CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 21-Jul-23 | 14-Jul-23 | Change |

| Nifty 50 | 19,745 | 19,590 | 0.79% |

| Nifty 500 | 16,904 | 16,781 | 0.73% |

| Nifty Midcap 50 | 10,447 | 10,352 | 0.91% |

| Nifty Smallcap 100 | 11,530 | 11,325 | 1.81% |

Chart Ki Baat

Gyaan Ki Baat

With a week left for filing your ITRs, check if you knew about the below benefit available towards health expenses.

Under section 80D of Chapter VI-A of Income Tax Act, one can claim INR 5K as deduction against medical consultations and lab tests. We do not need to furnish any documentary proof for the same. This deduction is subject to the upper limit of INR 25K which is available as deduction for Mediclaim for self.

Further, one can also claim deduction of expenses done towards consultations, medications and tests of dependant senior citizen parents up to a maximum amount of INR 75K.

Here’s the list of curated readings for you this week:

Personal Finance

- Why are world leaders pleading to get Taylor Swift to tour their countries? – Media reports say that because UOB bank credit cards had preferred access to Taylor Swift’s concert tickets, there was a 45 percent surge in daily credit card applications in Singapore, Thailand, Malaysia, Indonesia and Vietnam the week that she announced her concert dates. Read here.

- As The Income Tax Filing Deadline Approaches, How To File ITR Without Using Form 16? – Learn how. Read here

- What is Nasdaq’s special rebalancing and its impact? – Microsoft, Apple, Nvidia, Amazon.com and Tesla combined account for 43.8% weight in the index, according to Refinitiv data as of Monday’s close. As part of the rebalance that will come down to 38.5%.Read here.

- NRI Knowledge Series – Things to know about NRI repatriation? – Some #nris are certain that they will return to India at some point. But a lot of them don’t know what the future holds for them. And while they like to continue #investing in India, they would want to enjoy the flexibility of moving that money out of the country at some point. Watch here.

- Indian ROCKET PARTS IN AUSTRALIA? BEACH DISCOVERY SPARKS BUZZ – Space launches are no rarity, with a global count of around five to ten every week. Read here.

- Revenue growth expected to moderate but profit margin seen picking up in Q1FY24 – India Inc revenue growth likely moderated for the fourth straight time to 6-8 in the first quarter of this fiscal because of low realizations and high-base effect. However, operating profit margin is seen edging up to ~20% from 19.6% in the first quarter of last fiscal, and 19.3% in the fourth quarter, helped by easing commodity prices, especially crude oil. Read here

- At the start the 2023, the conventional wisdom was that 2023 would be trying year for US stocks and bonds. – It should come as no surprise that markets surprised investors on almost every front. Valuation guru Aswath Damodaran notes that if the greatest sin in investing is arrogance, markets exist to bring us back to earth and teach us humility. Watch here

- Foreign investors are favouring India over China – Investors are increasingly tracking MSCI-ex China. China’s weight on the MSCI EM Index has reduced to 29.55 percent from 38.7 percent in 2020 whereas exposure to India stocks has increased from 8.3 percent in 2020 to 14.63 percent currently. Clearly, investors are looking to reduce exposure to China stocks for better returns. Read here

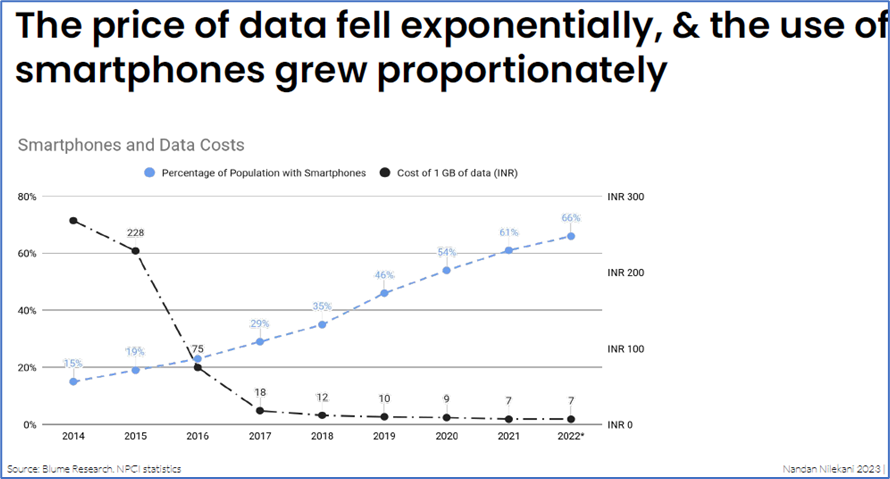

- Megatrends in India – Temasek – Temasek believes that digitisation of the economy via UPI and ONDC, consumption, healthcare, and sustainable living are the megatrends in India. Watch here.

- Succession Planning is Critical for Disruptive Capital Allocation – Large businesses often face the risk of stagnating growth due to saturation of their core market or disruption from new innovators. One way to mitigate this risk is to invest in disruption, innovation & expansion of the business into adjacencies. Read here.

Economy

- Did you know that Turkey has been one of the fastest-growing economies for the past two decades? – I personally thought that the Turkish economy is in a dire state and I am also right. Read here.

- FASTag saving fuel one toll at a time – Integrating FASTag into the country’s toll collection infrastructure has also increased the revenue — it rose from $770 million in 2013–14 to nearly $5 billion in 2022–2023, according to Gadkari. The government now aims to increase its toll revenue to over $15 billion by 2030. Read here.

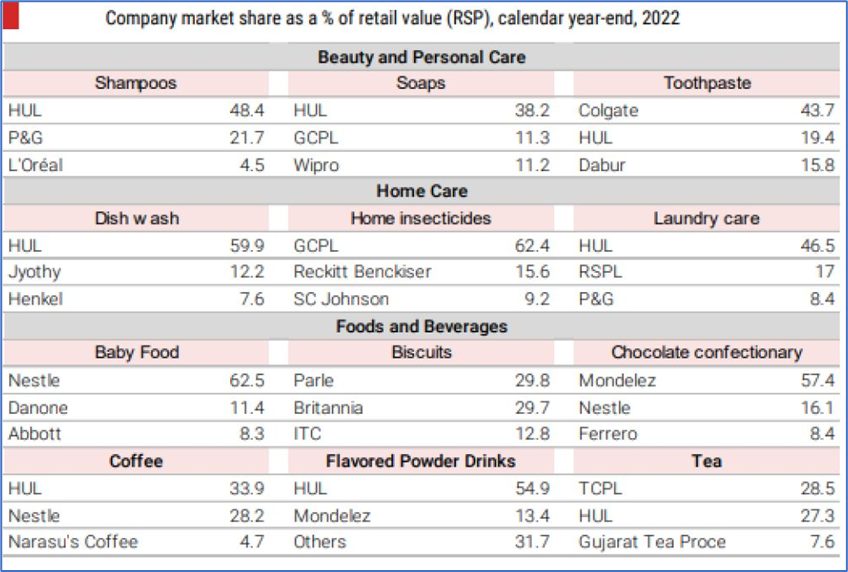

- Q: How does the world’s biggest pizza brand respond to high inflation in the world’s most populous nation? A: With the world’s cheapest Domino’s pizza. And Domino’s are not alone in this. Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.