If a genie popped in front of me today and granted me three wishes, the child inside me would probably want to get an endless supply of money, a surreal supply of cake and to live forever to enjoy all of those things. But everything in life has an expiry date, including our wealth and us.

Therefore, the adult in me would wish for enough money to enable me to have a comfortable working life & a delightful retirement, a healthy & fit life and maybe a large cup of Cappuccino.

The fear of not having enough money to sustain ourselves post-retirement is real and that’s why the government launched the National Pension Scheme, so that we could garner enough to continue with our current lifestyle, even after our primary source of income is gone.

We, at CAGRfunds, have recently started enabling our clients to subscribe to NPS. Let’s try and understand what NPS can do for you!

National Pension Scheme or NPS, is a defined voluntary contribution pension system. It was initially started for Government Employees in 2004 but was later expanded to all citizens of India in 2009.

Investors can invest in both equity and debt which enables them to make good returns on equity while having the safe assurance of debt!

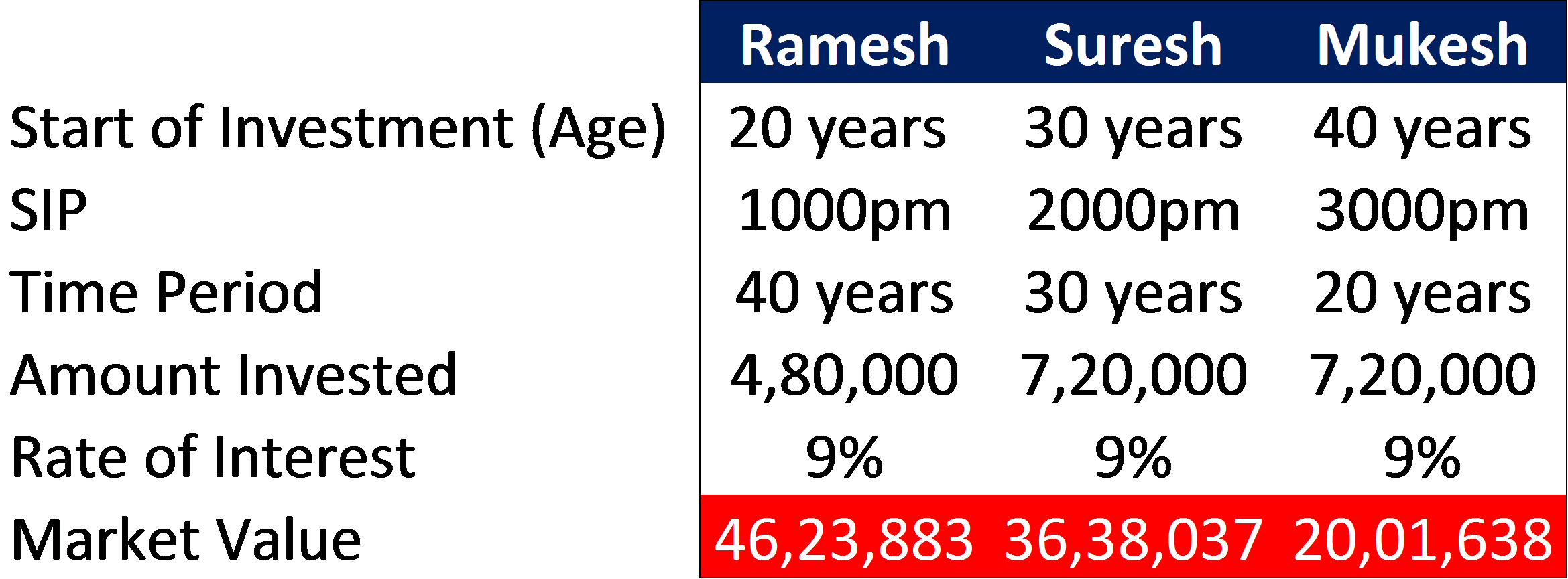

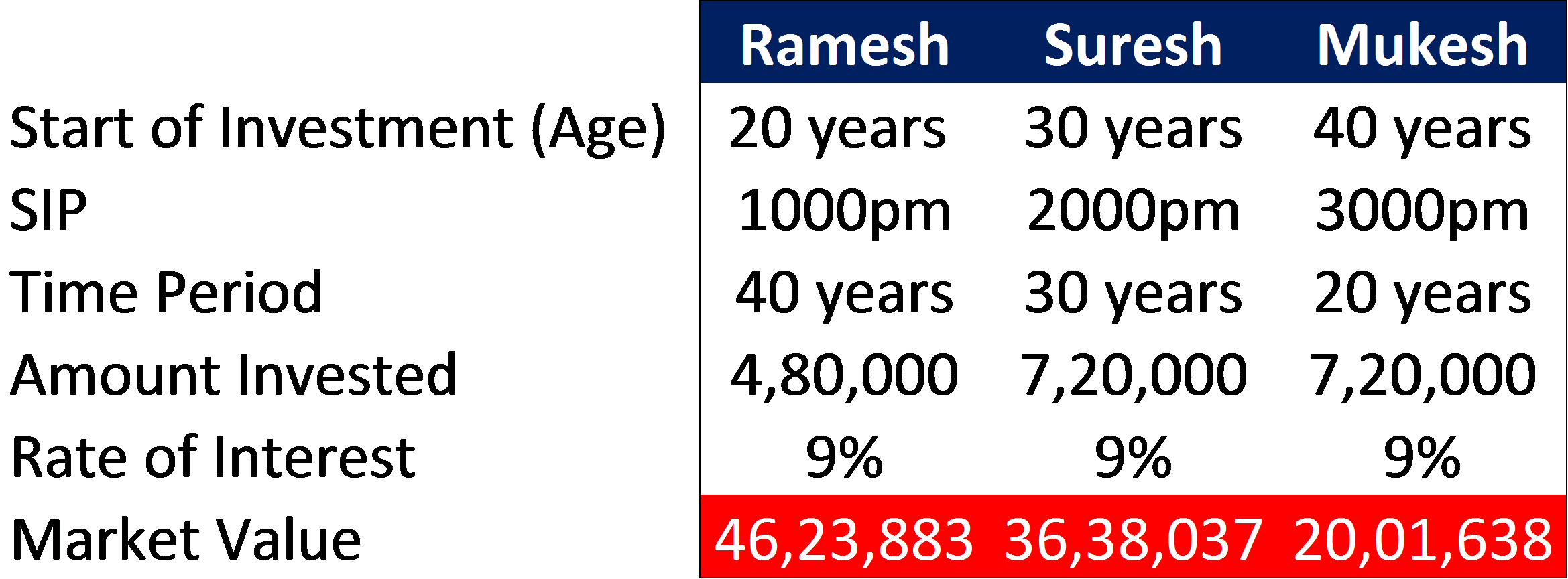

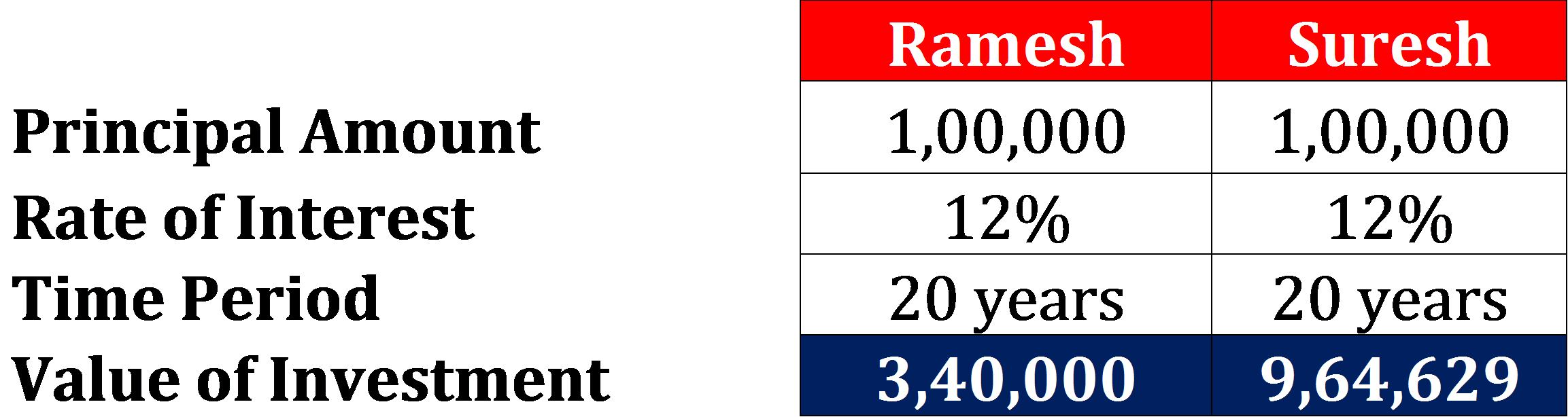

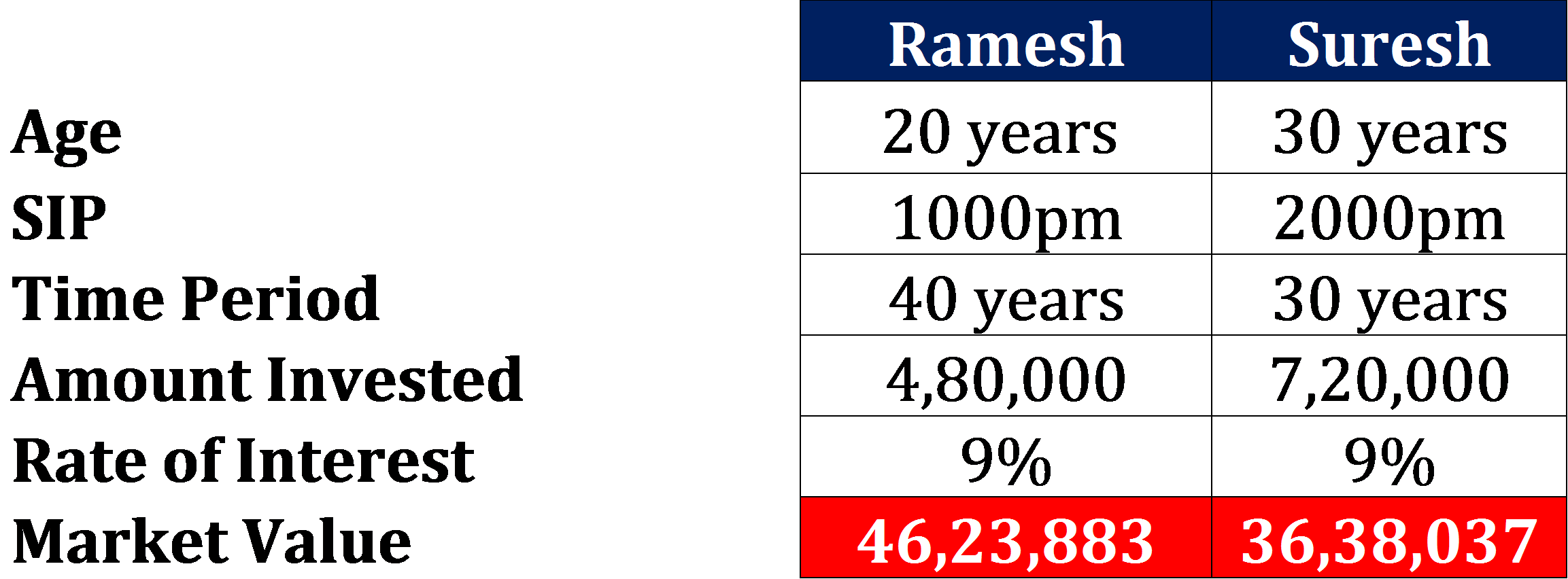

To understand better how and when to invest in NPS, let us have a look at Ramesh, Suresh and Mukesh and how their choices could affect them at the age of retirement.

Ramesh started investing in NPS at the age of 20 while Suresh and Mukesh started investing at the age of 30 and 40 respectively. Let us see how their investments will perform when they reach the age of 60 (Retirement Age).

Ramesh has done very well with his corpus standing at an astonishing 46 lakhs. At the same time, even though Suresh and Mukesh have invested 2.4 lakhs more than him, their investments are only 36 lakhs and 20 lakhs. This difference has arisen because of the power of compounding! You can read our article on the miracles of compounding here!

To help you out further, here is a small description of the types of NPS accounts:

Tier 1 (Investment Account)

It is an investment account wherein you can deposit money via SIP or Lumpsum. Investors can invest from the age of 18 years up until 65 years of age. Money once deposited in this account, can only be removed before maturity in a few circumstances. This often sends people away but we feel that its focused approach towards retirement prevents the customers from making mistakes during market volatility.

Note:

- You can withdraw up to 25% of your initial investment amount after three years of investing.

- Investors can withdraw 20% of corpus as lumpsum after ten years of investing.

There are two stages of investing. The first is the Accumulation Phase wherein you invest your money at regular intervals into NPS. The second is the Distribution Phase wherein the money comes back to you. Once you reach the age of 60, you have an option of withdrawing 60% of your corpus as lump-sum and you can buy a pension scheme (annuity) with the remaining 40%.

Note: It is compulsory to invest a minimum of 40% in annuity.

Government employees can mostly invest in corporate or government bonds. However, other investors can choose from various ‘Pension Fund Managers’ ranging from SBI and LIC to HDFC and ICICI. Investors can invest in two ways:

Active Choice

Investor gets to choose their investments. However, they have the following limits:

- Equity: Max 50%

- Bonds: No limit

- Alternative Funds: Max 5%

Auto Choice

In this option, investments are automatically adjusted based on the individual choice of plan. The exposure to equity will gradually reduce after the age of 35 in all three plans.

- Conservative Plan: Max 25% Equity

- Moderate Plan: Max 50% Equity

- Aggressive Plan: Max 75% Equity

Note: Investors can change their investment options twice a year and their PFMs once a year.

Tier 2 (Savings Account)

Tier 2 is a savings account. You can put and remove money as and when you wish as there is no exit load in this account. You can choose to invest in a Tier 2 account only if you have a Tier 1 account. It is possible to go back from a Tier 2 account to a Tier 1 account but once changed, you cannot change your account to Tier 2 again. In our view, one should only consider investing in Tier 1 account.

Tax Deductions

Investments

Investments in Tier 1 are tax exempt up to 1.5 lakhs every year under section 80C of the Income Tax Act. An additional 50,000 is also tax-exempt under section 80CCD (1b).

Investments in Tier 2 are not tax exempt and will be charged at slab rates (and hence, we feel that only Tier 1 is the relevant part in NPS).

Withdrawals

Withdrawals in Tier 1 have the following taxation:

- Premature withdrawal of up to 25% is tax exempt

- Withdrawal of 40% of investment at maturity is tax exempt. If you withdraw more than 40% (upper cap of 60%), then differential is chargeable at slab rate

- Returns earned on the part of corpus that is used to buy annuity (minimum 40%) are also tax-exempt

- Income from annuity will be charged at slab rate

Withdrawals from Tier 2 are not tax exempt.

In conclusion, as scary as the idea of growing old and having to let go of your lifestyle on your way to retirement seems, by investing in NPS now, you will save much more than enough to continue living your life the way you like it.

For further advise on investing in NPS, feel free to contact us at contact@cagrfunds.com or call / Whatsapp us on +91 9769356440.

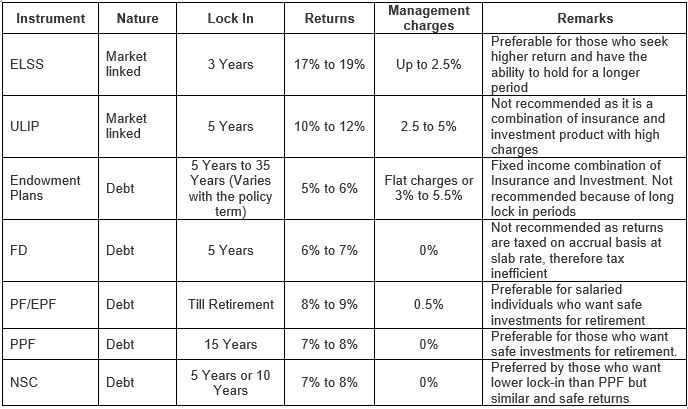

ELSS will therefore be appealing to an investor who has a higher risk appetite as ELSS funds have the potential to outperform and generate better returns than FDs, NSCs, and PPF/EPF.

ELSS will therefore be appealing to an investor who has a higher risk appetite as ELSS funds have the potential to outperform and generate better returns than FDs, NSCs, and PPF/EPF.