Parag Parikh Long Term Equity Fund (PPLTE) is the only equity fund that is managed by the investment team of PPFAS. As a recent entrant in the Mutual Fund Industry (fund was launched in May 2013), it is not the most popular fund in the market. At least we do not see people including them in the “Top 10 Funds to invest in 2019” list (Frankly, we find such lists to be very silly).

There are several reasons why we believe that PPLTE is a good addition to the portfolio for investors who exhibit all of the following traits:

a) Looking to add equity exposure

b) Willing to not withdraw their investments for 7-8 years

c) Keen to add some overseas diversification to their investments

d) Unwilling to risk capital erosion in lieu of high returns

e) Want to prioritize downside protection for times when markets don’t seem to be too ecstatic

If you think you are the one we are referring to, you should contact us to check if this is a worthy addition to your existing portfolio.

Reasons why we like PPLTE

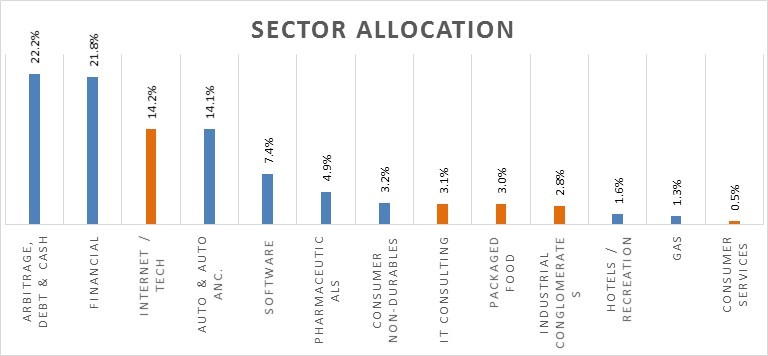

Sector Allocation

Several things stand out when we look at the sector allocation of this fund.

a) 22% of the corpus is kept in liquid resources, waiting to be deployed when opportunities emerge. Some might say that this will drag returns down (since liquid resources at best earn you around 6-7%), but let us tell you that investing in businesses at a price that seems affordable is better than buying something expensive. Also, investing when one finds good businesses to invest in is also an important consideration for long term wealth generation

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price” – Warren Buffet

b) Substantial overseas exposure (~28%) adds to geographical diversification (orange bars are completely overseas). Out of this total overseas exposure, around 9.7% is in Google and 4.3% in Facebook. That adds to some real diversification to your portfolio! (Source: PPFAS Feb – March Factsheet)

Skin in the game

7.07% of the AUM represents own equity of the key persons in the fund management team. When people who are managing our funds have invested their own savings into the same, we know the commitment is for real. It is a good corporate governance practice to have their own financial being is linked with that of the investors. We give them a big thumbs up for this one.

Out-performance with focus on downside protection

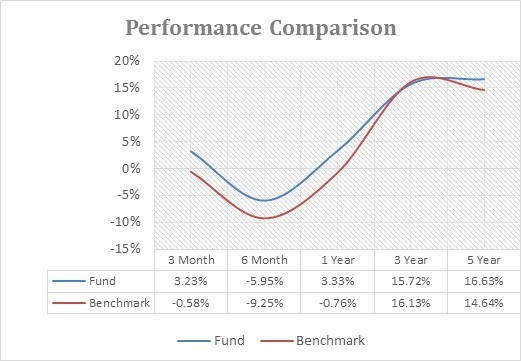

As can be seen from the chart below, the fund has outperformed its benchmark (Nifty / BSE 500 TRI) at all times considering point to point returns. In terms of Alpha, the fund ranks #2 within the Multi-Cap category.

However, out-performance is not what excites us. Active funds, after all, are supposed to out-perform their respective benchmarks.

What seems interesting and commendable to us is the ability of the fund to protect the downside during times of correction. Let us look at the 3 year rolling returns of the fund. The highest rolling return is 25% and the lowest that the fund has given over a 3 year period is 10%.

This means a lot of things for you as an investor if you would have held your investment for a 3 year period at any point in time:

a) You would have generated a CAGR of at least 10% even if you would have exited at the very low point of the market which was some time in the second half of the last year

b) You would not have seen a negative return for a 3 year period on your portfolio EVER

c) You would not have lost your peace of mind over losing your money

For investors who are uncomfortable with too much volatility, the above means a lot. We believe that the reason the fund has been able to demonstrate this performance is because of its patient and down to earth fund managers – Rajeev Thakkar and Raunak Onkar. Although this is not a guarantee for the future, the above track record during testing times gives additional comfort to investors.

Mr. Thakkar is quite active on twitter and we suggest you follow him to understand his ideology if you are an existing investor or are likely to become one.

In case you have any further query, do reach out to us on contact@cagrfunds.com