As much as this may seem like another millenial term invented in the world of finance, Financial Independence, Retire Early; more commonly known as FIRE has existed for more than a decade. Although the term for it wasn’t coined back then, the concept has been around for longer than you would imagine. FIRE is a movement wherein one takes a path towards extreme savings (almost 70% of the income) to quit their job and retire much earlier than the standard way of retiring at 60. The objective is to save enough to be able to live off the savings by withdrawing small amounts (typically 3-4% yearly) from the portfolio. And the motivation for it generally stems from the idea of having the freedom to do what you want to do. For example, traveling, blogging, authoring a book or anything as such which is more to do with pleasure, not necessarily generating income out of it. This frugality movement has been gaining awareness and spreading into the mainstream since the last decade.

People opting for FIRE are usually regular employees in corporate jobs with a definite timeline in mind. Their aim is to build a massive corpus for early retirement through extreme savings and once achieved, to quit their jobs/any form of employment. However, it’s important to note that with this decision there has to be extreme levels of discipline to be followed with regards to expenses and overall lifestyle choices. Almost 70% of your income contributed towards savings is a huge amount and hence, comes into picture the frugality aspect of the movement. Expenses have to be monitored diligently and the focus on continued maintenance and reallocation of the money is also just as crucial.

There are various approaches that people opt for while adopting the FIRE movement. The main goal is the same – extreme saving but there can be differences in the way they abide by this. Let us understand each of the types with the help of examples.

Fat FIRE – Rahul is a single, 33 year old software engineer who aims to retire at 45. He was introduced to the FIRE movement a few years ago when he gave it a serious thought and planned his life towards an early retirement. Three years ago, he dedicatedly started investing 70% of his income on a yearly basis towards his new financial goal. He has been very conscious about his expenses and has chosen to lead a simple life where there’s enough for his basic needs and some for an emergency. His brother who is 35 years old has opted for the traditional route of retiring at 60. Therefore, his saving towards his goal is 10% of his yearly income, and there’s no compromising on the lifestyle choices as there’s a budget allocated for that too. In short, saving more than the average retirement investor by adopting a very traditional and simple lifestyle is considered Fat FIRE.

Lean FIRE – Meenakshi is a college professor aged 35 years and her husband, Jay an insurance agent, is 38. Nearly five years ago, after gaining enough knowledge about FIRE through various sources and consultation with their financial planning experts, they decided to adopt a very stringent method of minimalist living to achieve their goal of extreme savings and mandating a far more restricted lifestyle. With the aim of retiring by the time they reach 50 years respectively, they have taken certain measures to meet their goal. They ensure that they eat only home cooked meals, they don’t subscribe to cable or Netflix/Amazon Prime but view only content that is aired free, they always opt for second hand goods when it comes to buying something for their house or their 7 year old son, they shop for necessities only when absolutely needed and they take buses and trains instead of cabs and have decided not to own a car. A lean lifestyle is how they look at it that brings them closer to their goal.

Barista FIRE – Rohan and Jharna are a millenial couple both aged 36 years. Rohan was in advertising for over a decade and Jharna, a journalist for the same amount of time. They aimed to retire at 50 years when they were both 25 and hence, hatched a plan for it. 10 years from then, they quit their corporate jobs and took over Rohan’s beach house. They renovated it and put it up on AirBnB, making an arrangement to cover their current expenses without eroding their retirement fund. Their aim to do so was not only to be financially independent and retire early but also to do some kind of part time work on their own terms. Their motivation for this financial goal was to bring an end to the stress of the corporate jobs or any form of employment where one doesn’t necessarily have the luxury or flexibility to do things as they please. With enough saved up over a decade for their early retirement, they still have work that keeps them busy and let’s them have the privilege of doing it on their terms while easily covering their current expenses through their new venture.

Coast FIRE – Mayuri is a 37 year old banker turned social media influencer. She is a single mother to her 5 year old daughter. With a finance background, Mayuri always had the tools to her disposal to understand the do’s and don’t’s with money management. Planning way ahead in her 20s, she knew she wanted to retire at the age of 35 and travel the world while she was still in her 30s. Her motivation to do so was to never work again for money and have enough to cover for her current expenses too. She worked seriously towards her goal through extreme savings and managed to achieve it just as planned. However, after being in a corporate job for close to 15 years it was actually not as simple as she thought – to not do anything at all. Besides, with a daughter in tow, needless to say that there are several expenses to keep up with. While money wasn’t an issue at all, Mayuri was drawn to social media marketing and became an influencer. While this helps her to still make money on her own terms, whether she does it part time or full time, her nature of work still involves all the privileges she dreamed of post the early retirement. And all of this while actually having enough in her retirement fund to cover for the current expenses too.

The FIRE movement has started spreading gradually as we see more people opting for it. Achieving financial independence to fund an early retirement is most definitely an act of severe discipline and stringent means that one ought to stick to. However, one should also be cautious while practicing extreme diligence that when stock markets fall and/or interest rate environments are low, the FIRE plan may fall short. The discipline too needs to continue post the early retirement to ensure that the corpus is not used up recklessly or too soon. They are after all fruits of all the hard work and compromises made for years to have a cushion much earlier in life. FIRE is certainly a redefined way of retirement and to make informed and sound decisions, it’s highly advisable to connect with financial planning advisors or companies who can guide you towards your goal in the right manner.

This one is not to be confused with the famous girl band from the 90s. Singapore-based Namita Moolani Mehra is a mom of two and is the founder of

This one is not to be confused with the famous girl band from the 90s. Singapore-based Namita Moolani Mehra is a mom of two and is the founder of  Namita’s drive to make a difference was her main inspiration to become an entrepreneur. She wanted to give back and do something with meaning and purpose. Therefore, by creating something of her own that would be purpose-driven and make her feel excited about getting out of bed, she wanted to put her strengths in service of something meaningful. After working at one of the world’s best companies (Facebook) with the most incredibly talented people, and supported by tremendous resources, she was afraid of going off on her own. She was worried about not having the teams and resources to keep her motivated and productive.

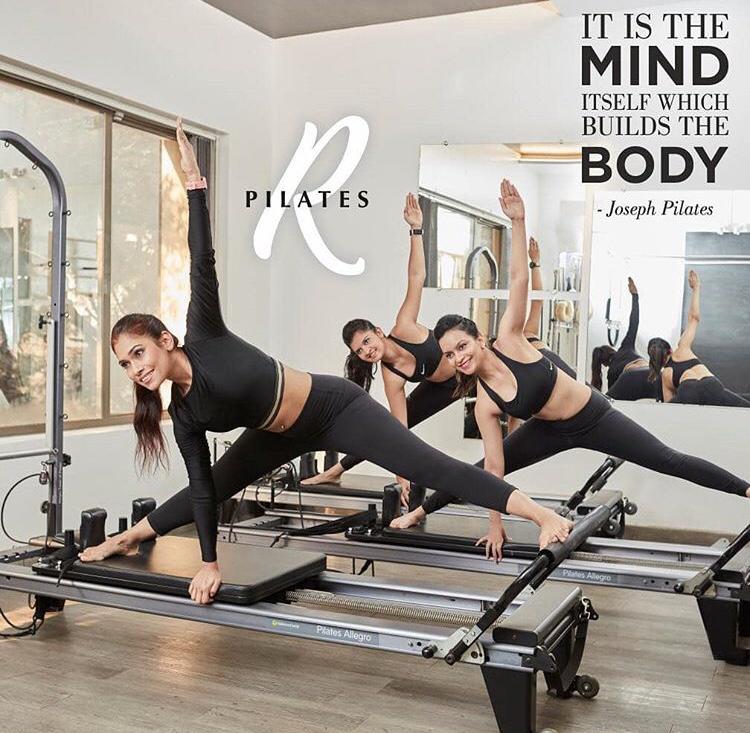

Namita’s drive to make a difference was her main inspiration to become an entrepreneur. She wanted to give back and do something with meaning and purpose. Therefore, by creating something of her own that would be purpose-driven and make her feel excited about getting out of bed, she wanted to put her strengths in service of something meaningful. After working at one of the world’s best companies (Facebook) with the most incredibly talented people, and supported by tremendous resources, she was afraid of going off on her own. She was worried about not having the teams and resources to keep her motivated and productive. After relinquishing her flying job, she enrolled herself for ACSM CPT (American College of Sports Medicine) then did all her Pilates certifications one by one. In 2013, Rucha started teaching mat Pilates classes at a gym and also started personal training at home. In 2014, she started her own Pilates Studio, R Pilates in Pune with only 1 reformer in a small apartment in her parents’ building. Today, she has a beautiful 1000 square feet studio in the most plush area of Pune with all the Pilates apparatus imported from Sacramento, California and a big family of 6 Pilates teachers, 150 clients and another branch opening soon.

After relinquishing her flying job, she enrolled herself for ACSM CPT (American College of Sports Medicine) then did all her Pilates certifications one by one. In 2013, Rucha started teaching mat Pilates classes at a gym and also started personal training at home. In 2014, she started her own Pilates Studio, R Pilates in Pune with only 1 reformer in a small apartment in her parents’ building. Today, she has a beautiful 1000 square feet studio in the most plush area of Pune with all the Pilates apparatus imported from Sacramento, California and a big family of 6 Pilates teachers, 150 clients and another branch opening soon. Having landed firmly on her feet with her venture, she shares her approach with us. “If you know exactly what you want to do, start small, watch the response, make your mistakes and learn your lessons in a small set up. Once you have tested the waters then dive in into the big pool. Always count your figures backwards. Give your business a strict teething period and make sure it picks up pace gradually. Set goals and talk to your team regularly.” While starting a business or even while scaling up, we know that finance is the key component. Since personal savings become a big part of investment in it, it is quite natural for one to experience that they are low on that reserve for a while. Rucha experienced the same after moving to a bigger studio where her overheads increased manifold and her personal savings took a back seat. However, she continued with her basic savings like PPF and left them untouched. Now that the new set-up too has been established well, she has been able to focus better on building up that reserve for her personal savings and has defined separate financial goals for herself and R Pilates where she has started two separate

Having landed firmly on her feet with her venture, she shares her approach with us. “If you know exactly what you want to do, start small, watch the response, make your mistakes and learn your lessons in a small set up. Once you have tested the waters then dive in into the big pool. Always count your figures backwards. Give your business a strict teething period and make sure it picks up pace gradually. Set goals and talk to your team regularly.” While starting a business or even while scaling up, we know that finance is the key component. Since personal savings become a big part of investment in it, it is quite natural for one to experience that they are low on that reserve for a while. Rucha experienced the same after moving to a bigger studio where her overheads increased manifold and her personal savings took a back seat. However, she continued with her basic savings like PPF and left them untouched. Now that the new set-up too has been established well, she has been able to focus better on building up that reserve for her personal savings and has defined separate financial goals for herself and R Pilates where she has started two separate