At CAGRfunds, January to March quarter is perhaps the busiest for us. No special reason why it should be so, but it is. Why? Because, many of our investors wake up to the need for tax saving investments just then. And then they end up investing a lumpsum amount in tax saving funds (ELSS).

What is wrong with that?

Well, nothing. Except that a lumpsum investment in any equity oriented fund forces us to lock a single price. What most investors miss are the problems they would face when they invest lumpsum instead of SIP.

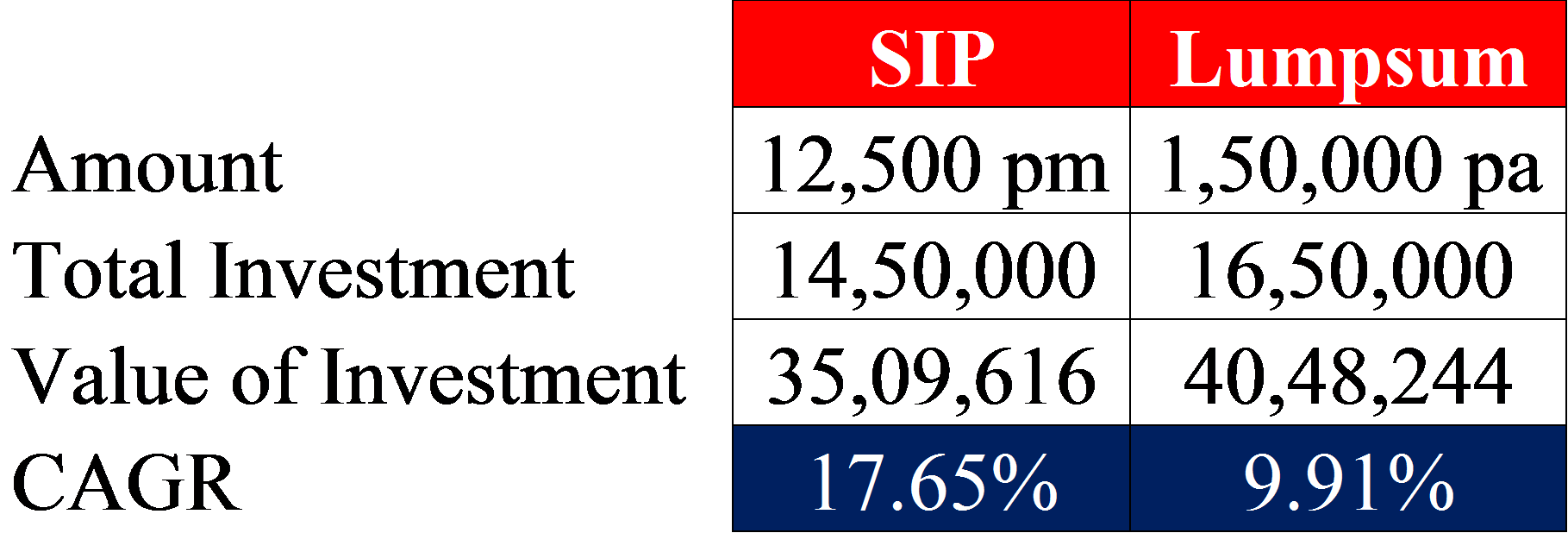

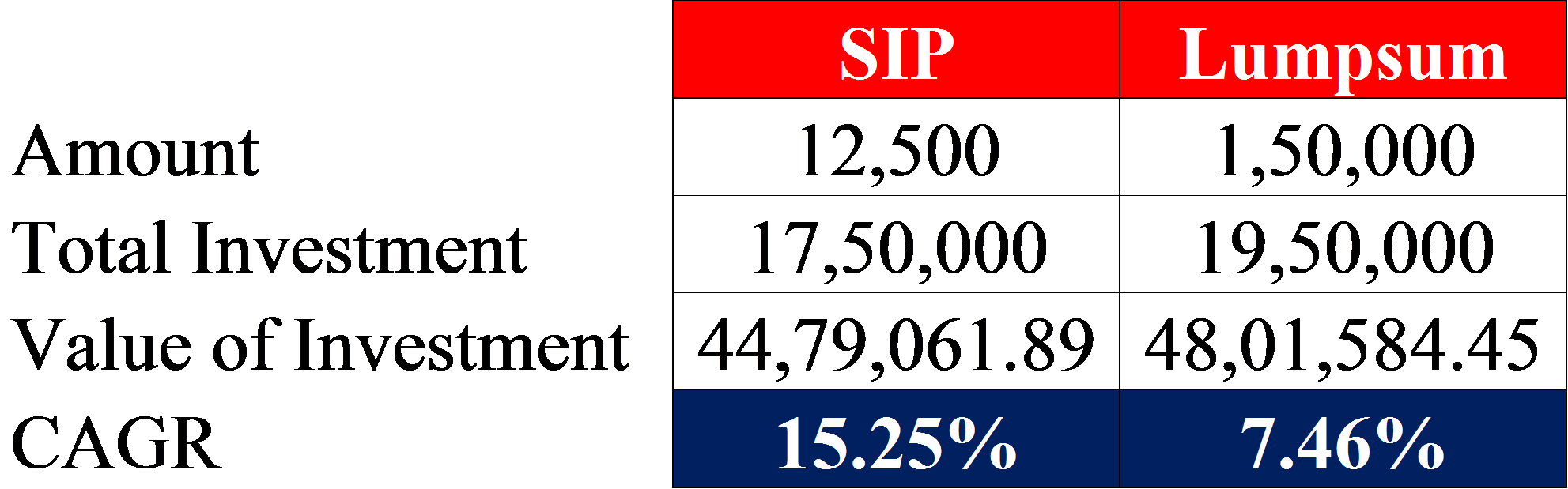

Let us see an example of a SIP and a Lumpsum investment in an ELSS fund. We have two comparisons:

- SIP of 12,500 every month since 15th Dec 2008 until 15th July 2018, and

- Lumpsum of 1,50,000 every year on 15th December

Scenario 1: ABSL Tax Relief’96 (since 2008)

Scenario 2: Axis Long Term Equity Fund (since 2010)

Scenario 3: Franklin India Tax Shield (since 2006)

As we can see, an annual lumpsum investment in any of the above ELSS funds would have given significantly lower returns than SIP over the same period. This is because SIP enables the investor to invest every month at different prices. SIP thus averages out the cost of purchase. On the other hand, with a lumpsum investment, money gets locked in at one price and that can give lower returns if the pricing, unfortunately, is at a high level. This happened with a lot of our investors who had to compulsorily invest a lumpsum amount in ELSS in January 2018 since they were restricted by the last date of submitting tax proofs.

So if you have not yet planned your taxes and are still waiting for the last date to knock your doors, you need to think again. Feel free to post a comment if you have any questions!