual funds for retirement planning and wealth creation, benefiting from the compounding effect over time. Read here

- How Does Inflation Impact Retirement? This article explores the impact of inflation on retirees. It asks how inflation affects retirees, whether it’s better for high inflation to occur early or late in retirement, and what strategies retirees can use to manage rising prices. Read here

Investing

- FPI inflows poised to surge after a modest H1 2024; June sees strong recovery: In the first half of 2024, foreign portfolio investor (FPI) inflows into Indian equities were modest at ₹3,201 crore, following a strong 2023 with over ₹17,000 crore inflows. Despite market highs, FPIs were cautious due to election uncertainties, high valuations, and global factors. However, after election concerns settled, FPIs returned as buyers in June, purchasing ₹26,565 crore in Indian equities, the second-highest monthly inflow in 2024 after March’s ₹35,098 crore. Read here

- How Bull Markets Work: The stock market is currently in a bull market, which means prices are generally going up. This year has been a bit unusual for a bull market because there haven’t been many days with large price swings, either up or down. Historically, bull markets tend to be slow and steady, while bear markets (when prices are going down) are more volatile with big swings in both directions. This is because investors tend to overreact to good and bad news during bear markets. The article explains what a long-term investor should looking for in a market. Read here

- Finding the right international market for your investments: In India, few people use financial instruments like stocks and bonds for retirement savings, with only 3% investing in the stock market. Diversification across sectors and geographies is essential for reducing volatility and achieving long-term success. Investors compare international markets based on liquidity, efficiency, protection, and currency risks. Developed markets, particularly the US, are preferred for their stability and returns. Interest in European markets and residency-linked investments is growing, driven by desires for better opportunities and quality of life. Read here

Economy

- From “Bottle of Lies” to Global Leader: India’s Pharma Compliance Climbs: “Bottle of Lies” exposed quality issues in Indian generic drugs for a decade (2004-2014). Recent data shows significant improvement since then. India now has the most USFDA-approved facilities globally, surpassing the US. The percentage of inspections with warnings has dropped from 15-16% to 11%. While compliance improved, the author believes further progress is necessary for patient safety. Read Here

- Indian government bonds join JP Morgan EM Bond Index: The EMBI is a benchmark index for emerging market bonds, launched in the 1990s. It’s including Indian government bonds (IGBs) starting June 2024, which is expected to bring significant investment (estimated at $21 billion) to India by March 2025. This inclusion is likely to increase foreign investment in Indian bonds, particularly in longer-term maturities (6Y to 10Y). The short-term bond market might become more attractive in the future if interest rates behave a certain way (bull steepening). Read here

****

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1 year returns.

• CFF (launched in June 2022) – Ranked among Top 20 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 40 across the smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.