CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 02-Jun-23 | 26-May-23 | Change |

| Nifty 50 | 18,534 | 18,499 | 0.19% |

| Nifty 500 | 15,811 | 15,696 | 0.73% |

| Nifty Midcap 50 | 9,630 | 9,428 | 2.14% |

| Nifty Smallcap 100 | 10,321 | 10,010 | 3.11% |

Chart Ki Baat

Gyaan Ki Baat

Commodity funds include investment in commodities such as petroleum, gold, silver. They generate returns based on the price movements of the underlying commodities same as equity mutual funds generate returns base on their underlying equity assets.

These funds offer diversification benefits and act as an inflation hedge in times of turmoil (Ex: gold mutual funds). These could be a better alternative than holding physical commodities. Although the fund manager has more expertise in dealing with commodities, one should keep in mind that commodities typically have a much larger cycle than equities. Some funds might invest in certain commodity futures which increase the added risk.

Here’s the list of curated readings for you this week:

Personal Finance

- NPS – An excellent way to secure your retirement – Comparing the NPS to an alternative instrument with a 2 percent annual charge, assuming both offer an 8 percent annual growth rate (conservative estimate) after 30 years, NPS accumulates around 1.6 to 1.7 times more than the alternative Read here.

- Sebi fee review to make a big dent in MFs’ profits – The Securities and Exchange Board of India (SEBI) may negatively impact India’s mutual fund sector with its proposal to review total expense ratio (TER) regulations, according to brokerage Nuvama. Read here.

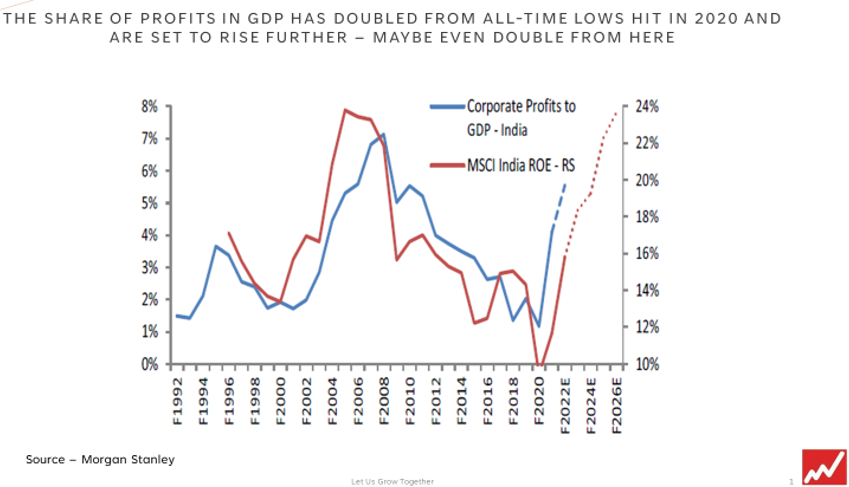

- A profit boom is coming – Morgan Stanley Report: The share of profits in GDP has doubled from all-time lows hit in 2020 and are set to rise further – maybe even double from here – leading to strong absolute and relative earnings. This explains India’s apparently rich headline equity valuations. Triggered by supply-side reforms by the government, we expect a major rise in investments, a moderation in the CAD and an increase in credit to GDP to support the coming profit growth. Read here

- India Industrial credit growth remains low, while personal unsecured loans grow sharply. Read twitter thread here

- Investing in broad indices may give a false sense of diversification – investors in the S&P 500 Index may think they are getting exposure to a diversified basket of 500 companies. But today, the top 10 mega-cap companies in the index account for almost 35% of its entire market capitalization. Read here.

- Credit profiles of microfinanciers to strengthen this fiscal – Assets under management (AUM) of non-banking financial company-microfinance institutions (NBFC-MFIs) is set to grow 25-30% this fiscal amid improving asset quality and continued traction in economic activity. Read here

Economy

- India’s unemployment problem – India will need to create 70 million new jobs over the next 10 years, wrote Pranjul Bhandari, chief India economist at HSBC, in a note earlier this month. But only 24 million will likely be created, leaving behind “46 million missing jobs.” Read here

- Investment more than consumption leading India’s economic growth – A surge in investments that offset sluggish consumption to boost India’s growth in 2022-23 is expected to power the economy in the current financial year as the government pushes ahead with massive capital expenditure plans, economists said. Read here.

- FY2023 fiscal deficit of Rs. 17.3 trillion restricted within revised target – Non-tax revenues overshot FY2023 RE by Rs. 244 billion, offsetting the shortfall in disinvestment receipts Read here.

- US Congress averts historic default, approves debt-limit suspension- The Treasury Department had warned it would be unable to pay all its bills on June 5 if Congress failed to act by then Read here.

Now avail Loan against your MF investments Do reach out to us for any queries.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.