Yet again, a discussion with few friends on a Sunday afternoon has brought me here today. We were discussing about our future plans and each one of us wanted to retire early and retire rich. No surprises there. What surprised me is that my friends only have a vague idea, no concrete plans about how they are going to achieve this goal. This is true for most of us. With rising cost of living and increasing life expectancy, the need to plan for one’s golden years is absolutely necessary.

Lack of a concrete plan for retirement may lead to problems just when you are least prepared for it. As one of the founding father of the United States, Benjamin Franklin, so succinctly put “If you fail to plan, you are planning to fail”.

Most of us tend to underestimate the retirement corpus. If you need Rs. 50,000 for monthly expenses today, will you need the same after 30 years, when you retire? The answer is no. You will need Rs. 2.2 lakhs every month, assuming just 5% inflation. There it is, now I have your attention. Inflation leads to reduction in purchasing power, by slowly but steadily eating up your money. Learn more about it here.

Let me tell you one more thing. With increasing life expectancy, the non-earning period in an individual’s life is expanding. Someone retiring at age 60 after working for 30 years could live on for another 25 years or more. Assuming your current age of 30 years, current monthly expense of Rs. 50,000, inflation of 5% and retirement age of 60 years, the amount of retirement corpus one needs for 25 years after retirement is Rs 5.3 cr and for 30 years after retirement is Rs. 6.1 crore. These are not small sums by any measure. If you do not start to plan now, there is a high probability to fall short.

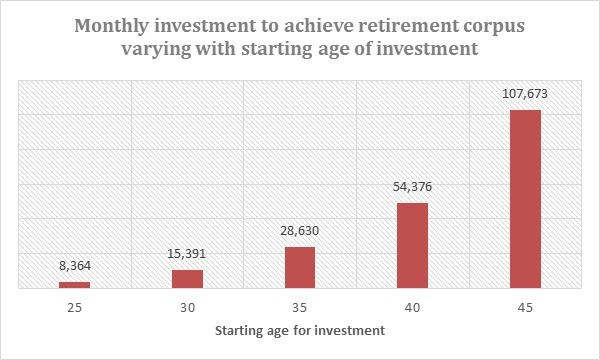

Are you now thinking when to start investing for retirement? The answer is as EARLY as possible. If you do that, your money gets more time to grow. Each rupee gained generates further returns. This is called “power of compounding”, and this helps you get rich… and richer over time.

Let us take the above example, say you start investing at age of 30 years and continue to do so for next 30 years. To achieve a corpus of Rs. 5.3 cr at retirement, assuming 12% return on your investment, you will have to invest Rs. 15,391 per month. If you delay the investment by even 5 years, the same monthly installment doubles itself to Rs. 28,630.

Don’t feel overwhelmed by all the numbers shown above, you can take help from your financial advisor for this. The key is to start early, invest regularly and choose the right products for your investments.