Marriage is a game changer on many levels. New dreams, new goals and new relatives – all shiny and with a bucket load of expectations. Amidst this, you and your spouse will continue to build a new life together, the one filled with love and tenderness. While for some enlightened couples, managing their combined finances is a piece of cake, for a lot of us it is the biggest thorn to be carefully pruned. Financial discussions have often led to higher decibels in the household in newly-wed couples and they continue to be so until sorted out. So, how to plan finances after marriage and still love each other? Here’s how:

1)Be Honest and Share Your Current Financial Situation

Marriage is a fresh start, or at least could be treated as one. The best way is to share your financials with your spouse with honesty and respect. If you could do this before marriage, it’s better. Often times with arranged marriage, it may not be possible but every effort should be made to get this important discussion started as early as you can. Start talking about your income, debts, and other savings and expense habits.

2)Set Down Goals

Now that you are married, you might have some dreams together – a house, an international vacation, a car, higher education, etc. Each of them needs significant investment that needs to be planned. You also have the inevitable retirement goal as part of your long-term financial planning. Write down all these goals and review them often. Doing this at the beginning of the marriage gives a clear idea of what path to financial management you need to do together for meeting those goals. For example, if you both plan to retire at 40, you have to earn and invest aggressively, save more and spend less now to accomplish that.

3) Decide on Bank Accounts

You are not required to have a joint account just because you are married. However, one can use a joint account as a common pool, or goal-specific account while maintaining separate accounts for independence. For example, if you plan to buy a house together in five years and decide to save Rs 5000 each every month, then set up a joint account so that both can deposit Rs 5000 in it. It not only acts as a pool both are responsible for but also brings in the team spirit in marriage.

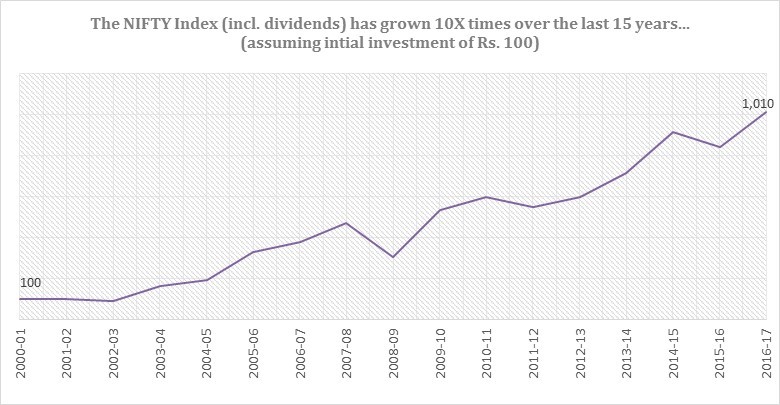

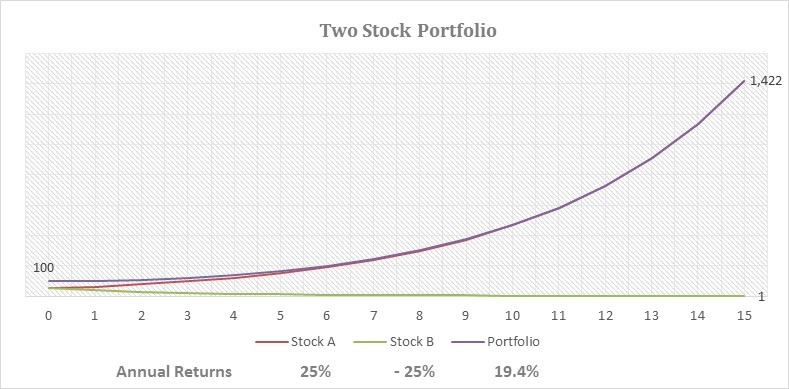

4) Create a “family” portfolio

`Before marriage, you and your spouse had your own investment portfolio that perfectly met the needs of your goals then. In fact, you might have also invested keeping some long term goals in mind like retirement. Post-wedding is an excellent time to take a look at both of your portfolio and combine them for your money to grow for common goals. An example of a common goal is buying real estate. Combining your portfolios in to a “family” portfolio is important as it will help you plan better and define your appropriate asset allocation. Get in touch with a good financial planner to run an end to end planning exercise and kick start your family investment journey.

4) Don’t Forget Emergency Fund

No matter what your goals are as a couple, ensure that you set up an emergency fund. An emergency fund is a financial cushion for you and your spouse when something expensive and unexpected strikes like an accident or job loss. Having money to rely on is a great stress relief and will reduce strain on your marriage at particularly bad times. Aim to save at least six months of income in your emergency account.

5) Plan and Track a Budget

Easier said than done, but planning a budget with your spouse is one of the smartest thing you would do in your marriage. It sets financial behavior expectations from each other while helping you both visualize how it helps you get closer to your goals. Planning a budget is not rocket science. Once a budget is set, track it every day to ensure you are on plan. You can use the numerous apps that are available on your phone to do it seamlessly. Or do the old-fashioned way on paper and pen and spend some quality time away with your spouse from the white screen.