The much awaited Union Budget 2018 was presented and views as usual are multi-fold and diverse. Here is a short summary of the key questions that must be on your mind as an investor. Please feel free to post any further questions as comments or reach out to us on contact@cagrfunds.com. You can also Whatsapp us your queries on +91 9769356440.

Which are the sectors which are under Government focus?

The focus of the NDA Government is on strengthening the ground level infrastructure and thus the focus has truly been on the lower pyramid of the society. Most of the budgetary support has been rolled out to sectors which therefore impact the rural economy. Key sectors that are under focus are:

Agriculture & Rural – Focus on agriculture was an expected move this year.

- MSPs to be 1.5 times the cost of input to the farmer. This should benefit all agri input companies (Seeds, Fertilizers, Pesticides)

- Focus on improving access to maximum MSPs – Historically, farmers have not received the MSPs that they have deserved. While the Government claims to be committed to improving access, we need to wait and watch the success of the same.

- Promotion of Organic farming – Will be useful for seed companies, not so good for fertilizers and pesticide companies. But given the small scale of organic farming in India, the impact is not expected to be material

- Cold Storage – They are likely to be positively impacted if Operation Green is implemented well. A good part of potato production in India gets wasted and hence this is a welcome move

- Overall, several initiatives have been rolled out for improving the rural livelihood. Actual benefits will depend on implementation

Health – Several initiatives have been rolled out for the Heathcare sectorHealthcare sector.

- Flagship National Health Programme to cover 50cr people. Poor families to have better health insurance coverage

- Focus on medical research

- Use of generic drugs likely to increase

Should you then start investing in the thematic funds related to the above sectors?

Every year the budget rolls out some enhanced and some new policies for the key sectors. Short term sops lead to short term gains while structural reforms have a very long term play. From a broader picture perspective, sectors which are over exposed and dependant on Government policies should be avoided as any change in the Government itself or their priorities can have a very significant impact on particular sectors.

We therefore suggest that taking concentrated exposures in particular sectors should be avoided. In mutual funds, diversified exposures are always safer.

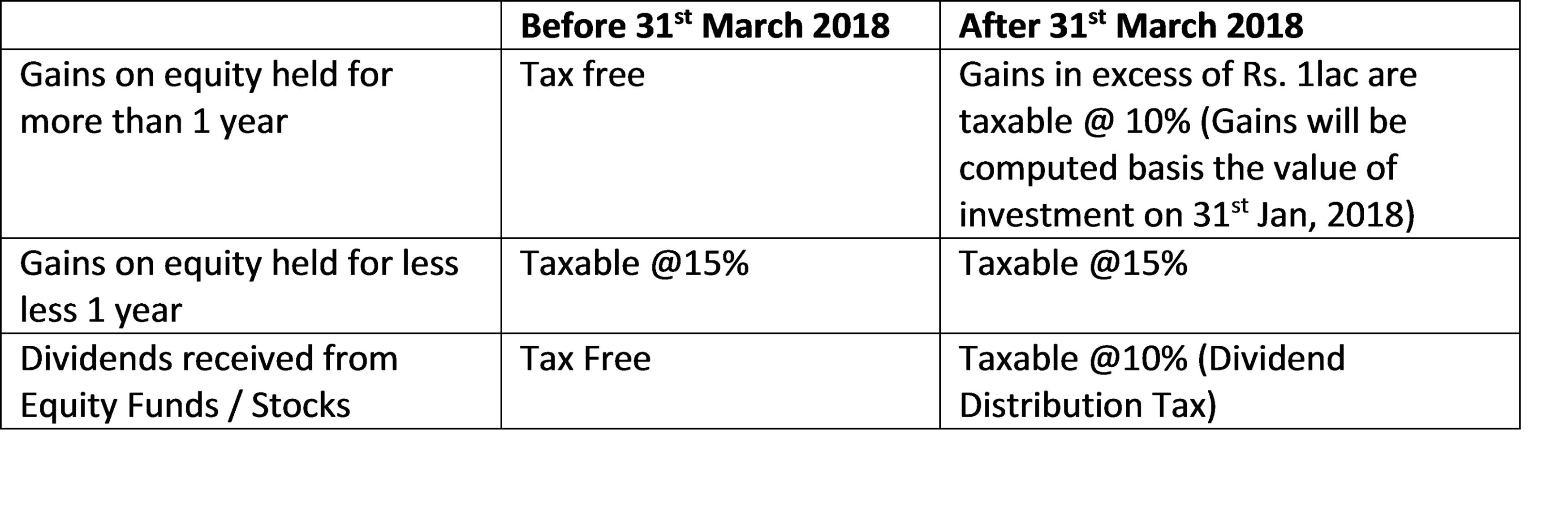

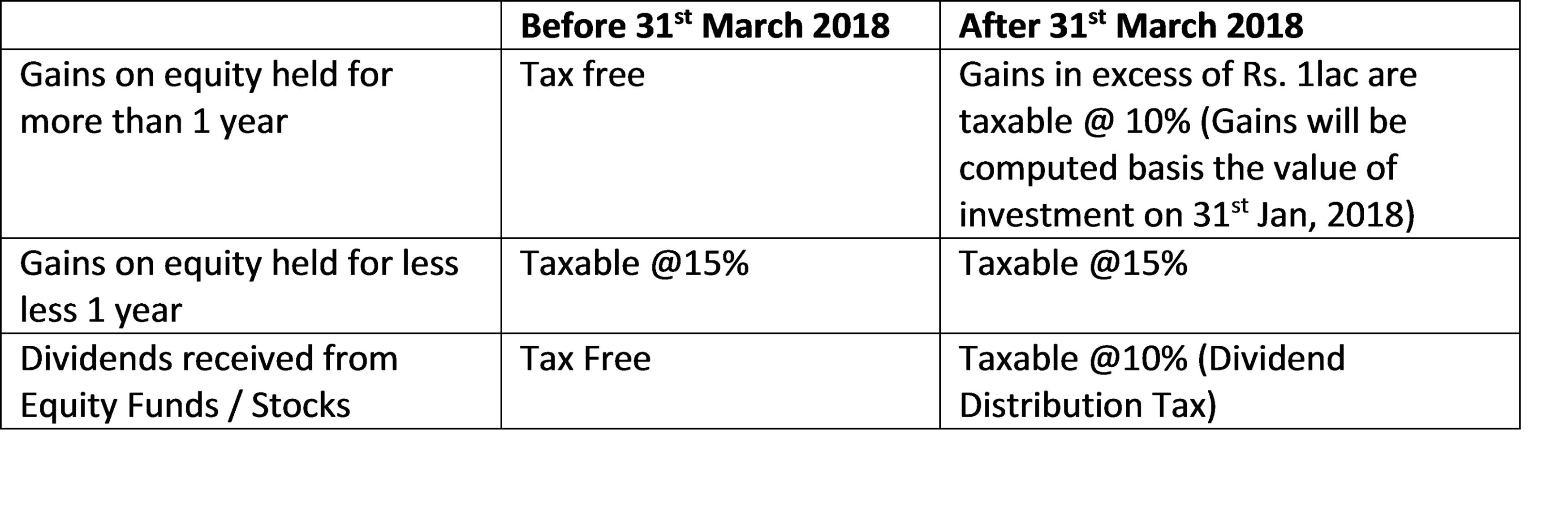

What is the tax implication on Equity?

What is grandfathering of returns?

If your investment in Mutual Funds and Equity is there for more than 1 year there would be a tax of 10% on the profit earned which was 0% as of now. For this they have considered Base Year as 31/01/2018 and profit calculation will be based on the higher of the two values – actual purchase price and the price on 31st January 2018.

For Example, consider that you have invested INR 100 on 1st September 2016 and you redeemed on 2nd April 2018.

Price on 2nd April 2018: INR 180

Price on 31st January 2018: INR 150

Long Term Capital Gains: INR 180 – 150 (since this is higher than the actual purchase price of INR 100) = INR 30

Tax to be paid: 10% of INR 30.

Short Term Capital Gain remain unchanged at 15%.

With long term capital gains tax on equity being levied, are equity mutual funds still an attractive investment avenue?

Equity as an asset class is still attractive when we compare the returns with other asset classes. The benefit of compounding your money at a higher rate is immense when you are planning for your long term financial goal. Further, this taxation does take away some of your gains in the form of taxes, but even after the tax implication the post-tax returns are far more lucrative than other asset classes.

What does it mean for the debt mutual funds?

Debt funds still remain an attractive investment vehicle for people in the 20-30% tax bracket. In the present budget there has been no change in the tax structure for debt mutual funds so it remains an attractive investment avenue to gain from the benefit of indexation in the long run. Read more about how and when are Debt funds useful here.

What does it mean for you if you are a senior citizen?

The budget gives a big relief to senior citizen. Any interest a senior citizen earns either from fixed deposit or savings bank account is exempt to an extent of Rs. 50000.

So if you are a senior citizen and want to park an amount up to Rs. 700,000 for 1-5 years, then a fixed deposit now makes better financial sense for you.

What does it mean for you as a retail equity investor?

If you want to invest for the purpose of wealth creation with a time horizon of more than 5 years

For retail investors on a relative basis equity mutual funds still remain an attractive asset class. On a risk adjusted basis it will still outscore other asset classes. As a retail investor you will gain financial independence by saving more and maintaining your asset allocation as per your risk appetite. Also, it is recommended that choose “Growth” schemes as dividends are now taxable at 10%.

If you want to invest for 3 – 5 years (but more than 1 year) to generate better returns

For people who were using dividend option for such measures will have to re-look as dividends now will be taxed at 10%. However, a hybrid product such as a balanced fund may still outperform other possible asset classes for this objective. Therefore it is suggested that you take exposure in “Growth” options of balanced equity funds through the SIP or STP route. Lump sum (one time) investments in equity or equity mutual funds for such time frame should be avoided.

If you want to park your money for use between 1 – 3 years

Ultra – Short Term and Short Term debt funds where there is no change in taxation still remain an attractive investment avenue.

If you want to park your money for use within 1 year

Arbitrage funds as a category will become relatively less attractive as you will have to pay 10% taxes on dividends received. However, if you are in the 30% tax bracket, this is still a more lucrative option than other alternatives available (since Ultra Short term debt funds are also giving lower than average returns). On the debt side there is no change

If your existing holdings are in below types of funds, then what actions should you be taking?

Arbitrage funds – Stay invested till March 2018 since all changes take effect from April 2018.

- If you are in 20 -30% tax bracket and withdrawal is planned within 1 year: Continue to stay invested in Arbitrage Funds even after March 2018

- If you are in 20 – 30% tax bracket and withdrawal is planned after 1 year: Split exposure between Arbitrage Funds and Short Term Debt Funds

- If you are in 10% tax bracket: Shift to Ultra Short Term and Short Term Debt Funds

Ultra Short Term Debt / Liquid Funds – Continue to stay invested. If funds are not required to be deployed in next 3 years, you can consider taking small exposures in equity on market corrections (if they happen over the next few weeks)

Dynamic Bond Funds – We are not recommending dynamic bond funds in the present scenario seeing the volatile debt markets to retail investors.

Short Term Funds – Short Term funds have had small hits because of the debt market volatility.

- Investors should not look into the category for less than 1 year. For less than 1 year stick to ultra-short term funds

- Some of you would have seen less returns in the short term funds in the last 3 months because of a sudden spike. We would like to emphasize that during our discussion with you we had suggested these funds for a horizon of more than 1 year. So please hold on the investments as the returns are likely to improve in the next 3-6 months

Duration Funds – We still hold our previous view of sticking to short term bond funds and accrual funds seeing the interest rate scenario.

Equity funds – As long as your time horizon is more than 5 years, stay invested. However, periodic look at the portfolio for re-allocation and re-balancing is inevitable. At CAGRfunds, we are committed to your wealth creation. While we are planning to start are annual re-allocation and re-balancing exercise after 15th February, 2018, do reach out to us if you want to discuss your portfolio prior to that.

Overall take: We feel that as retail investors we will benefit far more by focusing on the basics (which is our hand) which is consistent increase in our savings. Ensuring regular investments over a long period of time will help us reap the true benefit of compounding and create wealth over the long run. We therefore highly encourage starting / moving to the SIP mode of investment. While short term trading / speculation in direct stocks was never recommended for retail investors, it becomes all the more unattractive now. Also, the objective of investment at the first place is not to save tax. It is to build wealth. Equity mutual funds and a diversified portfolio continue to keep the objective intact and hence no major changes are required in the face of tax implication.

The only way to secure your future is to build it!

Disclaimer : This update is as per the information available as on 1st February 2018 from the budget document