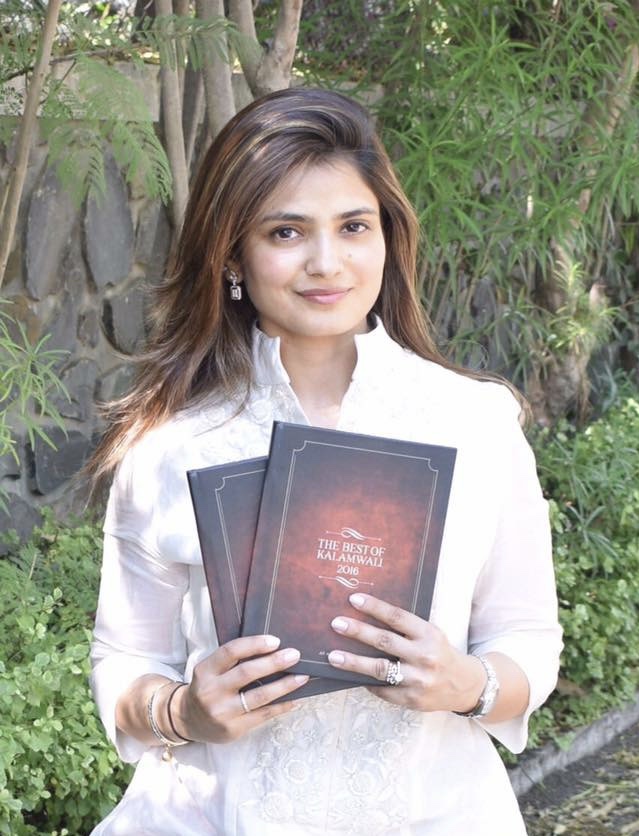

Anamika Singh is a second generation tea sommelier who has been learning, absorbing, experiencing, creating and spreading the good word of tea for the past 30 years. She has lived her life largely in the mountains of Darjeeling & Dharamsala. Around 6 years ago, after working for a considerable amount of time with her father, Abhai Singh in the estate and exporting their teas to Europe and Asia, she decided to introduce India to fine, boutique, niche teas and thus, Anandini Himalaya Tea was born. Anandini means where the earth and the sky meet and something that gives you happiness. After two years, her brother, Kunal Singh joined the business and now they have grown as a brand.

They started with 7 blends, the tea sourced from their own estate where they worked closely with farmers and got the purest of flowers and herbs from the Himalayan region of India. They now have close to 150 different teas that include handmade teas, infusions, and tisanes and are very happy working with the hospitality industry as well as the wellness industry. They curate events and workshops based on tea and are also working with the Indian Hospitality Management institutes to teach the students about the beverage of the nation, so that each one of them can become brand ambassadors of tea.

Anamika believes that it was the obstacles in her life that inspired her to become an entrepreneur and she is glad to have chosen the path less traveled. She quotes that, “Working with my father was one thing but starting a business on my own was another ball game altogether. There was a phase in my life around 9 years ago that actually made me question my abilities, my thought process, me as a person and my responsibilities towards others who surrounded me. I had to snap out of it which I did with the support and love of my family and close friends. I just decided that I have to work harder, create something of my own, catch hold of that silver lining and begin with courage and hope and prove first to myself and then the rest, that I believed in myself, my abilities, my skills and that if the mind can conceive it, there is no way that one cannot achieve it.”

Anamika believes that it was the obstacles in her life that inspired her to become an entrepreneur and she is glad to have chosen the path less traveled. She quotes that, “Working with my father was one thing but starting a business on my own was another ball game altogether. There was a phase in my life around 9 years ago that actually made me question my abilities, my thought process, me as a person and my responsibilities towards others who surrounded me. I had to snap out of it which I did with the support and love of my family and close friends. I just decided that I have to work harder, create something of my own, catch hold of that silver lining and begin with courage and hope and prove first to myself and then the rest, that I believed in myself, my abilities, my skills and that if the mind can conceive it, there is no way that one cannot achieve it.”

As with anyone starting out on their own, Anamika too had her fears. Her main concern was being one of the very few women in a male dominated industry and therefore, the apprehension of not being taken seriously in the business. She learnt the nuances of tea in their tea estate under the astute guidance of her father who has been her biggest inspiration, her guru and someone who always led the way for her to follow. After learning everything from scratch under him, she set up Anandini Himalaya Tea where she suspected again if the Food & Beverage industry would give her a chance as a tea sommelier and listen to her. In her opinion, tea has never been given the kind of significance it deserves and there’s very limited knowledge that people have about the different kinds of blends. This was a challenge for her as she wondered if she’d be able to hold the attention of people during meetings in the F&B industry. And this of course had a direct co-relation to how it would impact her business. Anamika quotes, “Their normal remark would be, ‘Tea is just Tea, how is yours any different?. People in India just didn’t understand the importance or the relevance of Single origin or Single estate teas. They still don’t. So it is an everyday challenge, but I love it. It keeps me going, changing one cup at a time.”

From her years of experience as an entrepreneur, Anamika shares her approach of starting a new business. She states that it’s crucial to have a business plan in place especially if you intend to create a brand. It is important to connect with financial planning organisations or government bodies that can help you register and further help you to figure out the way forward as far as finances are concerned.

She states that today it’s a huge advantage that we have accessibility to financial planning advisors, to discuss and figure out financial strategies as compared to earlier. Anamika quotes, “I think our biggest fear is of being seen as one who doesn’t know, hence we find it difficult to ask for help. But with all the infrastructure available to us today on how to take it forward, now is the best time to create your path.”

Anamika started off by putting her personal savings to establish Anandini Himalaya Tea. After a year, when she got an understanding of the market, she initiated the second phase where fresh funds were invested with the help of her family and friends to open a tea boutique and expand the market. This increased her outflow in a span of three years and as the founder/director of the business, she did not use any of the new funds for her personal use. When funds were required for expansion, marketing and new projects, they were again gathered from family and friends. She explains that they have not taken any debt from the market and Anandini Himalaya Tea is still a close family owned business. It was only since the fourth year of the business when she and Kunal have been able to take a salary. She mentions that all other profits are re-invested back into the company. They had consciously decided to not involve investing companies for further financing to keep their brand value intact.

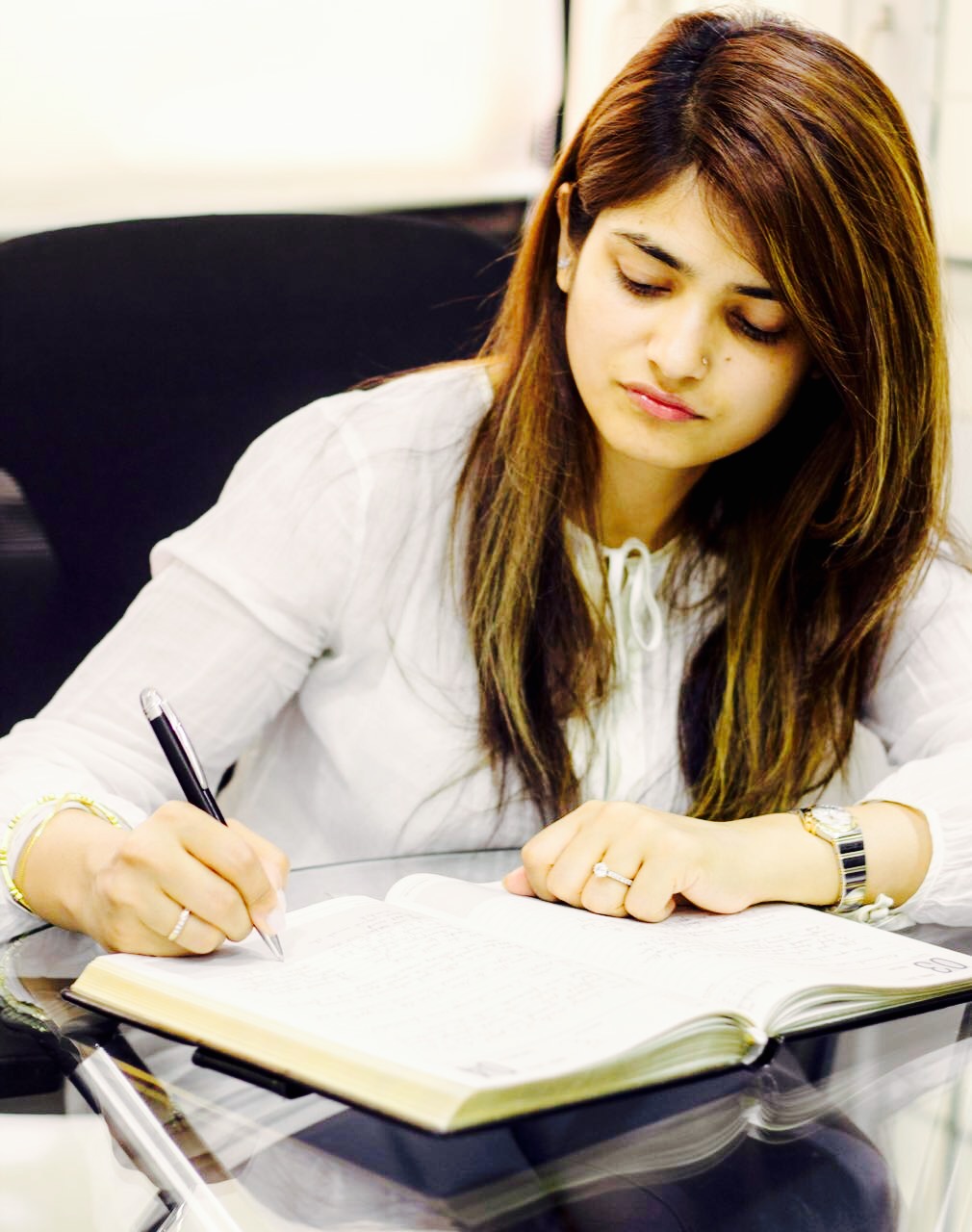

However, she also highlights a few things that one should be cautious of while starting out on your own. She emphasizes that once you’ve established clearly what you want to do, which direction you want to take and who you want to partner with, it’s possible that somewhere along this journey you get influenced wrongly and get deviated from your core values that your brand talks about. This may all be in an attempt to reach your goals faster and in ways that might bring in the limelight quicker than expected. She mentions that it is absolutely crucial to keep going back to the drawing board and figure out where you started and how you started. She states, “Stick to the values and principles, choose your clients wisely. Be careful of how you put across your brand on social media. The world is watching. And if you are an entrepreneur, remember you reflect your brand and vice versa. Hence, with the powerful tool that the social media is, remember to keep yourself linked to the brand and see how you can reflect the best rather than give any negative impact to what you are trying so hard to build.”. Anamika personally has a checklist that she goes back to off and on. Additionally, she maintains a daily diary of her expenses and has a personal CA who helps her with her investments and to keep a reality check on her personal finances as well as that of the business.

However, she also highlights a few things that one should be cautious of while starting out on your own. She emphasizes that once you’ve established clearly what you want to do, which direction you want to take and who you want to partner with, it’s possible that somewhere along this journey you get influenced wrongly and get deviated from your core values that your brand talks about. This may all be in an attempt to reach your goals faster and in ways that might bring in the limelight quicker than expected. She mentions that it is absolutely crucial to keep going back to the drawing board and figure out where you started and how you started. She states, “Stick to the values and principles, choose your clients wisely. Be careful of how you put across your brand on social media. The world is watching. And if you are an entrepreneur, remember you reflect your brand and vice versa. Hence, with the powerful tool that the social media is, remember to keep yourself linked to the brand and see how you can reflect the best rather than give any negative impact to what you are trying so hard to build.”. Anamika personally has a checklist that she goes back to off and on. Additionally, she maintains a daily diary of her expenses and has a personal CA who helps her with her investments and to keep a reality check on her personal finances as well as that of the business.

When asked about her success mantra, Anamika generously shares her thoughts with us. “Believe in yourself. Remain true to yourself and be you… Bravely! You are responsible for creating your path the way you want it. Listen to your heart and follow your dreams. There is no way that they will not manifest! Do not rush into anything without having done your homework. And in this entire process, do not forget yourself and the time you need to give to yourself. If you grow, your mind breathes and then your brand grows. Take out ‘me time’ always even if it is for just 30 minutes in a day. Spend time in solitude. It has helped me so many times when I was caught in a road block. Build a network of people who support you and believe in your dreams and last but not the least, stay away from negativity. Your time is precious. Respect it. Life is beautiful, we just have to learn to savour it sip by sip.”

Listen out and loud

Listen out and loud  Think big to achieve bigger

Think big to achieve bigger Concentrate and stay focused

Concentrate and stay focused

Sonia’s passion to translate ideas into possibilities was her main inspiration to become an entrepreneur. Besides, she did not see herself in a 9 to 5 job especially feeling averse to the monotony that she thought would be attached to it. However, she like many other entrepreneurs had her set of fears while starting out on her own. “Failure of not being able to explain my idea through my work. Fear of realising that work is boring for my employees and they hate their job. To face an unhappy client at the end of a job work.”, she states were some of them.

Sonia’s passion to translate ideas into possibilities was her main inspiration to become an entrepreneur. Besides, she did not see herself in a 9 to 5 job especially feeling averse to the monotony that she thought would be attached to it. However, she like many other entrepreneurs had her set of fears while starting out on her own. “Failure of not being able to explain my idea through my work. Fear of realising that work is boring for my employees and they hate their job. To face an unhappy client at the end of a job work.”, she states were some of them.

However, she also highlights a few things that one should be cautious of while starting out on your own. She emphasizes that once you’ve established clearly what you want to do, which direction you want to take and who you want to partner with, it’s possible that somewhere along this journey you get influenced wrongly and get deviated from your core values that your brand talks about. This may all be in an attempt to reach your goals faster and in ways that might bring in the limelight quicker than expected. She mentions that it is absolutely crucial to keep going back to the drawing board and figure out where you started and how you started. She states, “Stick to the values and principles, choose your clients wisely. Be careful of how you put across your brand on social media. The world is watching. And if you are an entrepreneur, remember you reflect your brand and vice versa. Hence, with the powerful tool that the social media is, remember to keep yourself linked to the brand and see how you can reflect the best rather than give any negative impact to what you are trying so hard to build.”. Anamika personally has a checklist that she goes back to off and on. Additionally, she maintains a daily diary of her expenses and has a personal CA who helps her with her investments and to keep a reality check on her personal finances as well as that of the business.

However, she also highlights a few things that one should be cautious of while starting out on your own. She emphasizes that once you’ve established clearly what you want to do, which direction you want to take and who you want to partner with, it’s possible that somewhere along this journey you get influenced wrongly and get deviated from your core values that your brand talks about. This may all be in an attempt to reach your goals faster and in ways that might bring in the limelight quicker than expected. She mentions that it is absolutely crucial to keep going back to the drawing board and figure out where you started and how you started. She states, “Stick to the values and principles, choose your clients wisely. Be careful of how you put across your brand on social media. The world is watching. And if you are an entrepreneur, remember you reflect your brand and vice versa. Hence, with the powerful tool that the social media is, remember to keep yourself linked to the brand and see how you can reflect the best rather than give any negative impact to what you are trying so hard to build.”. Anamika personally has a checklist that she goes back to off and on. Additionally, she maintains a daily diary of her expenses and has a personal CA who helps her with her investments and to keep a reality check on her personal finances as well as that of the business.