You must have heard the phrase, “…with a cherry on top!” That would be what compound interest does for your money, and more. A relatively easy topic that we all covered in our tenth-grade mathematics. However, few of us managed to unravel the wonders that lie within its very basic formula.

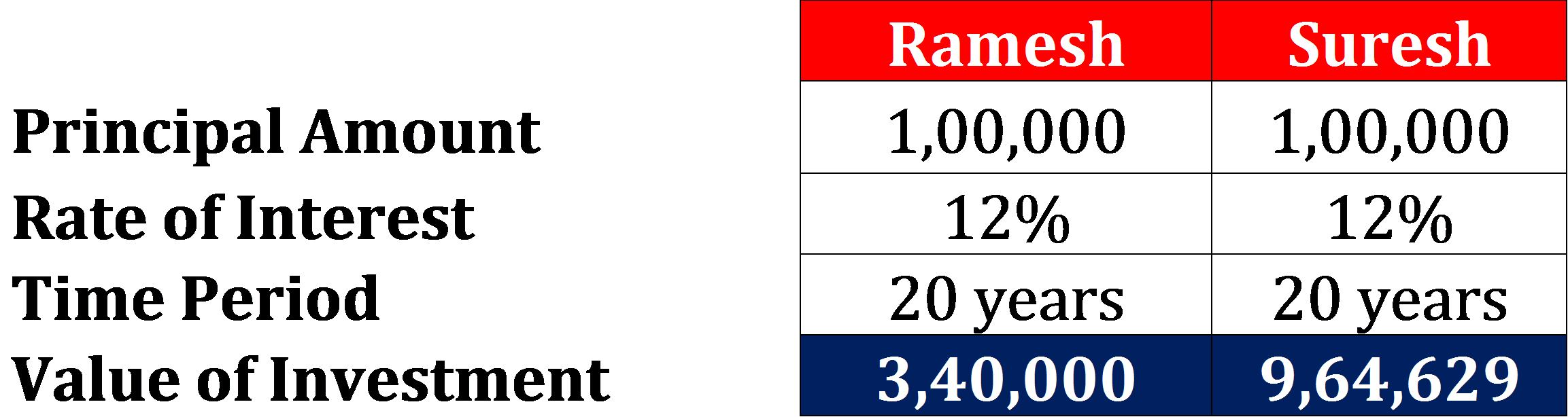

Compound Interest is earning an interest on your interest. When your money is being compounded, you will earn money on your principal amount as well as the interest that has been earned previously. Let us see a small comparison between Simple Interest and Compound Interest.

As we can see, an investment that is being compounded annually at 12% over 20 years gives 3 times as much returns than an investment that gives a simple interest of 12% over the same period.

Like wine, compound interest is truly enjoyed by those who give it the time to get older, and thus better. To further elaborate on this comparison, let me present to you a small story, proving yet again how time is wealth.

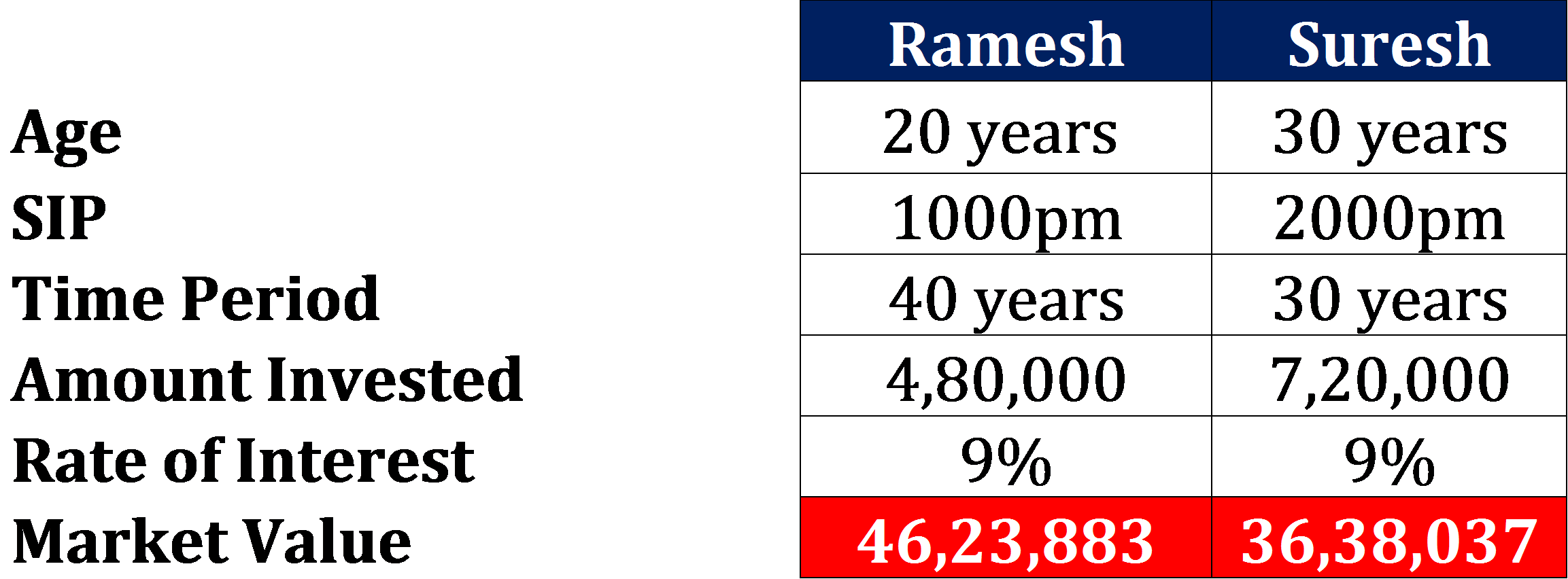

Let’s meet two friends, Ramesh and Suresh. Both are twenty years old and have just graduated from their college. Ramesh decides that he will invest 1,000 rupees every month for his retirement. He starts investing immediately in a pension scheme. Suresh sees this and takes Ramesh for a fool as there are still 40 years left for their retirement!

Ten years later, Suresh sees that Ramesh’s corpus has grown to 2.6 lakhs! Suresh starts investing 2,000 rupees per month for his retirement to catch up with Ramesh’s investments.

Now, they have both reached retirement. Let us see how their investments have performed.

As we can see, Ramesh has invested a lesser amount over the same period. However, he has earned 10 lakhs more than Suresh. This is because the money that goes in early does the major work for your investment. Read on to find out why we say “Start Small But Start Early”.

Therefore, it’s not timing the market. It is time in the market!

So, invest early and let the magic of compounding do its job.